A User Perspective and Introduction to Blockchain Governance

This article gives my perspective on the governance of blockchains and cryptocurrencies. I didn’t take much interest in the blockchain space until summer of 2017

By Richard Red - Oct 10, 2019

This article gives my perspective on the governance of blockchains and cryptocurrencies. I didn’t take much interest in the blockchain space until summer of 2017, when the Bitcoin Cash fork and the underlying reasons for it caught my attention. I started looking into this and discovered an interest in how these decentralized networks/projects/currencies make decisions about how they should evolve. On the one hand these are (mostly) open source software projects, but on the other hand the software is being used to run networks that hold hundreds of millions of dollars in value. Who decides when to change this software and the rules it enforces, and how does that process work? If the expectation that blockchains will have a major impact on the world is correct, it’s going to be important to understand the answers to these questions.

This post is an attempt to summarize what I’ve learned in a way which introduces newcomers to the ongoing and recently intensified debate about how cryptocurrencies are governed. It covers some illuminating stories from the history of major projects, and considers the emerging variety in approaches to governance.

This post got a lot longer than I’d intended, so I will probably re-write some chunks as standalone posts. I’m in this to learn, so if there are flaws or gaps in my understanding I’m hoping people will let me know. A more comprehensive description of how I arrived at my perspective should facilitate that. If you’ve been following the blockchain space for a while you could probably skip ahead to section 14 without missing much.

As I see it there are two aspects of governance:

- How does a cryptocurrency ensure that users follow the rules?

- How are those rules determined?

I’m more interested in the second, but it’s impossible to consider that in any depth without an understanding of the first.

Cryptocurrencies are in essence software, everybody using a blockchain has to run software that is compatible with its rules. Often there are dominant versions of this software that the majority of participants run. It is this software and the computers that run it which enforce the rules, so any change to the rules means participants running a new version of the software. These rules are referred to as the consensus rules, because everyone has to agree on them for the network to function as a whole. There must be consensus as to what the rules are. This is common to every cryptocurrency and blockchain. There is divergence around how exactly the software enforces the rules, and how the users of a blockchain decide to run a new version of that software which changes the rules.

1. Bitcoin

Bitcoin is a good place to start because it is the original and most established cryptocurrency. Consequently, it is the most well known, researched and discussed.

Bitcoin is complex, it’s possible to write whole books about “how Bitcoin works” (and people have) and what it’s for. It’s not even easy to define “what Bitcoin is” (software, a network, a currency). To go beyond that and understand “why Bitcoin is the way it is” is an even more ambitious undertaking.

2. Enforcing Bitcoin’s consensus rules

The enforcers of Bitcoin’s rules are Proof of Work (PoW) miners. Miners are people (running computers) competing to find the answer to a complex and arbitrary problem. Miners prepare a block that they want to broadcast by filling it with transactions that are waiting to be processed (in the mempool). In order for this new block to be accepted, it must pass a very specific test. Miners combine a set of inputs and run these through a hash function: the header of the previous block, a current timestamp, a merkle tree representing the transactions they want to include in the new block, and an arbitrary value. The hash that comes out of this function must start with a certain number of of zeroes (determined by the current difficulty level) for the new block to be accepted by the network. There is no way to know whether a hash will be acceptable other than to try it and see, then change the arbitrary value and guess again. This is the “work” in Proof of Work. This process is often referred to as hashing. The rate at which a computer can make guesses depends on how quickly it can run the hash function, its hashpower.

The difficulty of the problem adapts every two weeks so that when more miners are guessing it becomes more difficult to find the solution. The intention of this adjustment is to keep the average time between blocks at around 10 minutes. We’re talking about random guessing though, so the actual interval between blocks fluctuates.

People running full nodes in the network are listening for these new blocks. Full nodes runs software that has the full Bitcoin blockchain (a history of every transaction ever made), this is what makes Bitcoin a decentralized ledger. It is through storing and processing this blockchain that full nodes know which Bitcoins can be spent by which private keys (and where those Bitcoins came from).

Full nodes check that new blocks follow the rules, including:

- That the hash of the block meets the difficulty criteria, and that when it is decoded through the same hash function its contents match the specification of a Bitcoin block. This constitutes proof that the required work has been done by the miner.

- That each transaction has been signed by the private key for the wallet it comes from (ensuring that only the holder of the private key can spend the Bitcoin).

- That the wallets making transactions held enough Bitcoin to make those transactions (ensuring that people cannot “double spend” their Bitcoin).

If the new block is valid the nodes will add it to their version of the blockchain and broadcast that version. The contents of this block determine the possible solutions to broadcast the next block. One of the required inputs to the hash function has been changed, and so the guessing process begins anew.

Each new block allows some new Bitcoin to be claimed, the block reward. Miners claim the block reward by including a transaction sending it to a wallet they control. Miners also collect the fees for transactions they include in the block (and so are incentivized to include the transactions that offer to pay the highest fees).

The fact that anyone can find a solution that allows them to broadcast the next block is another reason why Bitcoin is said to be decentralized.

These days, Bitcoin is mined almost exclusively by ASICs. These are custom built computer chips whose only purpose is to make guesses by running Bitcoin’s hash function. They are designed to do this as efficiently as possible. In principle, and in the past, one could mine Bitcoin using any computer. Faster processors are better because they can make more guesses per second or watt of electricity, graphics cards are better still. Now, it is inefficient to compete with ASICs. While it is possible that I could mine a block with my CPU it is highly unlikely that I will ever find a solution before one of the many ASICs that I’m competing with — and I still have electricity costs to run that CPU, so the chances are I would be doing so at a loss.

Taking this a step further, there are so many ASICs mining Bitcoin now that even if I have one running I might never find a valid block, or it could take years. So, most miners participate in mining pools, where you send the proof of your work to the pool along with many others. When one of the participants finds a valid solution the pool uses that to form a new block on behalf of the pool, and distributes the rewards between pool participants according to how much work they contributed towards finding that solution. Pools make Bitcoin mining not quite so decentralized, because there are a countable number of pools that actually produce new blocks. It is however relatively easy for a miner to switch between pools, switching costs are low. If miners don’t agree with the actions of the mining pool operator they can easily move their hashpower to another pool.

Miners are stakeholders in that they have invested in hardware and pay ongoing electricity costs to run that hardware in search of new blocks. The blocks a miner broadcasts must follow the rules of the software running on Bitcoin nodes or those nodes won’t accept their blocks as part of the chain. It is only because nodes collectively accept my version of block 1234567, saying that the reward goes to wallet X that I control, that I get any reward for my work. Miners must follow the same rules as nodes to be on the same network, part of the same blockchain.

Understanding how a cryptocurrency works goes beyond just knowing the rules, incentives are also key to understanding the behavior of the network. There is no rule that says how a miner should choose the transactions to include in a new block, or that a miner has to include any transactions at all. Miners sometimes mine empty blocks. An individual miner (or, more realistically, mining pool) could decide not to include certain transactions. If they wanted to, they could blacklist an address.

Miners typically include the transactions with the highest fees because they are incentivized to do so. That’s what maximizes their profit. If Miner A gives preference to the wallets of their friends and allows them to make low-fee transactions, Miner B can pick up the rewards for the higher fee transactions. Over time Miner B will earn more rewards, which they could re-invest to grow their mining operation faster than Miner A.

Miners also have a broader incentive to look out for the health of the network. If all miners started to mine empty blocks Bitcoin would be paralyzed and have no utility. Without utility it would have no value, this would hurt the miners because the rewards they’re earning would have no value. The expensive ASICs they’re using would have no means of earning a return because they have no utility besides mining Bitcoin. Bitcoin’s value proposition, of being able to transfer value in a way which is reliable and resistant to censorship, relies on miners not only following the rules but acting in a way which is aligned with their incentives.

As an aside, this is why decentralization is such a big topic among blockchain enthusiasts. The system is based on the premise that because I can offer a fee to mine my transaction and include it in the blockchain I can be assured that it will be possible for me to make that transaction. I can make any transaction that the rules permit me to make if I offer to pay a high enough fee. If all of the new blocks were mined by eight pools that would introduce a degree of centralization. If all of those pools decided (or were persuaded) that transactions from my address shouldn’t be mined then my Bitcoin would become worthless.

