November 2023 roundup of all things crypto and what’s happening in the cryptocurrency realm. What was your biggest news piece?

November 1st to November 8th:

- Coinbase crypto futures for retail US traders goes live, includes 'nano' Bitcoin trading

- PayPal UK unit registers as crypto service provider

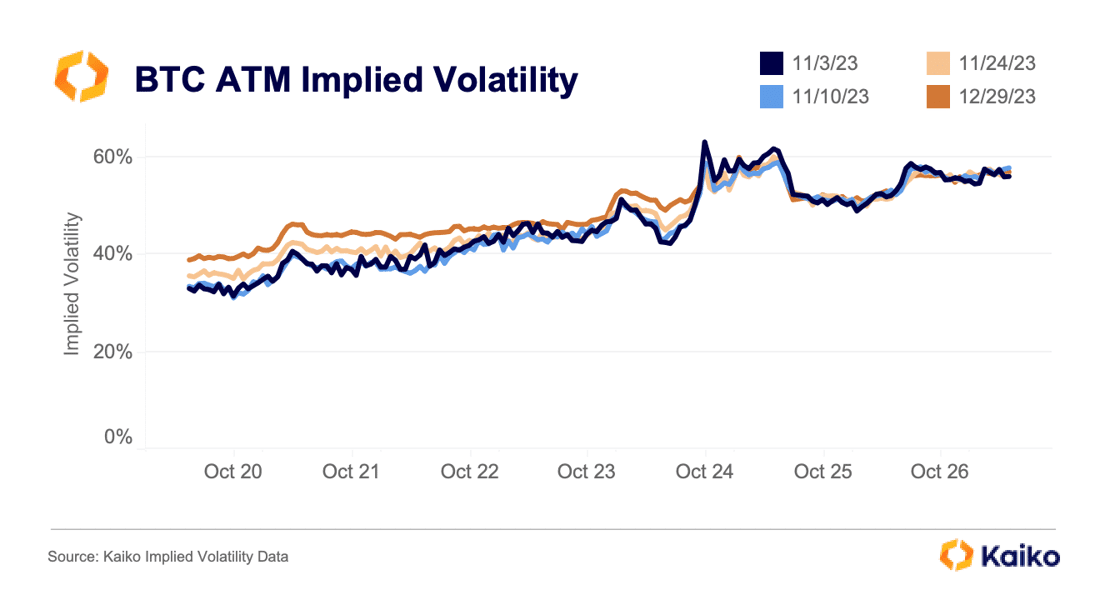

- Funding rates for Bitcoin perpetual futures markets have flipped positive across exchanges for the first time in months, suggesting a bullish bias. Open interest is also slowly rebuilding after a wave of liquidations during the initial price surge

