New taxes can be a stone in the shoe, but there are many ways to protect your identity and investments.

Bad news for crypto investors in Brazil, they may soon face a new tax as part of the country's efforts to regulate the crypto market. The Federal Government has proposed a tax rate of 22.5% for investors who hold funds on international cryptocurrency exchanges.

The tax proposal has been submitted to the Chamber of Deputies by the government. The key point of the proposal is that it would apply exclusively to cryptocurrency transactions conducted on platforms based outside of Brazil but operating within the Brazilian crypto market. Under this proposal, investors with balances exceeding R$ 6.000 (U$1.250) on international exchanges, like Binance or Coinbase, would be required to pay a 22.5% tax on their holdings. This marks a significant development in the regulation of the Brazilian crypto landscape, potentially impacting the taxation of crypto investments in the country.

The regulatory siege in Brazil has not been seen as harsh as the one going on in the U.S. coordinated by the SEC. Crypto legislation approved by Congress has been written with the contribution of market members, crypto specialists, and government agents. Even with this progress, this last tax proposed by the new government will surely be a harsh blow if approved.

Although not yet approved, the concept of introducing a new crypto tax is likely to be considered by federal deputies. The proposal has been transformed into a legislative bill, which will subsequently undergo voting in the Senate. Therefore, the new 22.5% crypto tax must be approved by both the Senate and the Chamber of Deputies before it can move on to receive presidential approval.

As the government stated, there is R$ 1 trillion invested in foreign assets. The purpose of introducing a new crypto tax is to boost fiscal revenue in Brazil. Therefore, the government anticipates collecting over R$ 7 billion in 2024. This law is not only directed to cryptocurrencies but to all kinds of investments made outside of Brazil, as it is written on the bill:

"§ 1 For the purposes of this article, the following are considered:

I - financial investments abroad - any financial operations outside the country, including, for example, interest-bearing bank deposits,

certificates of interest-bearing deposits, crypto assets, digital wallets, or accounts

income streams, investment fund shares..."

The Brazilian Association of Cryptoeconomics (ABCripto) has already emphasized that the proposal to establish a new tax on cryptocurrencies in Brazil is considered illegal. According to the association, categorizing crypto-assets indiscriminately as financial investments is a contentious, improper, illegal, and potentially unconstitutional matter.

What can be done?

If approved the new legislation will impact mainly investors with cryptos in international exchanges. This new tax is a tragedy for many since 22.5% is a huge portion of everyone's investment. The legislative bill affirms in its text what it means by entities controlled abroad:

"§ 1 For the purposes of the provisions of this Law, they will be considered as

controlled companies and other entities, whether personified or not, including investment funds and foundations, in which the individual:

I - holds, directly or indirectly, alone or jointly with other parties, including due to the existence of voting agreements, rights that ensure its preponderance in social deliberations or the power to elect or dismiss the majority of its administrators; or

II - possess, directly or indirectly, alone or together with related persons, more than fifty percent participation in the share capital, or equivalent, or in the rights to the realization of its profits, or to the receipt of its assets in the event of its liquidation."

After reading this part of the text is clear that investments made in Brazil are not taxed.