3. Setting Bitcoin’s rules

The software which Bitcoin runs on, along with most other cryptocurrencies, is open source. Cryptocurrency is all about not having to trust individual actors but being able to rely on cryptographic truth and the following of rules and incentives. Proprietary software is anathema to this ideal as it necessitates trusting the (closed) source of that software. Open source software means being able to inspect that software and know, intimately, what it will do when you run it. In practice, most of us trust certain sources to give us software that behaves as described, because we lack the expertise or inclination to verify it ourselves. This trust is underpinned by the fact that people can and do perform this auditing, and they have channels through which they can communicate any problems they observe.

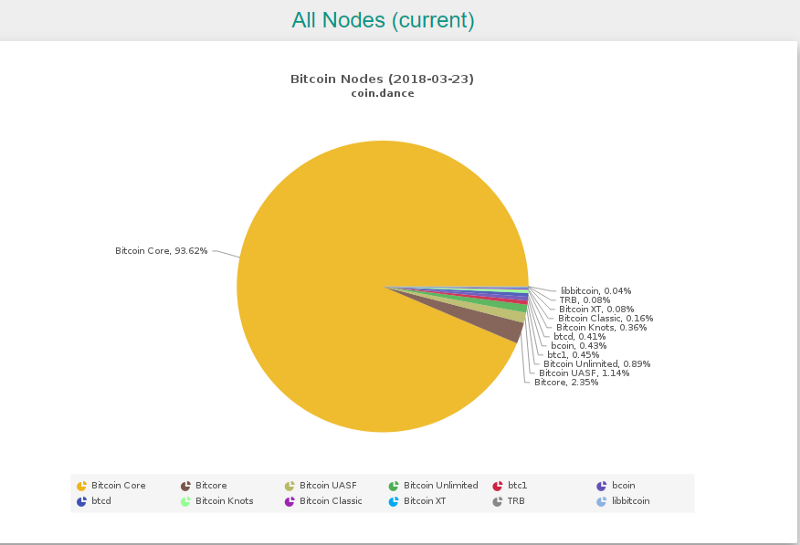

Bitcoin Core is the software that most of the full nodes in the Bitcoin network run, as of now 93.6% of the 10,923 Bitcoin full nodes are running this software. Bitcoin Core is the original Bitcoin full node, for almost two years after the launch of Bitcoin it was the only full node implementation. There are now alternative implementations of a Bitcoin full node that follow the same consensus rules and are therefore compatible and can run on the same network/chain.

Software Bitcoin Nodes are running — source: https://coin.dance/nodes

Open source software allows for broad participation in its development, anyone can make a copy of (clone) the software, fix bugs or add new features. If I clone Bitcoin Core and fix a bug or improve something, I can make a pull request whereby I propose that the changes I made in my version be merged back into the master version and become part of Bitcoin Core. Anyone can do this. To date, the Bitcoin Core github repository lists 522 contributors who have all contributed something to the software. I can also clone Bitcoin Core (or any full node software) and make some changes with no intention of merging those changes back in, this is a fork.

As the software running on full nodes enforces Bitcoin’s rules, one can change those rules by changing the software. The stakes are high when deciding whether changes that will affect the consensus rules should be committed or merged into Bitcoin full node software for inclusion in a new release.

There are only certain people who have permission to commit changes to the Bitcoin Core repository. I couldn’t find a particularly good source for this but this reddit comment says only two people have commit access, this bitcointalk post had it at four people/accounts a year ago, with a total 12 accounts in Bitcoin Core’s history ever having commit access. That there are a limited number of people with the technical permission to accept changes to a master branch is true of every software project. The amount of decision-making power these individuals have depends on the social method of governance of the project. I couldn’t find much documentation on Bitcoin Core’s decision-making process, this (potentially biased) reddit comment describes a yes/no vote of Bitcoin Core contributors, with the maintainers interpreting how to proceed on this basis, which seems plausible.

A release of Bitcoin Core (or any cryptocurrency full node software) that changes the rules of consensus differs from most software projects in the importance of obtaining stakeholder approval prior to release.

4. Soft forks, hard forks, chain splits and free coins!

Soft forks and hard forks both involve some change to Bitcoin’s rules of consensus. I will offer a short summary, see here for a more comprehensive description, and I also found Vitalik Buterin’s post on the subject informative.

A soft fork introduces a new rule or makes the rules more restrictive. For Bitcoin, miners are the key actors who decide if a soft fork is adopted. If the majority of miners agree to enforce a soft fork it will be adopted, because miners are the actors who decide how new blocks are constructed. Soft forks are in a sense backwards compatible. Full nodes that don’t upgrade will still recognize new blocks as valid because the blocks still follow the old rules that the nodes are checking. However, a full node that doesn’t upgrade may misinterpret some transactions that make use of the new rules.

A hard fork removes or relaxes consensus rules. Once a hard fork has activated and miners start producing blocks according to these relaxed rules, any node that hasn’t been updated to follow the new rules will reject these new blocks. This can cause a chain split if some miners and nodes continue on the old software and some switch to the new.

Some forking examples (taken from here): Bitcoin originally did not have a block size limit. A 1mb limit was added in September 2010. This was a soft fork because it added a new rule. Nodes that didn’t upgrade would continue to follow the right chain because they didn’t care what size the blocks were. Any miners in the minority who didn’t want this limit would be forced to upgrade to software that followed the new rules, because any blocks they mined which were greater than 1MB would be rejected by nodes and miners following the new rules. This change was added as a soft fork, it could not be undone without a hard fork — this is true for any soft fork that has been adopted.

Bitcoin has had three chain split events. The first of these occurred in 2010 when a transaction was mined which spent 184.5 billion Bitcoin — the rules as implemented by the software had a bug which allowed massive transactions to be accepted. This was fixed with a soft fork which addressed the bug and added an explicit rule that no transaction could spend more than 21 million Bitcoins (the maximum supply). It took five hours before the patch was released, and 51 blocks were mined on this “bad chain” before the good (patched) chain overtook it in terms of PoW. This raises an interesting point, in the case of a chain split of Bitcoin the accepted method of deciding which chain “is Bitcoin” is to consider the length of the PoW chain — the chain with the most accumulated work “is Bitcoin”.

Orphaned blocks happen semi-regularly because it takes time for news of a new block to propagate in the network, and the hash of the latest block determines the solution for the next block. If Miner A and Miner B broadcast a new block at exactly the same time, and half the nodes see block A first and half see block B first, then until the next block is found there are two competing chains (stubs). If the next miner to find a block was working on block B, then block B will be the good chain and block A will be an orphan, as nodes will switch to regarding stub B “as Bitcoin” when it has a longer PoW chain.

This is why merchants often wait for two or more confirmations before accepting a payment. A number of confirmations is another way to say that the block including the transaction has been built on by X subsequent blocks. It’s always possible that the latest block will become an orphan (i.e. turns out to not be a part of the Bitcoin chain), but once a few blocks have been mined on top of it it the transactions become an immutable part of Bitcoin’s ledger.

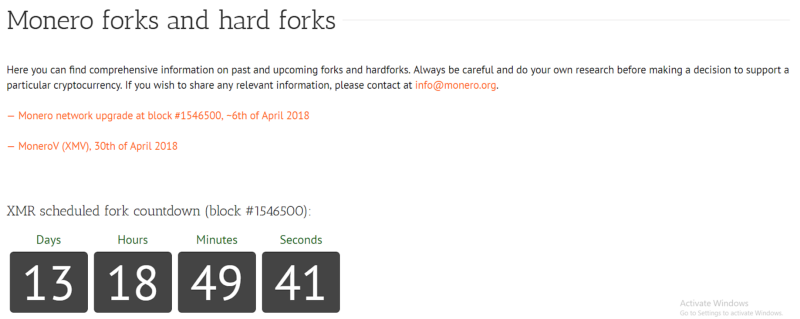

Some hard forks are intended as upgrades. If there is consensus that a change to the rules will be beneficial, users coordinate to implement that change at a specific block height. As it is important that everyone changes to the new rules simultaneously, a version of the software is typically released that incorporates both sets of rules, with some logic that says “until block X use these rules, after block X use these other rules”. Monero has hard forks that aren’t intended to split the chain roughly every six months. These are announced well in advance so that node operators have time to download a version of the software that follows the new rules. The Bitcoin Segwit2X hard fork was intended to be an upgrade (increasing the maximum allowed block size to 2MB). It was abandoned due to a perceived lack of stakeholder support. More on this later.

Some hard forks are intended to cause a chain split. Bitcoin Cash (BCH) is a well known example, and there have been several similar hard forks of Bitcoin since then. Monero also has a hard fork that is intended to split its chain coming up (MoneroV). This kind of hard fork happens when a subset of a coin’s users decide to change the rules, on the understanding that not everyone will change to the new rules. These are also usually announced well in advance. People who use the new software know that they’ll be forking to their own chain after a specific block, and what the consensus rules will be for that branch of the chain.