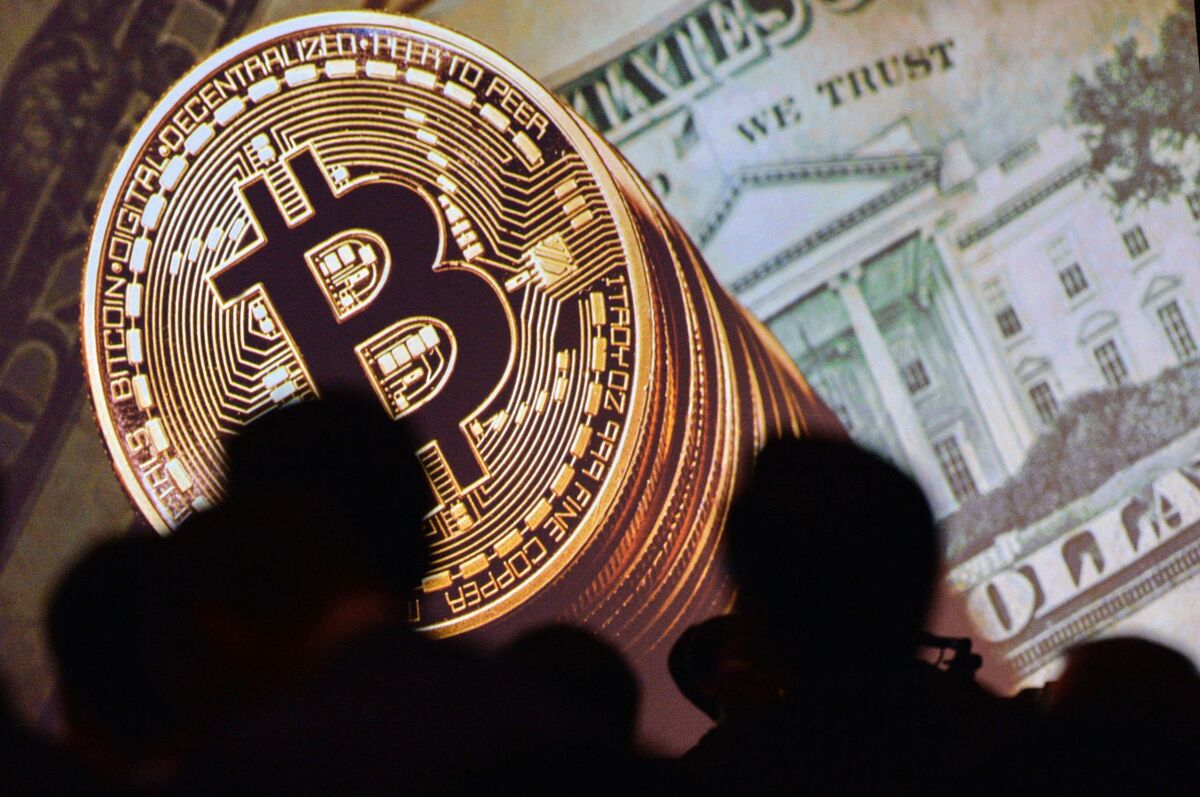

- In October, MicroStrategy acquired an additional 155 BTC for $5.3 million and now holds 158,400 BTC

In October, @MicroStrategy acquired an additional 155 BTC for $5.3 million and now holds 158,400 BTC. Please join us at 5pm ET as we discuss our Q3 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/w7eRUcGobi

— Michael Saylor⚡️ (@saylor) November 1, 2023

- SBF's closing argument: Prosecution's 'movie villain' narrative lacks any clear motive

- Swiss bank launches Bitcoin and Ether custody and trading services, in partnership with SEBA

- Hong Kong sets out requirements for asset tokenization in light of ‘market demand’

- PayPal received a subpoena from U.S. SEC division of enforcement relating to PYUSD stablecoin

- On Coinbase, BTC and ETH account for the majority of volumes, at 36% and 22%, respectively. Altcoins account for just 31% while stablecoins represent 10%.

