On November 28th, the Brazilian congress finished the approval of the bill that regulates the Crypto market. The bill, authored by deputy Aureo Ribeiro, was voted on by the Senate in April and locked in the Chamber of Deputies since then. The chamber parties approved the Project of Law by unanimous decision, defining regulatory guidelines to guide legal regulation, consumer protection, and the fight against financial crimes.

This project has been in discussion since 2015 when cryptocurrencies started to advance in Brazil. The approval achieved by all parties shows that there is much interest in regulating those assets in the country. The proposal will now pass outgoing for President Jair Bolsonaro for approval. According to Brazilian law, after the sanction companies will have 180 days to adapt to the new rules.

Discussing the regulation

The new law impacts companies that act in the crypto sector. Exchanges will need to apply for a license to operate in the country, needing a juridic person serial number (CNPJ) and the obligation to report to state financial regulatory organs. Details for obtaining the license are still under debate, the likely regulatory institution will be the central bank. While those norms do not get disclosed, exchanges with no presence in Brazil will be able to continue operating.

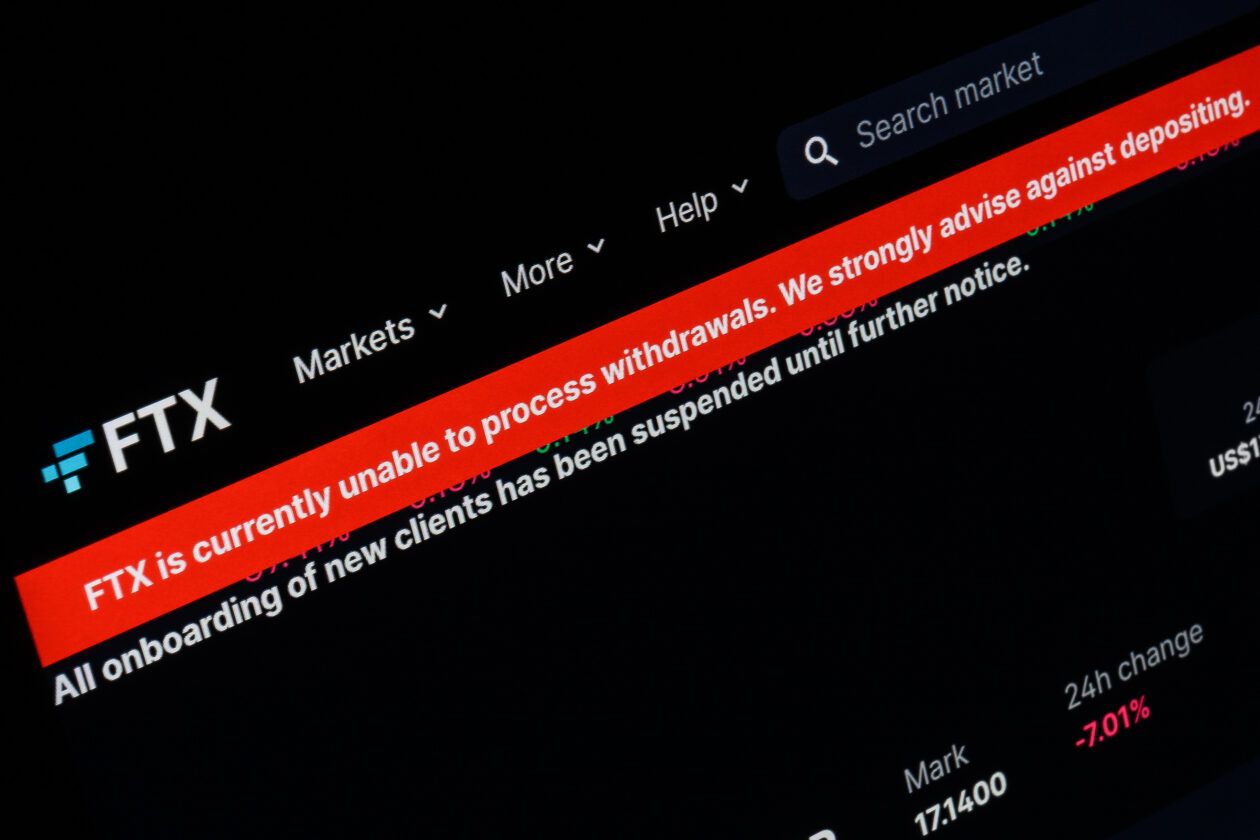

Even after the FTX bankruptcy, deputies of the Brazilian congress rejected the asset segregation proposal of the bill. This proposal was heavily defended by Brazilian crypto exchanges, while foreign brokerages, such as Binance, were against it. This mechanism would separate the assets of investors and exchanges, assuring that those companies would not play with users' values. It is expected that asset segregation will be discussed again in 2023 by the Brazilian Central Bank

DCRDEX is a decentralized exchange built by the Decred project. It is not run by a central company or system, but by those who operate with it. The custody of the coins remains with owners, not enabling events like the FTX scandal. It does not work based on a specific country, so it will have a different adaptation to this regulation if compared to Binance and Crypto.com.

The FTX crash caused many Brazilian crypto investors to demand regulation for the market. The change of government was also a motive for immediate approval since the new president, Lula, does not have the crypto market as a priority.

This regulation intends to increase the protection of investors and companies that act in the Brazilian crypto market. Marcos Castellari, CEO at Brasil Bitcoin, sees regulation as an opportunity for more investors to enter the market. "The general public often does not invest in this market due to lack of legal protection." He comments.

Frauds and scams committed using crypto assets are also part of the bill. The crime of fraud in the provision of virtual assets will be added to the Brazilian Penal Code by mid-2023. This section was formulated by deputies who defend effective combat against the many crypto scammers, like the Bitcoin Pharaoh.

Regulation works?

Many countries have regulated or are discussing the regulation of crypto assets. Places like Australia and Japan already treat cryptocurrencies like property, monitoring and taxing them, while EU countries tend to treat crypto with no legal tender. Regulation is also on the radar of US lawmakers after the FTX turmoil. Do you consider regulation to be a good thing for the crypto market? Or do you think it harms the freedom of investors? Leave a comment with your opinion!

Comments ()