Source: https://monero.org/forks/

Some people regard a chain split as offering free coins. Bitcoin Cash mined its first block as block 478559 on top of Bitcoin’s block 478558. If you had 1 BTC at block 478558, you still had 1 BTC at block 478559, but your private key also worked on the BCH chain, and so you had 1 BCH there too because their blockchains are identical up to this point. You could see this as receiving 1 BCH for free, but one could also argue that your 1 BTC was split, like the chains, because most of the resources that gave BTC value (people buying it, people mining it, people accepting it as payment) were now being shared between BTC and BCH.

5. How does Bitcoin (BTC) evolve?

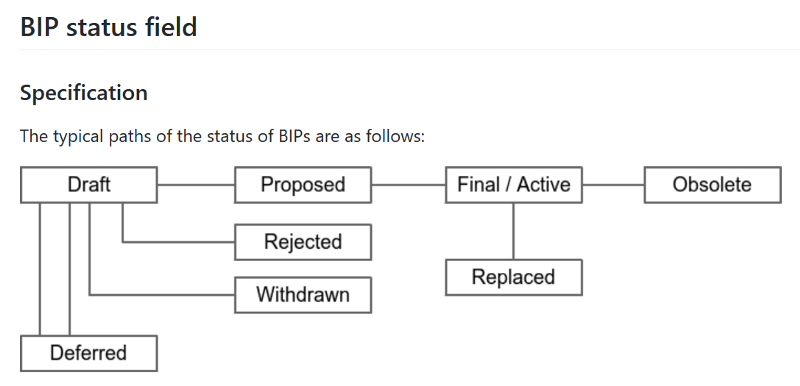

There’s no easy answer to that question, but since August 2011 there has been a defined process: Bitcoin Improvement Proposals (BIPs). BIPs have their own github repository, the process for handling BIPs was laid out in the original BIP-001, but this has been replaced by BIP-002. There follows my take on the process which BIP-002 describes.

Source: https://github.com/bitcoin/bips/blob/master/bip-0002.mediawiki

Each BIP needs a champion/author to shepherd it through this process.

- Submit an idea for discussion to the Bitcoin development mailing list

- If members of that list seem receptive, submit a draft BIP to the same Bitcoin development mailing list

- No red flags? Submit the BIP to the BIPs git as a pull request. BIPs have a set format that should be followed

- The BIPs editor (Luke Dashjr) will review it and if it passes some minimum criteria it will be accepted, assigned a number and a category

- The BIPs editor now decides if it progresses to Proposed or Final/Active status (see image above), while the BIP’s author can change the status to Deferred or Withdrawn

- To move from “Draft” status to “Proposed”, the BIP needs to nail down the details and provide a reference implementation. This is significant, a developer/champion must go to the effort of implementing their idea in usable code before the BIP can progress.

- BIP-002 also defines a method of soliciting commentary on a BIP through a public wiki space that anyone can contribute to, but where “Participants should freely refrain from commenting outside of their area of knowledge or expertise. However, comments should not be censored, and participation should be open to the public.”

A soft-fork BIP strictly requires a clear miner majority expressed by blockchain voting (eg, using BIP 9)

Miners can use the “version” field in the block header to signal support for a proposed soft fork. A vote runs for a set interval and you can know whether miners support the change (weighted by their hashpower) by looking at the number of blocks that signal support.

A majority of Bitcoin miners (i.e. miners controlling the majority of hashpower) has the power to adopt a soft fork (adding new rules). This is true because miners make the blocks. If a majority of miners decide that 50kb is the new block size limit, other nodes will still accept those blocks as valid — and a majority of mining power following the same set of more restrictive rules will produce the longest PoW chain. Those miners won’t recognize or build on any blocks which don’t follow the new rules.

Things are more complex for BIPs that involve hard fork consensus changes, because they move to “Final/Active” status only when they have been adopted by “the entire Bitcoin economy”. BIP-002 has this to say:

A hard-fork BIP requires adoption from the entire Bitcoin economy, particularly including those selling desirable goods and services in exchange for bitcoin payments, as well as Bitcoin holders who wish to spend or would spend their bitcoins (including selling for other currencies) differently in the event of such a hard-fork. Adoption must be expressed by de facto usage of the hard-fork in practice (ie, not merely expressing public support, although that is a good step to establish agreement before adoption of the BIP)…

…Miners are not included in the economy, because they merely rely on others to sell/spend their otherwise-worthless mined produce. Therefore, they must accept everyone else’s direction in deciding the consensus rules.

Exchanges are not included in the economy, because they merely provide services of connecting the merchants and users who wish to trade. Even if all exchanges were to defect from Bitcoin, those merchants and users can always trade directly and/or establish their own exchanges.

Developers are not included in the economy, since they merely write code, and it is up to others to decide to use that code or not…

This BIP does not aim to address what “should” be the basis of decisions. Such a statement, no matter how perfect in its justification, would be futile without some way to force others to use it. The BIP process does not aim to be a kind of forceful “governance” of Bitcoin, merely to provide a collaborative repository for proposing and providing information on standards, which people may voluntarily adopt or not. It can only hope to achieve accuracy in regard to the “Status” field by striving to reflect the reality of how things actually are, rather than how they should be.

The BIP process has very little to say about how a BIP that requires a hard fork should go about obtaining the approval of “the entire Bitcoin Economy” (defined as merchants who accept Bitcoin as payment and holders), it just defines this criteria for the status of the BIP to be changed in the GitHub repository.

I understand the logic here, that participants in the Bitcoin economy have the freedom to choose which software they run and which consensus rules that software follows; but how does one go about getting the entire Bitcoin economy to adopt a hard fork change to the consensus rules? This seems difficult, given that this entire Bitcoin economy would have to adopt said hard fork at the same time to avoid a chain split. It is perhaps unsurprising that none of the hard-fork BIPs listed have ever achieved this “Active” status.

From my outsider’s perspective, it seems like the best chance of achieving adoption of a hard-fork change to Bitcoin’s consensus rules would be to push that change out in a new version of Bitcoin Core, the software which 96.5% of full nodes are running. I would also guess that a lot of merchants, the ultimate decision-makers according to BIP-002, may not even particularly care about a change to Bitcoin’s rules that doesn’t affect them directly.

BIP-002 lists a number of stakeholders and explains why they’re not included in “the economy”, and therefore don’t get to decide whether a BIP is accepted — miners, exchanges and developers. This seems backwards to me, because from my observations these three groups are exactly the actors that do have power to decide how Bitcoin evolves.

My observations are based primarily on the Bitcoin Cash and the “Segwit2X” hard forks, I will recount them here to explain why I think these stakeholders have power. As a small scale user/holder of Bitcoin, in principle I fall into the group that is supposed to decide whether hard forks “are Bitcoin”. It didn’t feel that way, in fact I struggled to make any sense of what was going on as all of this was unfolding.

Developers have power because any change to consensus rules must be manifested in code. Bitcoin Core developers specifically seem to have a lot of power, because 96.5% of full nodes are running this software. I’m going to go ahead and assume that a lot of those node operators trust new versions of Bitcoin Core without auditing the code themselves — and this trust might well extend to a new version that changes the consensus rules. I don’t know how the Bitcoin Core developers make decisions, but they have weekly open meetings on IRC and publish the logs. That’s great, truly, I am all for transparency, but I don’t have time to follow all of these meetings, and there’s a steep learning curve to doing so.

Miners have power because any version of Bitcoin that changes the consensus rules needs miners to be on board or it will go nowhere. The rules covering “which blockchain is Bitcoin”, to the extent that they exist in a form that’s not social consensus, also point to the chain with the most Proof of Work (i.e. mining power).

Miners decide what goes in every new block, and if the majority of mining power agrees on a new rule they can enforce that new rule as a soft fork. BIP-0016 was adopted with approval of 55% of the mining power, the miners who didn’t upgrade along with the herd ended up producing a number of invalid blocks over the following months.

The only kind of power that the rest of the Bitcoin economy has to oppose the majority of miners is that in principle they could “veto” the miners by changing the PoW algorithm (meaning that all of those ASICs would no longer be able to mine “Bitcoin”). This would require a tremendous degree of coordination between other stakeholders, who would have to collectively agree and convince the world that the thing which has always been Bitcoin (the blockchain started by Satoshi with the longest SHA-256 PoW chain) is no longer Bitcoin. The Bitcoin Gold fork changed the PoW hash function recently, but I don’t think they ever really planned to “be Bitcoin”, and their cause wasn’t helped by the fact that they set aside a two week window where they only allowed themselves to mine 100,000 coins.