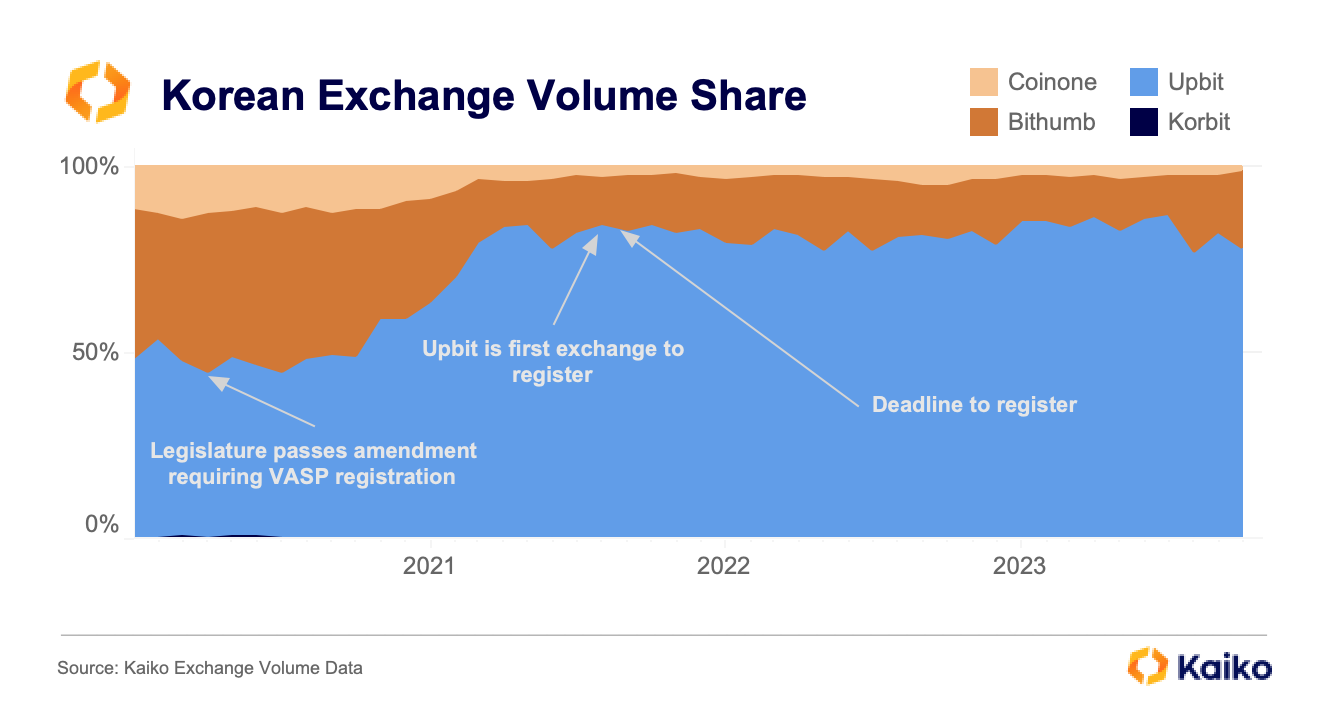

However, on Korean exchanges, the vast majority of volume comes from altcoins. On Upbit, just 2% of its volume has come from ETH and just 9% from BTC

- ProShares launches Ether futures ETF for crypto bears

/cloudfront-us-east-2.images.arcpublishing.com/reuters/37QXKDW5J5JDXBI4KV4H5GGN2E.jpg)

- Tether extends debt financing to Northern Data capped at $610 million

- Coinbase beats estimates but sees lower trading volumes in third quarter

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WDLQ7AOO7BL4HFMX7UBXZUR3Y4.jpg)

- Sam Bankman-Fried found guilty on all seven criminal fraud counts, sentencing set for March 28, 2024

- Bitcoin settled more than 40 million transactions in a single quarter for the first time since its inception in Q3 of 2023

https://4822441.fs1.hubspotusercontent-na1.net/hubfs/4822441/HDX%20-%20Q323%20Market%20Pulse.pdf

November 9th to November 16th:

- SEC Chair Gensler says rebooted FTX run by ex-NYSE chief is possible if done 'within the law'

- Standard Chartered unit, SBI Holdings team up to invest $100 million in crypto startups

- Lightspeed Faction launches $285M early-stage crypto fund

- EU Parliament approves Data Act with smart-contract kill switch provision

- OneCoin legal chief pleads guilty to money laundering and wire fraud: DOJ

- Celsius Network cleared to exit bankruptcy, said it could start repaying customers in January

- BlackRock Eth ETF confirmed in Nasdaq filing

A proposed rule change to list and trade shares of the iShares Ethereum Trust (the "Trust") under Nasdaq Rule 5711(d) ("Commodity-Based Trust Shares").https://t.co/1UIucYnsb3

— db (@tier10k) November 9, 2023

- CME just flipped Binance for the largest share of Bitcoin futures open interest

Wow, the real flippening that no one is talking about:

— Will (@WClementeIII) November 9, 2023

CME just flipped Binance for the largest share of Bitcoin futures open interest.

Bittersweet -- there will soon be more suits than hoodies here.

(h/t @VidiellaLaura) pic.twitter.com/SIPRLMlFcy

- JPMorgan switches on programmable payments using blockchain tech

- Poloniex wallet seemingly drained of around $63 million in cryptocurrency; Poloniex hack estimates rise to $114 million

- FTX sues crypto firm Bybit to recover assets worth $953 million

- Genesis, Three Arrows Capital reach agreement on $1B of claims with a payment of $33 million

- The Block sold it's majority stake to Foresight Ventures in deal valuing it at $70M, most capital used to buy out former CEO Mike McCaffrey's stake

https://www.axios.com/pro/fintech-deals/2023/11/13/the-block-70-million-foresight-ventures

- Cboe Digital to launch margined Bitcoin and Ether futures on January 11

- Tron's dominance of the stablecoin market has grown from 23% a year ago to 37.55% today

The potential flippening that no one is talking about.

— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) November 10, 2023

Tron's dominance of the stablecoin market has grown from 23% a year ago to 37.55% now. pic.twitter.com/CzfRElB48W

- Goldman and BNP Paribas lead $95M new funding for UK-based Fnality blockchain payments firm

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FTGFRPKZ4VJSBJ3IWS2JEOD66M.jpg)

- Australia updates its capital gains tax guidance to include wrapped tokens and DeFi

- The Bitcoin Illiquid Supply metric, which measures the amount of supply held in wallets with minimal history of spending is at an ATH of 15.4M BTC

The #Bitcoin Illiquid Supply metric, which measures the amount of supply held in wallets with minimal history of spending is at an ATH of 15.4M BTC.

— glassnode (@glassnode) November 10, 2023

Changes in Illiquid Supply often move in tandem with exchange withdrawals, suggesting investors continue to withdraw their coins… pic.twitter.com/lwHQmFkoMy

- Delaware authorities reported the authors of fake BlackRock XRP filing to law enforcement

- India's Supreme Court turns away petition asking government to frame crypto guidelines

- Binance Japan to list 13 new tokens, including Near and Optimism

- Commerzbank wins crypto custody license in digital assets push

- Judge denies motion by FTX lawyers to delay the bankruptcy process to 'find out what happened to FTX'

- South Korea’s national pension fund buys $19.9 million worth of Coinbase shares

- CoinShares tees up potential buy of Valkyrie’s crypto ETF wing

https://blockworks.co/news/coinshares-potential-buy-valkyrie

November 17th to November 24th:

- XREX obtains in-principle approval for Major Payment Institution license in Singapore

- Derivatives trading volume on the CME exchange rose 73.5% to $57.4bn, recording the highest volumes since November 2021

- Santander Private Bank introduces Bitcoin, Ethereum trading for clients in Switzerland

- Japan’s Osaka Digital Exchange to start digital securities trading next month

- Crypto exchange Bullish buys 100% of CoinDesk from DCG

- Tether freezes 225m in stolen USDT linked to an international human trafficking syndicate

- 21Shares & ARK amends its Bitcoin ETF spot filing, discloses 80bps fee

https://vxtwitter.com/EricBalchunas/status/1726593229481738448

- U.S. SEC just filed a case against Kraken for operating online crypto trading platform without registering with the agency

https://fxtwitter.com/SummersThings/status/1726725624159748172

- Binance founder Changpeng 'CZ' Zhao released on $175m bond, will be sentenced in February

- Genesis sues Gemini to recover “preferential transfers” worth $689m

- Mt. Gox creditors to receive 'repayments in cash' starting in 2023: trustee email

https://fxtwitter.com/pourteaux/status/1727192415214166494

- UK finance minister announces legislation to boost the nation's digital asset sector

- US prosecutors ask federal judge to prevent Binance founder CZ from returning to UAE before sentencing

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QOIXBBXF75I7ZE7CNA7J4WZ7ZQ.jpg)

- Singapore plans more rules to curb retail crypto speculation

- Do Kwon’s extradition approved by Montenegro court

November 25th to November 30th:

- CEO Teng outlines 'responsible growth’ vision amid Binance’s compliance overhaul

- Judge says former Binance CEO Changpeng Zhao cannot leave US ahead of sentencing

- USDC stablecoin to make Japan debut in SBI tie-up

- DCG struck a new repayment deal with bankrupt unit Genesis to end $620 million suit

- Philippines' SEC to block access to world's largest crypto exchange Binance

- US Treasury seeks expanded sanctions powers in digital space

- FTX approved to start selling $744 million in Grayscale assets

- MicroStrategy has acquired an additional 16,130 BTC for ~$593.3 million at an average price of $36,785 per Bitcoin

MicroStrategy has acquired an additional 16,130 BTC for ~$593.3 million at an average price of $36,785 per #bitcoin. As of 11/29/23, @MicroStrategy now hodls 174,530 $BTC acquired for ~$5.28 billion at an average price of $30,252 per bitcoin. $MSTR https://t.co/hSEZyzGBsr

— Michael Saylor⚡️ (@saylor) November 30, 2023

Comments ()