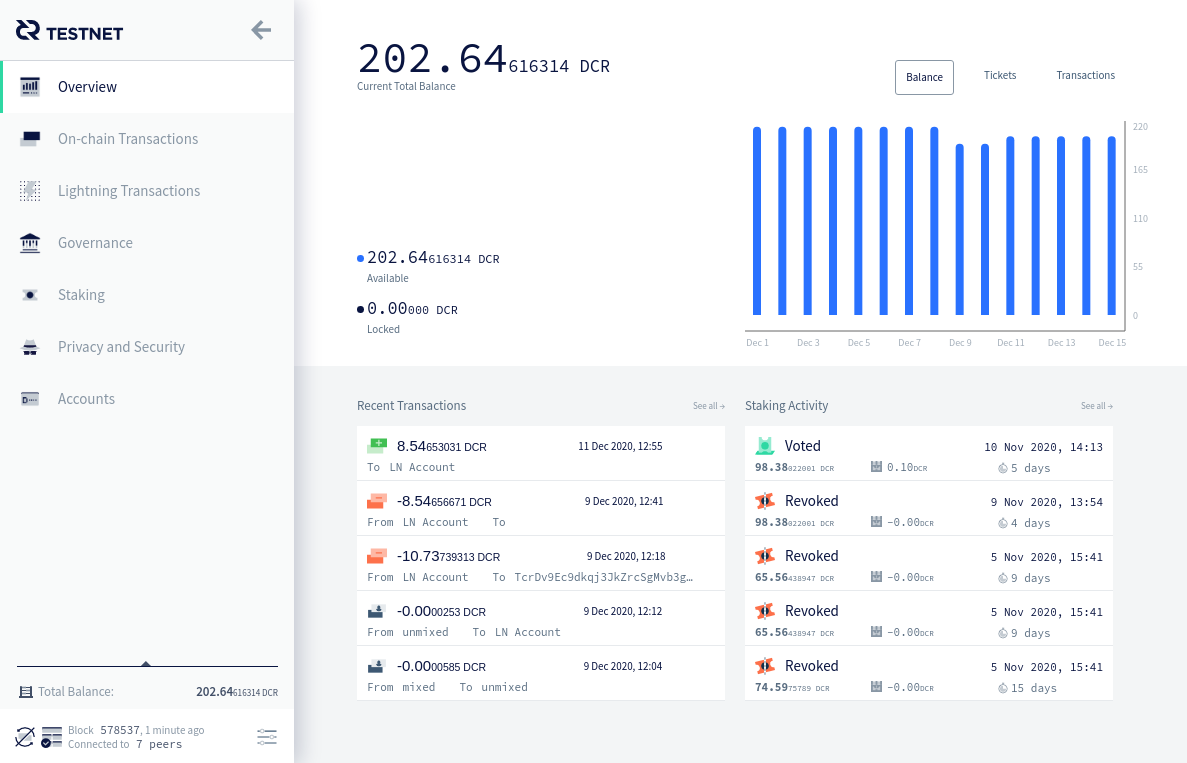

Diversification and secure storage of cryptocurrency investments are fundamental principles for anyone involved in the world of digital assets. While big crypto exchanges serve as convenient platforms for trading and acquiring cryptocurrencies, relying solely on these platforms can pose risks and higher surveillance. This is where the importance of personal digital wallets like Decrediton and decentralized exchanges like DCRDEX becomes evident.

Decrediton plays a main role in Decred's network. It ensures total control of someone's DCRs while enabling participation in the project decision-making process. The wallet is designed with a user-friendly interface, making it very easy to store, send, and receive DCR.

DCRDEX on the other hand is Decred's decentralized exchange. By being a decentralized exchange and having no centralized control in any country, DCRDEX is left in a grey area, since it does not meet the definitions of the bill for entity controlled abroad.

Besides not being popular like Binance or Coinbase, DCRDEX provides an amazing service in trading and storage. Many different coins are supported in DCRDEX, such as:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- USDC

- Litecoin (LTC)

- Doge (DOGE)

- ZCash (ZEC)

- Digibyte (DGB)

DCRDEX places a strong emphasis on privacy, making it an attractive option for users who value privacy. The platform has been built by Decred but delivered as a public good for the crypto space. Decred prioritizes privacy through technologies like Stakeshuffle and the Lightning Network. By leveraging these privacy-enhancing features, DCRDEX allows users to engage in peer-to-peer trading without exposing their transaction details to outsiders.

There is no need to verify your ID to trade on DCRDEX. There are also no trading fees, leaving only you to profit from your financial activity. New taxes can be a stone in the shoe, but there are many ways to protect your identity and investments, DCRDEX is one of them! Find out more about this exchange here.

Comments ()