Bitcoin Cash was a hard fork of Bitcoin because it relaxed a rule, increasing the block size limit from 1MB to 8MB. The rationale was that 1MB blocks were too small for the usage that Bitcoin was seeing, leading to people paying fees that were too high for Bitcoin to work as a currency. There’s a whole debate here, which I understand has been playing out for years, about whether scaling of Bitcoin should be “on-chain” (bigger blocks) or via “second-layer” solutions — I’m not touching that.

In addition to the block size limit increase, Bitcoin Cash’s rules added a fall-back where if new blocks weren’t coming fast enough the difficulty would drop, sharply. An adjustment of this nature was needed to keep BCH alive in the event that the majority of miners did not switch to mining it instead of BTC. Bitcoin Cash didn’t change the PoW hash function, so all those Bitcoin ASIC operators could choose which chain to mine on.

This “Emergency Difficulty Adjustment” (EDA) had interesting consequences. When BCH’s difficulty dropped after an EDA it became more profitable to mine because it was much easier to find new blocks and claim the reward (even though each unit of BCH had a lower value). Bitcoin miners, as a group, behaved in a predictable way — they followed the incentives (profitability). If BCH difficulty was low, some miners would switch to mining that chain. When it re-adjusted upwards they would switch back to BTC. This kept both chains moving, but in an inconsistent way, as the chart below shows. When BCH difficulty was high most miners weren’t interested, it could take 100 minutes for a new block to be found. When the difficulty adjusted downwards sharply this attracted many more miners and blocks were being found every few minutes, until difficulty re-adjusted upwards and those miners went back to BTC. This also affected BTC block time, but to a smaller degree, as BTC was worth more and so more miners would stick with it even when BCH difficulty was low.

Showing the time between blocks for Bitcoin Cash, August 2017 — January 2018. Source: https://bitinfocharts.com/comparison/bitcoin%20cash-confirmationtime.html

In a sense this was good, because it confirmed that the behavior of miners, key actors in Bitcoin, could be predicted (controlled?) by economic incentives — you’ll recall that Bitcoin needs this to be true. From a user’s perspective, this was bad, because it became harder to predict how long it would take for a transaction to be mined. This dynamic got fairly spicy in early November, when the price of Bitcoin Cash increased rapidly as Bitcoin’s price fell. This price action was accompanied by a surge in low-value transactions on the Bitcoin chain, causing Bitcoin’s transaction fees to increase sharply. This was described in some circles as a civil war, there were rumors of a dragon slayer conspiracy to dethrone Bitcoin. There was even speculation that Bitcoin may suffer a chain death spiral whereby people sell it because they can’t make transactions, this pushes its price lower which in turn makes it less attractive to miners and slows the creation of new blocks, triggering a feedback loop that could drive the price down so far that there would no longer be enough hashpower to find new blocks.

Bitcoin Cash underwent another hard fork (of the upgrade variety) to make the difficulty adjustment smoother on November 14th, and as the chart shows this returned consistency to the block time.

Exchanges are important as public spaces because they are the venues where the price of a cryptocurrency is negotiated, and they also have direct power. In the Bitcoin Cash example the exchanges had power in that they decided Bitcoin Cash was not Bitcoin (BTC). However, many of the larger exchanges decided to support Bitcoin Cash and trade it as BCH. Many exchanges decided to honor the principle that people who owned BTC at block 478558 also became owners of an equivalent amount of BCH. Exchanges didn’t have to do this, when Bitcoin is stored on an exchange the exchange holds the private keys to spend it — I doubt the exchanges had terms which said their clients would become the owners of the coins on new chains forked from the coins in their accounts.

Many exchanges also opened markets for trading BCH, and this bolstered its legitimacy. The relative price of BTC and BCH is important because it dictated what holders of those coins could buy and it influenced the behavior of miners — this was negotiated on exchanges.

Exchanges were perhaps even more influential in relation to the Bitcoin Segwit2x fork that never really happened.

Segwit2x Background: On May 23rd 2017 a statement was released following a meeting of certain Bitcoin stakeholders at a conference (the New York Agreement). The attendees at this meeting had apparently reached an agreement on how Bitcoin should scale — a soft fork to implement segregated witness, followed by a hard fork to double the block size limit from 1mb to 2mb within six months. This agreement seemed to have the support of some major players, including miners that controlled 83.28% of the Bitcoin hash power, and a list of companies that together accounted for a significant proportion of “the Bitcoin economy” — for example BitPay, a payment processor that handles the receipt of Bitcoin by merchants in exchange for goods and services.

This agreement proved to be controversial (more on that later). Exchanges played a role here as when it “became clear” that the Segwit2x fork was contentious they started announcing that they would support trading of both the Segwit2x chain and the legacy BTC chain. This is itself significant, because Segwit2x was supposed to be an upgrade hard fork. If exchanges are planning to support trading of two chains that’s a strong indication that they don’t expect the upgrade to go smoothly, they expect a chain split. Furthermore, the labels they gave to these chains tended to give primacy to the legacy BTC chain (example: BTC and B2X). Perhaps even more significantly, some exchanges started to offer trading on “Segwit2x futures”, where people could speculate on the value of Segwit2x relative to legacy BTC. The message from participants in these markets was that they expected Segwit2x to be worth significantly less than legacy BTC.

6. Gauging the mood of “the Bitcoin economy”

How did it become clear that the Segwit2x upgrade was controversial, or how did the controversy about Segwit2x manifest?

In the absence of an accepted way of obtaining the “approval of the Bitcoin economy” for a hard fork, getting a lot of the major players in that economy in a room and hashing out an agreement seems like a reasonable starting point to me. However, making decisions in a way which is transparent and open also seems like an important part of Bitcoin’s governance philosophy. An in-person meeting that wasn’t recorded or transcribed, and which millions of participants in the Bitcoin economy were not invited to, does not fit with this philosophy. When the outcome of that meeting was expressed as two bullet-points explaining “this is how we’ve decided Bitcoin is going to be”, it is not surprising that a lot of those people who weren’t invited to the meeting seem to have felt left out.

This raises some interesting questions for me, like how do you involve “the entire Bitcoin economy” in the process of deciding how the rules should change? There seems to be an expectation that this process should be transparent and inclusive, but how do you include that many people in a meaningful way?

There are a lot of people who hold Bitcoin, this paper estimates 2.9 to 5.8 million people hold some sort of cryptocurrency, to be conservative and keep things simple let’s say 1 million people hold Bitcoin. As I suggested earlier, a lot of these people probably don’t care about any given change to the consensus rules, but if even 10% of holders care that’s still 100,000 people who want to participate or at least feel included.

We have the internet now, social media, all of those people can speak, and some proportion of them can even be heard. Anyone can join Bitcointalk and post there, but who’s got the time to read those 50 page threads? Lots of crypto folk are on Twitter, but there one’s capacity to be heard depends on being known and followed (and is subject to the whims of the twitter administrators). Reddit seems to offer a solution which works at scale because support for perspectives can be indicated through voting — although that’s not how you’re supposed to use those up/down buttons, up-votes are for posts and comments that contribute to the discourse constructively!

The problem is that all of these public spaces are vulnerable to a) censorship and b) abuse/distortion/gaming. Moderators can make posts and comments disappear. /r/Bitcoin actually has a rule which states:

Promotion of client software which attempts to alter the Bitcoin protocol without overwhelming consensus is not permitted.

A BIP can’t be considered to be Proposed until it has a working implementation, and the largest Bitcoin subreddit doesn’t allow discussion of client software which attempts to alter the protocol unless there is overwhelming consensus. That would seem to exclude /r/Bitcoin as a public space where the Bitcoin community might work towards this consensus. Will discussion of a

Actors with resources (time to create and cultivate sock-puppet accounts, money to pay people) can make it seem like the community support for a perspective is greater than it actually is. All of this happens in a way which is opaque and hard to quantify, we just see indicators that something doesn’t seem right from time to time.

Returning to Segwit2x specifically, users of /r/bitcoin seemed to be opposed to this, many of them vehemently. The nature of this opposition seemed to stem more from their lack of inclusion rather than the specific change from a 1MB to 2MB block limit. People objected to the perception of a backroom deal which sought to dictate Bitcoin’s future to them. But, there have been accusations of censorship on /r/bitcoin which marginalizes certain points of view.

