15 years after the 2008 financial crisis, the world is again upon the possibility of a global financial crisis, this time one created from the failure of the Silicon Valley Bank, a fiance corporation made for technology companies. At its peak, SVB had U$200 billion in assets, with a very undiversified customer base: VC funds and tech/life-science companies, which received most of the bank loans.

But how could a promising bank for such a growing area, which received significant deposits in 2020 and 2021, have failed? Well, the answer is quite simple. SVB gambled with clients' money, betting on a strategy that would only work with low-interest rates. Shortly after the FED raised interest rates at the beginning of 2022, the Silicon Valley Bank failed after a bank run on March 10. This was the second-largest bank failure in United States history and the largest since the 2008 financial crisis.

A financial crisis in the U.S. can affect human society globally, especially the unprivileged population since the United States is the most economically relevant country. When a big bank fails, it can lead to widespread job losses, business closures, and economic instability. Most low-income individuals live paycheck to paycheck, working hard to maintain basic life quality, with little to zero income growth. A global economic crisis can mean a heavy blow for many people and even death for some.

The U.S. Census reported that The real median earnings of all workers (including part-time and full-time workers) increased by 4.6 percent between 2020 and 2021, while the median earnings of those who worked full-time, decreased by 4.1 percent. This evolution of income happens in a scenario where the average person still has to deal with economic problems like inflation and unemployment. The U.S. is taken as an example, but the situation is similar in countries like Brazil, Argentina, France, and Canada, where the income growth also does not match the rhythm of the country's social challenges.

Comparing the two crisis

The 2008 financial crisis got triggered by a combination of factors, including careless lending practices, complex financial instruments, and human greed. The crisis source was the subprime mortgage market. Banks started offering loans to people with poor credit ratings. Low-income people received unpayable loans, and banks were being backed up by corrupted credit rating agencies. Companies such as Moody`s, Standard & Poor`s, and Fitch gave high ratings to banks' financial instruments that were ultimately risky.

These agencies were paid by the companies they were rating, showing a clear conflict of interest. Companies would shop around for high ratings, and rating agencies that did not give the desired rate would certainly lose business. In many cases, agencies did not have complete access to information and numbers about the instruments they were rating, relying on assumptions and models. The Securities and Exchange Commission (SEC), responsible for regulating the agencies, did not have the power or will to force the improvement of rating practices /impose penalties for misconduct. The whole system was co-opted, creating the perfect scenario for a crisis.

On the other hand, the recent 2023 financial crisis began after a classic bank run. SVB customers frantically pulled out their deposits before US regulators intervened to control. The fall started when the bank took a multibillion-dollar loss cashing out US government bonds, trying to raise money for depositors. It also tried to sell shares to shore up its finances, which triggered the alarm that led to its ruin.

The SVB recorded an increase in deposits during the COVID pandemic. In 2021, the bank purchased long-term treasury bonds to capitalize on those deposits. Nevertheless, the market value of those bonds decreased as the Federal Reserve raised interest rates to hold back inflation. With higher interest rates, borrowing costs also increased, and many SVB clients started pulling out money to meet their liquidity needs. The announcement of the sale of assets to pay depositors, coupled with warnings from prominent investors, caused the bank run in which customers withdrew U$42 billion. There is still much to study about the current crisis since not even one month has passed, but it became clear that SVB strategies were not trustworthy and gambled with customers' money.

What Crypto has to do with it?

The Crypto market is a young one, having risen in recent years. Many promises also surround blockchain technology, like financial freedom and transparent/secure operations for everyone. This new area must take a lot of cautious moves, so it does not follow the direction of creating a new financial crisis.

There is a lot of distrust from the big media and traditional investors in the Crypto market. Some people say it is a useless technology, and others it is speculation-driven, but projects like Decred prove they are wrong. When looking at Decred we notice that many applications were developed to secure regular people's money, and not involve it in arbitrary decisions by a couple of individuals. Check some examples:

DCRDEX: Decred decentralized exchange with no arbitrary fees, leaving only users to profit from their transactions. Using atomic swaps to complete trades, DCRDEX leaves users with full custody of their coins. DCRDEX symbolizes true sovereignty!

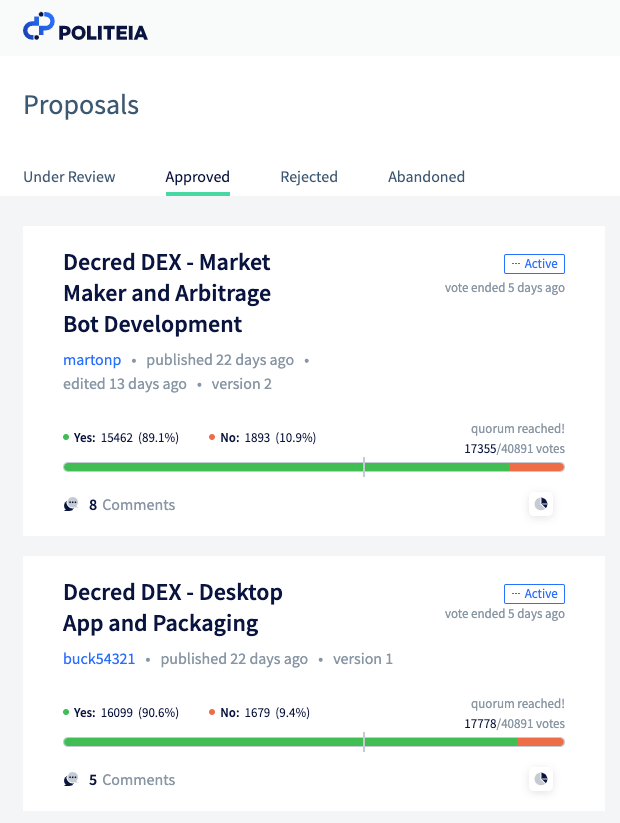

POLITEIA: The platform that enables Decred's superior governance. Built with intelligence and forward-thinking, Politeia enhances the debate and decisions of Decred future! Anyone can submit a proposal on the platform, and if it is approved treasury funds will get directed to the author for work provided. With Politeia no decision over the Decred treasury is taken by individuals, every proposal must be approved by the stakeholder's vote.

Cryptocurrency has already changed the world, but there is still much discussion about its applications. Communities and developers should not worry only about the expected profit, but also about how blockchain will help society in the building of a new trustworthy financial system, not repeating the same mistakes as traditional banks.

Comments ()