BRC-20 tokens are still in their experimental stage, the Bitcoin community has grown interest in the possibilities this initiative has to offer, which has prompted many to create their own ordinal inscriptions and BRC-20 tokens

In the past few weeks, we have seen a tremendous wave of new narratives; from the Frog-themed memecoin $PEPE that did over 100000%, to the popularization of Bitcoin’s native token standard – BRC-20. Bitcoin Request for Comment (commonly called BRC-20) is an experimental token standard theorized by an anonymous developer (with the Twitter username – domodata) on March 9 2023 that allow users to mint, trade and transfer fungible tokens on the Bitcoin blockchain.

Initially, the Bitcoin blockchain was built as a decentralized p2p network that removed the need for centralized entities (e.g banks). Smart contract functionality was never a feature in the network until the Bitcoin Taproot upgrade in November, 2021 which allowed developers to attach more data onto Bitcoin block space through the Ordinal protocol. Ordinals provide a means for Bitcoin node operators to inscribe text, images, videos, audios and applications into the smallest unit of a Bitcoin (satoshi). This allowed satoshi's to store various forms of data on the Bitcoin mainnet, making ordinal NFTs Bitcoin-native.

BRC-20 tokens are simply ordinal inscriptions with JavaScript Object Notation (JSON) embedded in them that sets the rules and criteria for minting and trading the tokens, similar to the way a smart contract works.

New Tech, New Problem

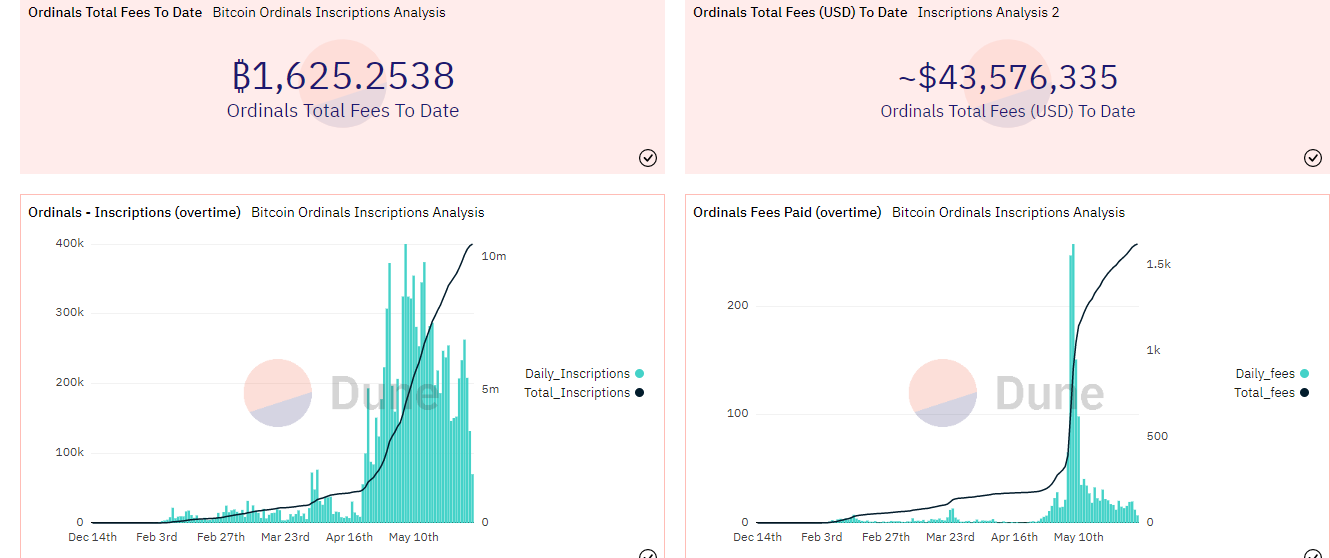

Although BRC-20 tokens are still in their experimental stage, the Bitcoin community has grown interest in the possibilities this initiative has to offer, which has prompted many to create their own ordinal inscriptions and BRC-20 tokens, leading to Bitcoin’s network congestion and eye-watering transaction fees. Data from a Dune analytics contributor reveals that over 10 million Ordinal inscriptions have been created (with majority being texts) and a total of 1,621 $BTC ($43.7 million) paid in network fees between the months of March to May.