Reddit is also susceptible to manipulation (all sides seem to accept that the other side is capable of this). So how much weight should we place on reddit-expressed sentiment? Was sentiment against Segwit2x on social media the reason it was cancelled? Did the poor showing for Segwit2x futures play a part in this? These futures markets had fairly low volume and were therefore also vulnerable to manipulation. The only people who really know why the Segwit2x fork was cancelled are the six who signed the email announcing the cancellation.

7. Characterizing Bitcoin’s governance

Bitcoin’s governance is characterized by inertia and confusion. The inertia stems from the high barrier to accepting a change in consensus rules. The entire Bitcoin economy has to adopt software which implements the new rules — and there is no accepted procedure for establishing that new consensus before the magical moment when everyone starts following the new rules.

This lack of an accepted procedure also induces confusion, without an established procedure nobody knows what to expect. Miners can signal what they want to happen as a group on the blockchain, developer groups also have channels through which they can be heard — but when it comes to the users we are left with a cacophony of unreliable signals in various social media forums, and speculation on the relative price of the new chain if it does in fact split. Users lack an accepted and robust way of signalling their wishes, this limits their capacity to coordinate and diminishes their power.

8. (How) could a Bitcoin hard fork happen?

I see three scenarios:

- Bitcoin never changes the rules of consensus in a way which causes a hard fork.Bitcoin is in a sense encumbered by the scale and diversity of its user-base, and the fact that there is no established method to gauge whether an attempt to collectively hard-fork will succeed or split the chain. Maybe that’s fine and how it should be, maybe inertia is actually resilience. This is true, to a degree, because it would be dangerous for Bitcoin if it was easy to change the consensus rules. It is good that it’s hard to change the rules, but I don’t see how Bitcoin can be the world’s digital currency in future if it is impossible to change the rules. For example, even if the lightning network is a huge success, massive use is still going to mean a large number of on-chain transactions to open and close channels, those are going to be expensive without at least modest increases in the block size. If we accept that rule changes will be necessary, then we’re back to the mechanism for making those changes being important.

- Bitcoin Core developers push a new version which causes a hard fork. I think it’s quite likely that this will happen, and that it’s the most likely way for Bitcoin to hard fork without chaos. Inertia works in Bitcoin Core’s favor, 96.5% of full nodes already use and trust their software, some proportion of these nodes would go along with a Bitcoin Core hard fork, and I think that proportion would be high. There’s no guarantee of course, Bitcoin Core’s developers don’t have the authority to force a hard fork by any means, but my impression is that they are in the strongest position to achieve this.

- Another Bitcoin developer group pushes a hard fork and takes over as the dominant full node implementation, probably after a chain split. Bitcoin Cash could conceivably have achieved this, could conceivably still achieve this (although I think it was more likely in the early days before the chains diverged too much). Segwit2x didn’t have the support of Bitcoin Core developers, if the attempt had gone ahead it would have been as an alternative full node implementation. It is worth noting that Bitcoin Core played an active part in how the Segwit2x story unfolded, by publishing a warning which proclaimed that: “This hard fork is not supported by the majority of the Bitcoin users and developers and is therefore a contentious hard fork. By adopting this hard fork, we believe the supporters of this agreement are shifting their users to an alternative currency (an altcoin) which is incompatible with Bitcoin.” In this warning Bitcoin Core speaks on behalf of Bitcoin’s users, while advising them to be wary of the entities who supported the fork.

9. A worm’s-eye view of Bitcoin’s governance

A worm’s-eye view is a view of an object from below, as though the observer were a worm; the opposite of a bird’s-eye view. It can be used to look up to something to make an object look tall, strong, and mighty while the viewer feels child-like or powerless. — Wikipedia

The question of whether to increase Bitcoin’s block size limit was the subject of debate for quite some time before supporters of big blocks abandoned ship and launched the Bitcoin Cash fork. That fork not only divided Bitcoin’s users, network effect and hashpower — it spawned two communities whose most vocal members spend a lot of time and effort hating on the other chain and its users. Calling this a civil war may be extreme, but it has that kind of vibe sometimes.

The proposed Segwit2x fork also saw /r/bitcoin getting pretty ugly, with the anti-Segwit2x case being made loudly and unpleasantly (including ad hominem attacks on Segwit2x supporters) and /r/bitcoin refugees turning up on /r/btc claiming they’d been banned for voicing pro-Segwit2x opinions.

Users of Bitcoin have notional power, but without a designated channel for exercising that power those users are reduced to supporters/spectators cheering and jeering from the stands. The supposed sovereignty and significance of these users makes things worse, because other stakeholders like developers and miners are supposed to listen to them. This means there’s an incentive to shout the loudest and be heard — in fact, the perception that an individual, group or community speaks on behalf of the Bitcoin’s users is power.

As the value of Bitcoin and the Bitcoin economy grows, it becomes more worthwhile for actors to invest resources in manipulating the Bitcoin community or what that community appears to say. The public spaces where the Bitcoin community congregates (forums, reddit, twitter) are vulnerable to manipulation, through censorship and sybil attacks.

I mentioned censorship earlier, this post gives another account of censorship on /r/bitcoin, framed as part of a broader effort to manipulate the Bitcoin community. I’m not taking a position on whether accusations like these are true, but they are plausible, and that’s enough to make them damaging. I see suspicions about manipulation on every cryptocurrency subreddit I look at (also true for other subjects, like politics), sometimes with evidence.

Platforms like reddit, twitter, and public fora are all susceptible to sybil attacks. If a social media platform allows you to sign up without verifying your identity that platform is vulnerable to a sybil attack — it’s just a case of whether a potential attacker stands to gain enough to justify their investment of resources (time/money to cultivate, steal, buy or bribe accounts). As the value and adoption of cryptocurrency increases there is more at stake, more to be gained from influencing public perception, hence social media will likely be more heavily manipulated.

Bitcoin is a big enough deal now for this to be a serious problem. I don’t see how anyone can get a signal from the Bitcoin user community that they can trust. If you can’t trust the like or vote-weighted opinions of pseudonymous strangers on the internet, who can you trust? You can trust that the wishes of Bitcoin’s miners are being accurately conveyed through on-chain signalling, because hashpower can’t be faked. You can also choose to pay attention to specific entities that you trust who have established communications channels (i.e. social media accounts, github accounts, websites). If you’re a user that doesn’t have an established name in the space, your part in this discourse can be spoofed or marginalized in a cost-effective manner by any actor with an agenda and resources to pursue it.

In addition to the problems with gauging user sentiment, I believe Bitcoin’s community suffers from the lack of a process which can bring resolution to contentious issues.

If I’m a member of a group that wants to change Bitcoin’s rules in a certain way, when should we give up? If our BIP proposal doesn’t have a lot of support among developers should we give up? Developers don’t speak for Bitcoin. If miners signal a lack of support, should we give up? Miners don’t speak for Bitcoin. If the majority of people on /r/bitcoin and bitcointalk forums criticize our plan, should we give up? Those fora are vulnerable to manipulation. If we go ahead and make our own Bitcoin fork and it trades at 0.1 or 0.01 or 0.001 BTC, should we give up on the idea that our vision is Bitcoin? The only thing that will kill a fork (or any blockchain) outright is if miners stop mining new blocks.

The role Bitcoin’s users have to play in governance doesn’t much appeal to me. That’s fine because I can just choose to not participate. If I’m not buying, holding or using Bitcoin it probably won’t affect me. That’s true because Bitcoin is still relatively small scale, but it will no longer be true if Bitcoin becomes the de facto global currency of the internet. With an eye to the future, it is worth considering the dynamics of governance as a blockchain increases in adoption and significance.

10. Blockchain governance as projects scale

A new blockchain begins as software — for mining new blocks and for running full nodes that validate the blockchain. An individual or organisation creates this software with an initial set of consensus rules. It is also standard practice to publish a white paper or road map which explains how the blockchain is intended to function and what the intended use case is. It is considered best practice to announce the launch of a new cryptocurrency before mining begins. A pre-launch announcement is considered fair because it gives those outside the project an opportunity to participate in mining from the start.

When the software developers mine their own blockchain before announcing its launch, this is known as a pre-mine. An instamine is a similar concept, where initial block rewards are very high and this allows the initial miners (probably people within the project team) to mine a considerable proportion of the total supply. Projects that hold Initial Coin Offerings (ICOs) are all pre-mined to a degree, because this is where the coins that are sold to ICO participants come from. Some projects are 100% “pre-mined”, in that the entire circulating supply exists at the project’s launch (e.g. Ripple and EOS). These projects could also be described as “not mineable”, because they have an alternative method of distributing tokens to users. Blockchains that were pre-mined, completely or partially, have a genesis which is fundamentally different to those which were openly mined from the start. This has implications for governance in the early stages of the project, so I will consider these cases separately.

Bitcoin is a good example of a cryptocurrency which began with no premine. On October 31st 2008 Satoshi Nakamoto posted to a cryptography mailing list announcing:

I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party. The paper is available at http://www.bitcoin.org/bitcoin.pdf.

On January 3rd, 2009, the Bitcoin genesis block was mined by Satoshi, on January 8th the Bitcoin software was released and on January 9th mining began in earnest. Bitcoin’s blockchain and software began with a set of consensus rules, but to start with Satoshi was the only participant. As others began to mine on the blockchain it could be said to have a network, these others accepted the consensus rules established by Satoshi.

For a long time after it launched, Bitcoin had no discernible value. It wasn’t until October 2009 that the first Bitcoin exchange opened, New Liberty Standard offered a rate of 1,309 BTC for one USD, or about $0.008 per BTC.

Whatever asset a blockchain’s distributed ledger tracks has no value until someone is willing to accept it in exchange for something else. At this stage there’s nothing that distinguishes the governance of a cryptocurrency project from any other open source software project. The miners and developers are probably the same people. While the asset being mined has little value there’s little reason for anyone outside the development team to take much interest in the project. The governance of the project could probably follow any model for governance of an open source projectat this point without issues.

At the point when the assets being tracked by the blockchain have established value, governance starts to become more complicated because there are stakeholders involved who do not participate in development. Miners may mine the chain because they perceive an economic benefit in doing so. Users buy, sell and transact in the asset because it offers them utility or they speculate that its value will increase. The value of the blockchain is bound to its network, not its software. As the value the blockchain represents increases, so too does the power associated with governing its development.

This introduces a dynamic which is unfamiliar for open source projects and their governance models. Where a group of developers on an open source project have an irreconcilable difference of opinion on how to proceed, forking is usually a good solution. Developers in the legacy group may have the benefit of name recognition but there’s very little lock-in effect because the software doesn’t usually derive its value from network effects. Nobody lost out when Ubuntu forked from Debian, we all benefited from greater choice in Linux distributions.

Cryptocurrencies are different because they are more like protocols, they derive their value from the things that are built on top of them, and they rely on everyone in the network following the same rules. The software is also the means of enforcing these rules. From the genesis of any blockchain, there is a norm whereby new participants are adopting a set of rules (and at least initially, software) from the developer(s) who launched that blockchain. There is a default to trust those developers, and this gives them influence.

Projects that held an ICO are different in that their coins/tokens have value before a blockchain exists, sometimes before any software exists. The balance of power is also different, because the development team has been paid up-front for work that they said they will do. They might hold 40% of the assets and also $10 million that others paid for the remaining 60%. Developers in these projects are likely not as beholden to other stakeholders because they’ve already been well compensated. Even if the project amounts to nothing they can still cash in whatever assets they received in exchange for the tokens they sold. This is why some people regard ICO projects as inherently scam-like.

I see a lot of similarities between cryptocurrencies and companies. Stakeholders like developers and miners are providing a service to users/customers and the value of that service is being determined by market forces. The people who are engaged in providing this service share a common interest in increasing its perceived value. Developers often have significant holdings of the asset from the early days when it had little value and garnered little external interest. Miners have invested in hardware and their potential return on investment is tied to the perceived value of the asset they’re mining.

Some cryptocurrencies are governed more or less as companies, because there is an organisation which explicitly controls the network. NEO and XRP rely on a small set of trusted validator nodes to run their networks, and those validators are selected by companies (OnChain and Ripple respectively). For now at least it seems like the governance of those blockchains is intimately tied to the governance of specific companies.

Most cryptocurrencies are different to companies because there is no central authority that decides who can perform a particular role in the network. Conventional hierarchical organisations can be important players in these networks but they have no means of imposing their will on the network. While the aims of the network may be similar to that of a company, the network can’t rely on conventional approaches to governance.

I also see similarities between cryptocurrencies and companies when it comes to failure. Failure of a cryptocurrency hurts the people who were participating, the developers, holders, miners and users — but we haven’t yet reached a point where the failure of any cryptocurrency would have much impact beyond these stakeholders. At this point it doesn’t matter so much if a project’s governance is flawed and begins to produce bad decisions or no decisions — failure means abandoning ship and trying something else.

Widespread adoption is the aim of every cryptocurrency project, they aim to disrupt industries and supplant institutions and organisations. If and when a cryptocurrency project achieves its aim of providing a new infrastructure for some aspect of the economy or society, it will achieve a degree of lock-in that we haven’t yet seen. At the point when a cryptocurrency becomes too big to fail (without causing significant collateral damage), will it also be too big to change its rules or method of governance?

Altavista and Friendster failed without causing much of an effect, Google and Facebook won their battles and now seem too entrenched and powerful to easily fail. As a society we may have been wise to consider the business models of our search engines and social networks, but the longer-term implications of an exchange of data for services was lost on most of us and we went with the providers who offered the most appealing service. It is hard to imagine a scenario where Google or Facebook’s users migrate to another service en masse as a rejection of that company’s practices. Google and Facebook are however conventional, hierarchical, centralized companies. They answer to their shareholders and to the national governments where they operate, we can in principle exert some degree of control over their behavior through those institutions.

Cryptocurrencies are by their decentralized nature resilient to coercion and control, that’s one of their selling points. The idea that Bitcoin aims to become the world’s currency makes me uncomfortable about its governance model. Is a currency that affords miners sovereignty to change the rules, where our only recourse is to collectively say “that’s not Bitcoin any more”, really more desirable than central banks? Looking at how Bitcoin has handled a change in the block size limit makes me glad it’s something I can just walk away from. The prospect of this as the governance model of our global currency does not appeal to me.

Democracy offers us a means of representation in decision-making. While we can argue that certain formulations are better than others there is a lot of value simply in having a process that people are for the most part willing to go along with. Elections and referenda can be divisive, but those divisions are firewalled and contained because there is a process, and even if we didn’t get what we wanted this time there are peaceful means through which we can pursue our aims — or if nobody shares them, know that and give up.

11. Flexibility to institute or reform governance

As a cryptocurrency becomes more significant and valuable it likely becomes more difficult to change its approach to governance. The stakeholders that the model of governance empowers and enriches become more powerful as the network gains value. Bitmain, a major player in Bitcoin (and other PoW coins) mining, made $3–4 Billion profit in 2017. Bitcoin miners have an interest in maintaining their power, and resources to pursue that agenda.

Bitcoin’s users (or full nodes) could in principle decide to institute a new form of governance which diminished or balanced the power of miners, but 1) without a process to follow there is a significant barrier to making that change, and 2) if miners don’t approve of that change they have resources to oppose it.

In the early stages of a cryptocurrency it is much easier to change the rules because there are fewer stakeholders and their interests tend to be more aligned. Some combination of follow the leaderand follow the plan is sufficient to make decisions. Every project starts with a leader, the person or organisation whose idea the project is based on and who produces the first iteration of the software and genesis block. People take an interest in the project because they believe in the ideal it aims for, this usually extends to faith in the person/team who started the project’s capability and dedication to following it through.

Bitcoin’s leader was of course Satoshi, and it seems like in the early phase of the project Satoshi’s word was as good as law. Bitcoin is interesting in this regard because Satoshi abdicated from his position and disappeared, we’ll never know how long he could have dictated Bitcoin’s course for. This can be viewed as a strength of Bitcoin, a single leader that people follow is a centralized point of failure. An individual can make mistakes or be coerced into taking actions which weaken the network.

In the absence of a leader there is still a plan for Bitcoin, the original white paper. These documents are important because they help to align the expectations of participants, they set a frame for what the project aims to achieve. People who don’t want to achieve that aim have no business joining the project. Bitcoin is a “peer-to-peer electronic cash system”, participants should agree on that at least. However, no plan can foresee every issue that will arise or every decision that will need to be taken en route to its goal. If the leader is absent, there is nobody who can definitively interpret what the correct course of action is to follow their plan. Supporters of Bitcoin and Bitcoin Cash make reference to “Satoshi’s vision”, but they interpret it, and the course of action it indicates now, in different ways.