In an interview with Cointelegraph, Bitcoin educator and chief marketing officer at Trust Machines – Dan Held discussed the implication of the high transaction fees on the Bitcoin network, citing that the growing demand for Bitcoin’s block space was a leading factor to the increased network fees. He also noted that the high fees was a good thing as it will prompt the community to seek various scaling solutions.

New Problems, New Solutions

Dan Held wasn’t wrong, as a blog post from Lightning Labs on May 16,2023 announced the release of the Taproot Assets Protocol testnet, which would allow developers to issue, send, receive and discover assets on the Bitcoin blockchain (similar to Ordinals, but with cheaper transaction fee). According to Ryan Gentry (the author of the blog post), he noted that the interest in asset issuance on Bitcoin has caused users to adopt protocols that write asset metadata directly into block space in an inefficient manner. In his words he wrote “While the excitement around building on Bitcoin is encouraging, the fee market’s response has indicated that these protocols are not designed for scale”.

The Taproot Assets Protocol was designed to operate off-chain, thereby reducing the congestion on the Bitcoin mainnet. When it goes live on the Lightning Network mainnet, users would be able to integrate their assets into the Lightning Network for instant, high volume, low fee transactions. Additionally, asset minters can enjoy the permissionless nature of the Bitcoin blockchain without running into Bitcoin’s scaling constraints.

Lightning Labs isn’t alone in the quest to scale the Bitcoin blockchain, a Swiss-based nonprofit known as ZeroSync Association is developing tools (using zero-knowledge proofs) that allows Bitcoin users to validate the state of the Bitcoin network without having to download over 500 gigabytes of blockchain data to sync a node. Similar to how Ethereum’s zk Layer-2 operates, ZeroSync uses Zk-proofs to generate valid proof and verify the recent state of the blockchain almost instantaneously.

Degens keep degening

Regardless of its shortcomings, BRC-20 tokens (and ordinal inscriptions) have gained new feats as they beat some EVM chains in trading volume. During the first week of its creation, the total market capitalization of BRC-20 tokens surpassed $1 billion with over 24k tokens minted on Bitcoin mainnet. Data from CryptoSlam also reveals that Bitcoin surpassed Solana in NFT trading volume in May, sitting in second place behind Ethereum. Recently, Ordinals announced its support for Ethereum ERC-721 nonfungible tokens (NFT) with the launch of BRC-721 E standard. This update allowed Bitcoin maxi's to convert their ERC-721 NFTs to the new BRC-721 E standard.

Final Thoughts

The question “here to stay or fade?” is one that attracts diverse opinions from different perspectives. While some see BRC-20 tokens as a new innovation with untapped opportunities, others consider the current boom in volume to be the handiwork of degens and airdrop farmers. Since the realization of BRC-20 tokens, there have been rumors of potential airdrops to reward active traders, similar to what we have seen in the past with new crypto infrastructure. On Feb 24, 2023 Ordinals wallet announced its first airdrop; giving users of its wallet free NFT that were valued as high as $14,000. Recently the team made a tweet “seems like an airdrop is in order” which has made many onboard themselves to the BRC-20 ecosystem via their wallet.

Jan3 CEO Samson Mow has also given his opinion regarding the hype around BRC-20 tokens – “These guys are basically paying massive amounts of fees that go directly to Bitcoin miners, and there is no way this can be sustained. They will fade away after even months; let’s not talk about years here”. From Mow’s perspective, he sees the whole trend as a way for Bitcoin miners to earn an extra buck from the high transaction fees; he said “These are just short-term money grabs similar to most things on competing chains like Ethereum and Solana”.

In general, it is important to note that BRC-20 tokens are still experimental projects with a questionable outlook, little to zero utility and an undecided future. In a gitbook page, Domo explained “This is just a fun experimental standard demonstrating that you can create off-chain balance states with inscriptions. It by no means should be considered THE standard for fungibility on Bitcoin with ordinal, as I believe there are almost certainly better design choices and optimization movements to be made. Consequently, this is an extremely dynamic experiment, and I strongly discourage any financial decision to be made on the basis of it’s design.”

Comments ()