A shared plan is a good basis for making governance decisions, until situations arise that aren’t explicitly addressed and the course to take is ambiguous. Following a leader is an efficient means of governance, until that leader disappears or participants lose confidence in their decisions.

12. Ethereum and the DAO hard fork

“The DAO” was an interesting experiment in governance on the blockchain, when a vulnerability was found and exploited this yielded interesting observations of governance of the (Ethereum) blockchain. The DAO was to be a Decentralized Autonomous Organization which investors would collectively control through a complex arrangement of smart contracts. It was to operate as a kind of venture capital fund where anyone could invest capital, capital invested gave one a share of the proceeds and also voting rights to determine what the DAO would do. It had no conventional (human) management structure like a CEO or Board of Directors that would interpret and implement the votes of stakeholders — decisions would be made and implemented directly on the Ethereum blockchain through smart contracts.

Before the DAO got going, some party found a way to exploit a vulnerability in these smart contracts and take control over all the Ether that had been committed by stakeholders in the DAO — worth $150 million at its peak. The DAO had a built-in waiting period before funds could be spent by recipients. The attack triggered a 27 day period where the Ethereum community could take action to mitigate the attack before the funds could be dispersed into the wider Ethereum ecosystem. In the post where Vitalik Buterin (Ethereum founder) announced this exploit on the Ethereum blog, he also proposed a soft-fork which would effectively lock or blacklist the stolen Ether if a majority of miners adopted it. The soft-fork seemed to have approval of the miners and was set to be implemented, but a vulnerability was found which would have exposed the whole Ethereum network to a Denial of Service attack — reading between the lines, this post tells miners they should now vote against the soft fork.

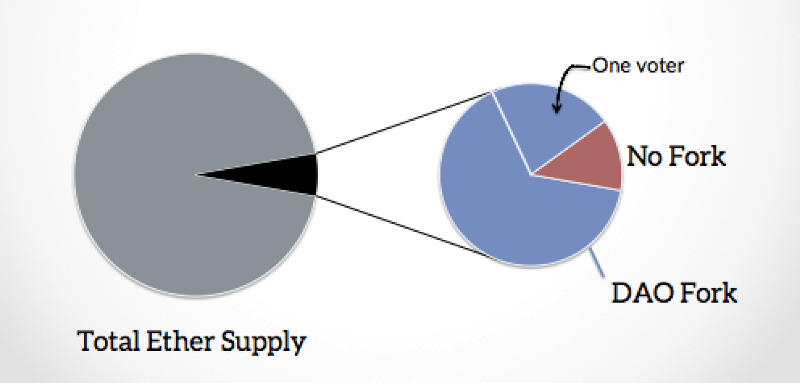

So, in the absence of a soft-fork solution, the Ethereum community were left with a decision of whether to adopt a hard-fork which would effectively re-write history as recorded on the Ethereum blockchain. A hard-fork was proposed by the Ethereum foundation which would take all of the Ether held by the DAO’s smart contracts and move it to a new contract where the people who had sent it to the DAO could re-claim it. This proposal came with a voting tool to allow Ethereum stakeholders to express their opinion about how to proceed, with the outcome of this vote being used to set a default for a parameter in a new version of the full-node software, to fork or not to fork.

The vote was conducted on the basis of one vote per Ether, not on the basis of one vote per wallet or individual. It was a coin vote. The largest stakeholders had the greatest say. There is a tendency for any vote on the governance of a blockchain to work on this basis, because the blockchain is a record of which private keys own which assets. Any full node can know how much Bitcoin or Ether a private key controls, but there is no way to know how many individuals have Ethereum wallets or how many wallets an individual controls. There is no way to hold a vote on the basis of one vote per person, because it would be trivial to game any proxy for this (like one vote per wallet or node), a sybil attack.

In this case, 87% of the Ether that voted said Yes to a hard fork, and the hard fork went ahead with 85% of the mining power switching to the new chain on which everyone got their DAO Ether back. This outcome is not that surprising because 15% of the entire circulating supply of ETH at the time was at stake. A considerable proportion of ETH holders must have been exposed to this and contemplating significant personal losses. That’s a strong motivation to vote Yes to the fork, whereas the motivation to vote No would have been more principled. The DAO hack would likely have left a cloud hanging over what was still a young project, with the prospect that the hacker could dump their ETH on the market, and maybe also some drawn-out legal proceedings against the group who set up the DAO. The catastrophic failure of what had become a flagship project for Ethereum would have been a significant setback, nullifying the damage was an attractive option.

In this case the leaders (Ethereum foundation) offered software which would contradict not only the Ethereum plan but a fundamental rule shared by all blockchains — immutability. The Ethereum Foundation seems to have played a leading role in how this played out (I didn’t see any of this first-hand but it’s the impression I get from this article). The first blog post about this from the foundation by Vitalik offers a soft-fork solution if people (miners) want it. This post didn’t say “you should do this”, and so the choice seems to be left to the miners— but it could have said “we at the foundation have no intention of forking to address this, that would be a gross violation of the principles this project is founded on” and things would likely have played out differently.

The relationship between the Ethereum foundation and Ethereum holders is an interesting one. Ethereum held a crowd-sale to fund development of the project in 2014, which raised around 25,000 BTC (or around $17 million at 2014 rates). I can’t find information on whether the foundation also kept some of the initial ETH for itself or bought it back using the BTC, but this articlesays they held 800K ETH in May 2017. The Ethereum foundation was funded at least initially by buyers of ETH.

What early investors got in exchange for their investment was not an asset that could be used but a promise to develop software, launch the Ethereum blockchain, and distribute coins that could be used on that blockchain to investors. Trust in the Ethereum foundation is woven into the fabric of the Ethereum community. This background creates a different dynamic between the Ethereum foundation and holders as compared to that between Bitcoin Core and Bitcoin holders.

The Ethereum Foundation didn’t (and couldn’t) mandate that the Ethereum blockchain hard fork to undo the DAO, but they made that option possible, and doing so constituted a signal of sorts to ETH holders. I like that they held a vote to gauge the opinion of ETH holders. 87% of the ETH that voted was in favor of a hard fork, but only 4.5% of circulating ETH participated in that vote, and as I noted above people who invested in the DAO had a strong incentive to vote Yes.Showing the time between blocks for Bitcoin Cash, August 2017 — January 2018. Source: https://bitinfocharts.com/comparison/bitcoin%20cash-confirmationtime.html

In a sense this was good, because it confirmed that the behavior of miners, key actors in Bitcoin, could be predicted (controlled?) by economic incentives — you’ll recall that Bitcoin needs this to be true. From a user’s perspective, this was bad, because it became harder to predict how long it would take for a transaction to be mined. This dynamic got fairly spicy in early November, when the price of Bitcoin Cash increased rapidly as Bitcoin’s price fell. This price action was accompanied by a surge in low-value transactions on the Bitcoin chain, causing Bitcoin’s transaction fees to increase sharply. This was described in some circles as a civil war, there were rumors of a dragon slayer conspiracy to dethrone Bitcoin. There was even speculation that Bitcoin may suffer a chain death spiral whereby people sell it because they can’t make transactions, this pushes its price lower which in turn makes it less attractive to miners and slows the creation of new blocks, triggering a feedback loop that could drive the price down so far that there would no longer be enough hashpower to find new blocks.

Bitcoin Cash underwent another hard fork (of the upgrade variety) to make the difficulty adjustment smoother on November 14th, and as the chart shows this returned consistency to the block time.

Exchanges are important as public spaces because they are the venues where the price of a cryptocurrency is negotiated, and they also have direct power. In the Bitcoin Cash example the exchanges had power in that they decided Bitcoin Cash was not Bitcoin (BTC). However, many of the larger exchanges decided to support Bitcoin Cash and trade it as BCH. Many exchanges decided to honor the principle that people who owned BTC at block 478558 also became owners of an equivalent amount of BCH. Exchanges didn’t have to do this, when Bitcoin is stored on an exchange the exchange holds the private keys to spend it — I doubt the exchanges had terms which said their clients would become the owners of the coins on new chains forked from the coins in their accounts.

Many exchanges also opened markets for trading BCH, and this bolstered its legitimacy. The relative price of BTC and BCH is important because it dictated what holders of those coins could buy and it influenced the behavior of miners — this was negotiated on exchanges.

Exchanges were perhaps even more influential in relation to the Bitcoin Segwit2x fork that never really happened.

Segwit2x Background: On May 23rd 2017 a statement was released following a meeting of certain Bitcoin stakeholders at a conference (the New York Agreement). The attendees at this meeting had apparently reached an agreement on how Bitcoin should scale — a soft fork to implement segregated witness, followed by a hard fork to double the block size limit from 1mb to 2mb within six months. This agreement seemed to have the support of some major players, including miners that controlled 83.28% of the Bitcoin hash power, and a list of companies that together accounted for a significant proportion of “the Bitcoin economy” — for example BitPay, a payment processor that handles the receipt of Bitcoin by merchants in exchange for goods and services.

This agreement proved to be controversial (more on that later). Exchanges played a role here as when it “became clear” that the Segwit2x fork was contentious they started announcing that they would support trading of both the Segwit2x chain and the legacy BTC chain. This is itself significant, because Segwit2x was supposed to be an upgrade hard fork. If exchanges are planning to support trading of two chains that’s a strong indication that they don’t expect the upgrade to go smoothly, they expect a chain split. Furthermore, the labels they gave to these chains tended to give primacy to the legacy BTC chain (example: BTC and B2X). Perhaps even more significantly, some exchanges started to offer trading on “Segwit2x futures”, where people could speculate on the value of Segwit2x relative to legacy BTC. The message from participants in these markets was that they expected Segwit2x to be worth significantly less than legacy BTC.

6. Gauging the mood of “the Bitcoin economy”

How did it become clear that the Segwit2x upgrade was controversial, or how did the controversy about Segwit2x manifest?

I’m not going to dig into the details of this controversy, but I can give my outsider’s perspective, and as I didn’t really have a horse in this race I think my perspective is fairly unbiased. In the absence of an accepted way of obtaining the “approval of the Bitcoin economy” for a hard fork, getting a lot of the major players in that economy in a room and hashing out an agreement seems like a reasonable starting point to me. However, making decisions in a way which is transparent and open also seems like an important part of Bitcoin’s governance philosophy. An in-person meeting that wasn’t recorded or transcribed, and which millions of participants in the Bitcoin economy were not invited to, does not fit with this philosophy. When the outcome of that meeting was expressed as two bullet-points explaining “this is how we’ve decided Bitcoin is going to be”, it is not surprising that a lot of those people who weren’t invited to the meeting seem to have felt left out.

This raises some interesting questions for me, like how do you involve “the entire Bitcoin economy” in the process of deciding how the rules should change? There seems to be an expectation that this process should be transparent and inclusive, but how do you include that many people in a meaningful way?

There are a lot of people who hold Bitcoin, this paper estimates 2.9 to 5.8 million people hold some sort of cryptocurrency, to be conservative and keep things simple let’s say 1 million people hold Bitcoin. As I suggested earlier, a lot of these people probably don’t care about any given change to the consensus rules, but if even 10% of holders care that’s still 100,000 people who want to participate or at least feel included.

We have the internet now, social media, all of those people can speak, and some proportion of them can even be heard. Anyone can join Bitcointalk and post there, but who’s got the time to read those 50 page threads? Lots of crypto folk are on Twitter, but there one’s capacity to be heard depends on being known and followed (and is subject to the whims of the twitter administrators). Reddit seems to offer a solution which works at scale because support for perspectives can be indicated through voting — although that’s not how you’re supposed to use those up/down buttons, up-votes are for posts and comments that contribute to the discourse constructively!

The problem is that all of these public spaces are vulnerable to a) censorship and b) abuse/distortion/gaming. Moderators can make posts and comments disappear. /r/Bitcoin actually has a rule which states:

Promotion of client software which attempts to alter the Bitcoin protocol without overwhelming consensus is not permitted.

A BIP can’t be considered to be Proposed until it has a working implementation, and the largest Bitcoin subreddit doesn’t allow discussion of client software which attempts to alter the protocol unless there is overwhelming consensus. That would seem to exclude /r/Bitcoin as a public space where the Bitcoin community might work towards this consensus. Will discussion of a

Actors with resources (time to create and cultivate sock-puppet accounts, money to pay people) can make it seem like the community support for a perspective is greater than it actually is. All of this happens in a way which is opaque and hard to quantify, we just see indicators that something doesn’t seem right from time to time.

Returning to Segwit2x specifically, users of /r/bitcoin seemed to be opposed to this, many of them vehemently. The nature of this opposition seemed to stem more from their lack of inclusion rather than the specific change from a 1MB to 2MB block limit. People objected to the perception of a backroom deal which sought to dictate Bitcoin’s future to them. But, there have been accusations of censorship on /r/bitcoin which marginalizes certain points of view.

Reddit is also susceptible to manipulation (all sides seem to accept that the other side is capable of this). So how much weight should we place on reddit-expressed sentiment? Was sentiment against Segwit2x on social media the reason it was cancelled? Did the poor showing for Segwit2x futures play a part in this? These futures markets had fairly low volume and were therefore also vulnerable to manipulation. The only people who really know why the Segwit2x fork was cancelled are the six who signed the email announcing the cancellation.

7. Characterizing Bitcoin’s governance

Bitcoin’s governance is characterized by inertia and confusion. The inertia stems from the high barrier to accepting a change in consensus rules. The entire Bitcoin economy has to adopt software which implements the new rules — and there is no accepted procedure for establishing that new consensus before the magical moment when everyone starts following the new rules.

This lack of an accepted procedure also induces confusion, without an established procedure nobody knows what to expect. Miners can signal what they want to happen as a group on the blockchain, developer groups also have channels through which they can be heard — but when it comes to the users we are left with a cacophony of unreliable signals in various social fora, and speculation on the relative price of the new chain if it does in fact split. Users lack an accepted and robust way of signalling their wishes, this limits their capacity to coordinate and diminishes their power.

8. (How) could a Bitcoin hard fork happen?

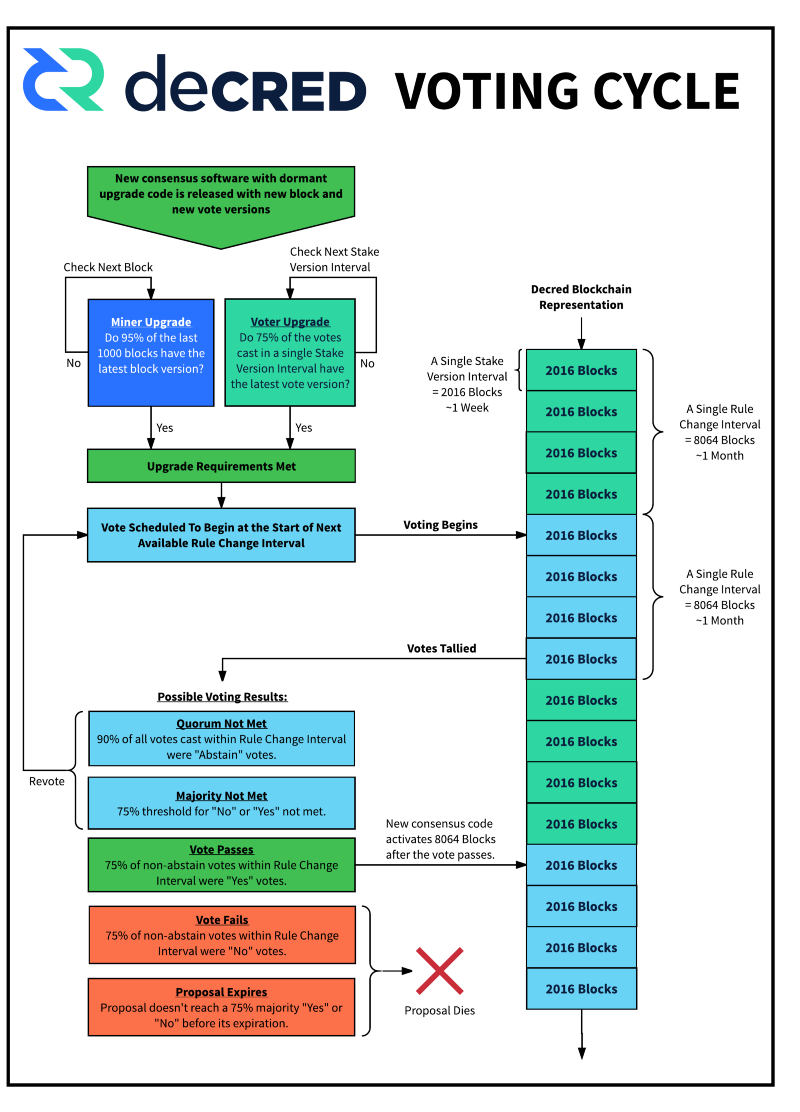

I see three scenarios: