During times of uncertainty, staking Decred tickets is proving to be a pretty solid store of value. Earn interest whilst waiting out the storm.

In terms of price, Decred has been in a downward cycle for almost 2 years since hitting its all-time high of $246 in Apr 16, 2021. During this time, Decred’s fundamentals have continued to improve with innovation and progress across its entire technology stack. Decred continues to develop at a remarkable rate and even add products to its ecosystem (Bison Relay). The price is not telling the whole story, with a bit of digging who knows what you’ll uncover!

Decred / USD price overview

Price action

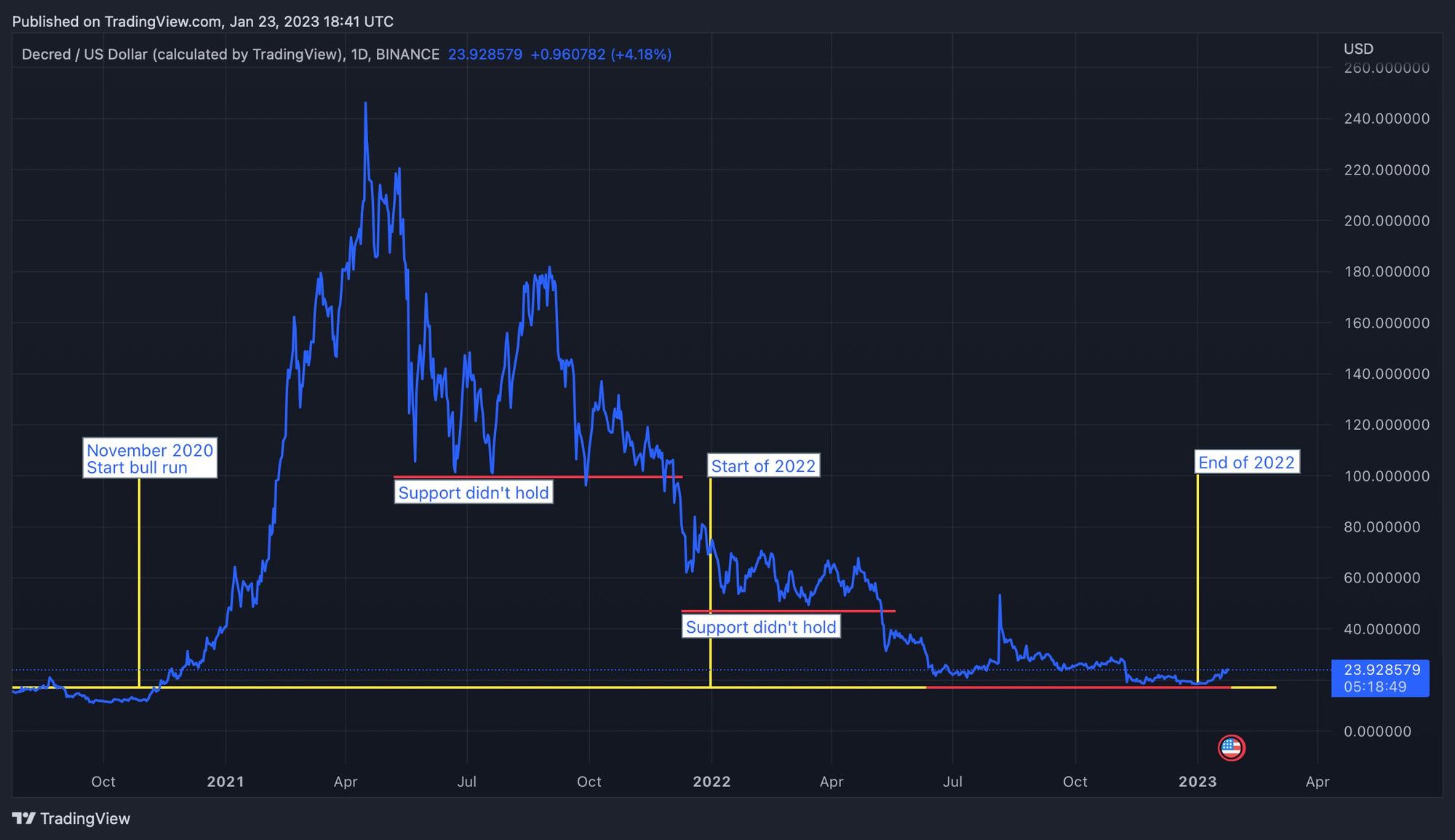

Decred opened the year with a price of $69.95 and ended 2022 with the yearly low of $18.29, $8 higher than the start of the November 2020 bull run. Support held at $47 until May 2022, which coincided with the consensus / miner reward change and the Terra Luna crash. This downward action was expected as miners began to add sell pressure as they exited their dcr positions, the expectation was, we would initially lose 2/3 of the project hash rate with a similar decline in price. Decred’s hash power dropped from 300ph/s to 30ph/s and is now consistently in a range of 65ph/s to 100ph/s. This negative action is likely to take between 6 months and 18 months to play out. The eventual stabilising of price and hash rate will lead to a more environmentally friendly project and stronger potential for price realisation. At almost, the same time as the protocol upgrade, the Terra death spiral occurred and started the bear market for the rest of the crypto space.

Decred hash rate

POW vs POS

During this year, we have seen wide speculation as to which is better POW or POS. Although POW is still the winning formula for Bitcoin BTC, other projects with pure proof of work and no ASIC resistance are likely to have considerably weaker security. The centralisation of chip manufacturing has also been considered a negative effect on POW project’s going forward.

Ethereum moved from POW to POS this year, with several other notable projects aiming to follow suite, including ZCash. Decred’s hybrid protocol is still seen as the best solution for the project in terms of security, efficiency, and decentralisation. As JYP put it in a recent interview, “POW is still needed in the project for numerous reasons including, offering the project more efficiency when delivering block headers to SPV clients”. There are currently no plans to move the project to pure proof of stake.

Crypto fraud

From September 2022 we started to see the hash rate rebalance, as did the price of DCR. That is, until the next crypto melt down in November 2022, when the exchange FTX started to fail, ultimately ending in bankruptcy and the loss of billions of dollars of investor money. Although FTX was acting in the crypto space, it didn’t hold true to any of the crypto ethos’s. One lesson learned the hard way, for many, “It’s not crypto if you don’t have custody of your assets”.

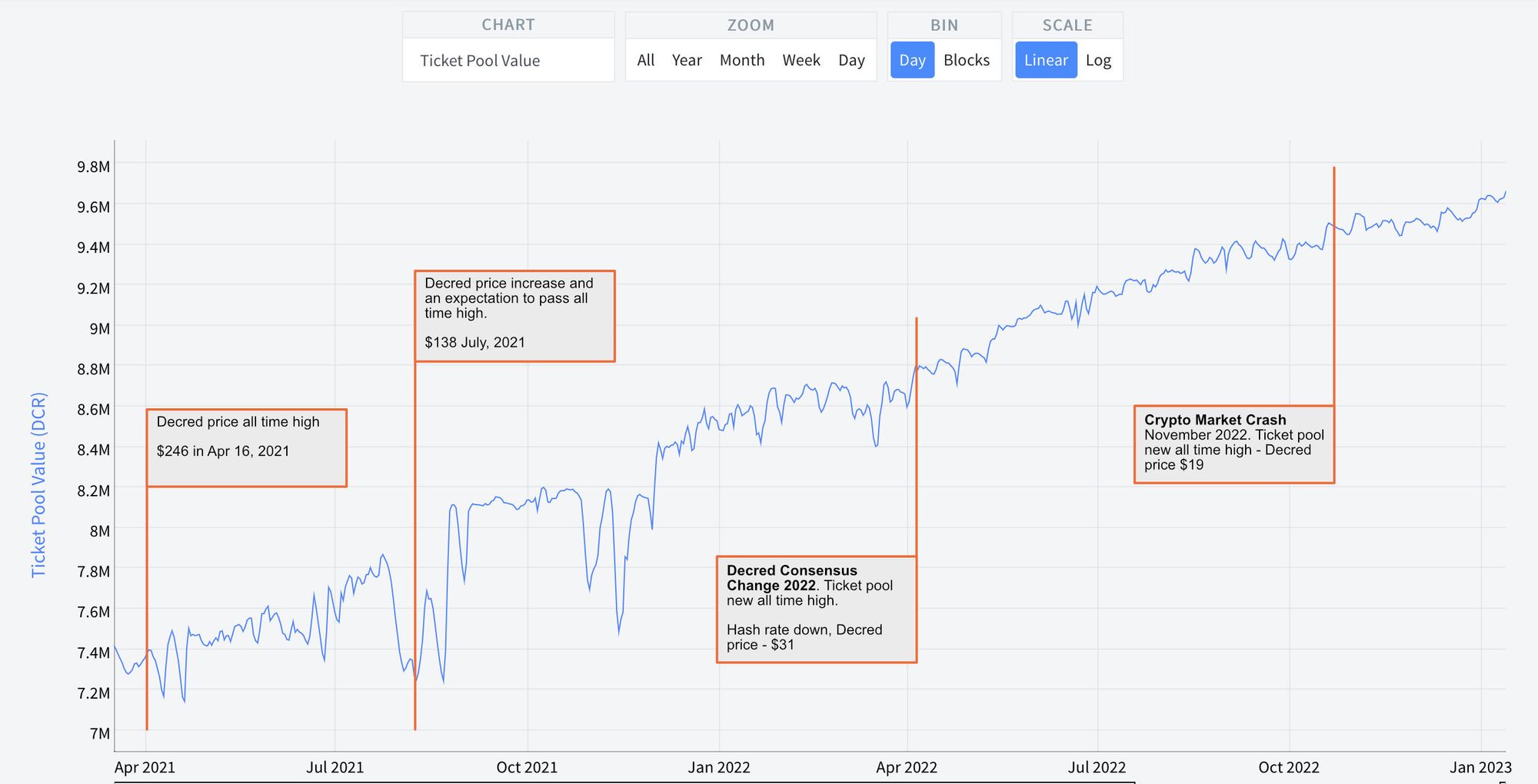

It’s fair to say that 2022, has been a very chaotic year for the space. But if you take your eyes off the price and the hash rate and focus them on a measure that can’t be found in any other project. You’ll notice that Decred has actually become a bit of a safe haven for investors. The measure I’m referencing is, the ticket pool value. During the price peak in April 2021 Decred’s ticket pool value was 7.4 million dcr. At this time, there was an exodus to cash because the dcr price was excellent both against fiat currencies and BTC. However, fast-forward to the start of 2022, when Decred’s price has been shredded, the ticket pool value increased exponentially to 8.5 million dcr. This can also be seen again in May and November 2022, when the market was plummeting due to sell pressure, the smart investors were moving their wealth to places of safety. Typically, this is gold and precious metals or positions that reduce their fiat debt burdens.

Ticket pool value

In November 2022, the ticket pool value reached an all-time high of 9.5 million dcr (over 65% of the current supply). At this time, the crypto space was experiencing a shock wave of pressures from every angle, taking prices even lower, including the dcr price which reached a yearly low of $19.

During times of uncertainty, staking Decred tickets is proving to be a pretty solid store of value. Earn interest whilst waiting out the storm. As stability comes back to the market, I wouldn’t be surprises to see the ticket pool value decrease to more relative levels. As people unlock their wealth and search for other lucrative and speculative ventures. This in turn offers others an opportunity to participate and earn yield in a stable project.

Decred ticket pool value

Comparing price

Comparing Decred’s price against both fiat currencies and Bitcoin BTC. Over the first weeks of January 2023, we’ve seen the price of Decred start to rise against the dollar, whilst simultaneously hitting a rare low against BTC. Interestingly, during this time, we’ve also seen the ticket pool value come down, whilst the hash rate has reached highs of 100ph/s. Relatively, it looks like the market is moving to more positive grounds. You should keep in mind that we’re likely to see plenty of fake price pumps in 2023 that will lead to nothing or speculators losing money during the dump. Don’t be pulled into the hype, understand your investment and try to stay the course.

Decred price comparison with DCR/BTC (top) and DCR/USD (bottom)

The last time Decred saw lows, like these, for both fiat currencies and BTC, it was November 2020. Which was followed by a 5-month rise of over 1000%. My suspicion is people are loading up their DCR ammo ready for some big movements in 2023.

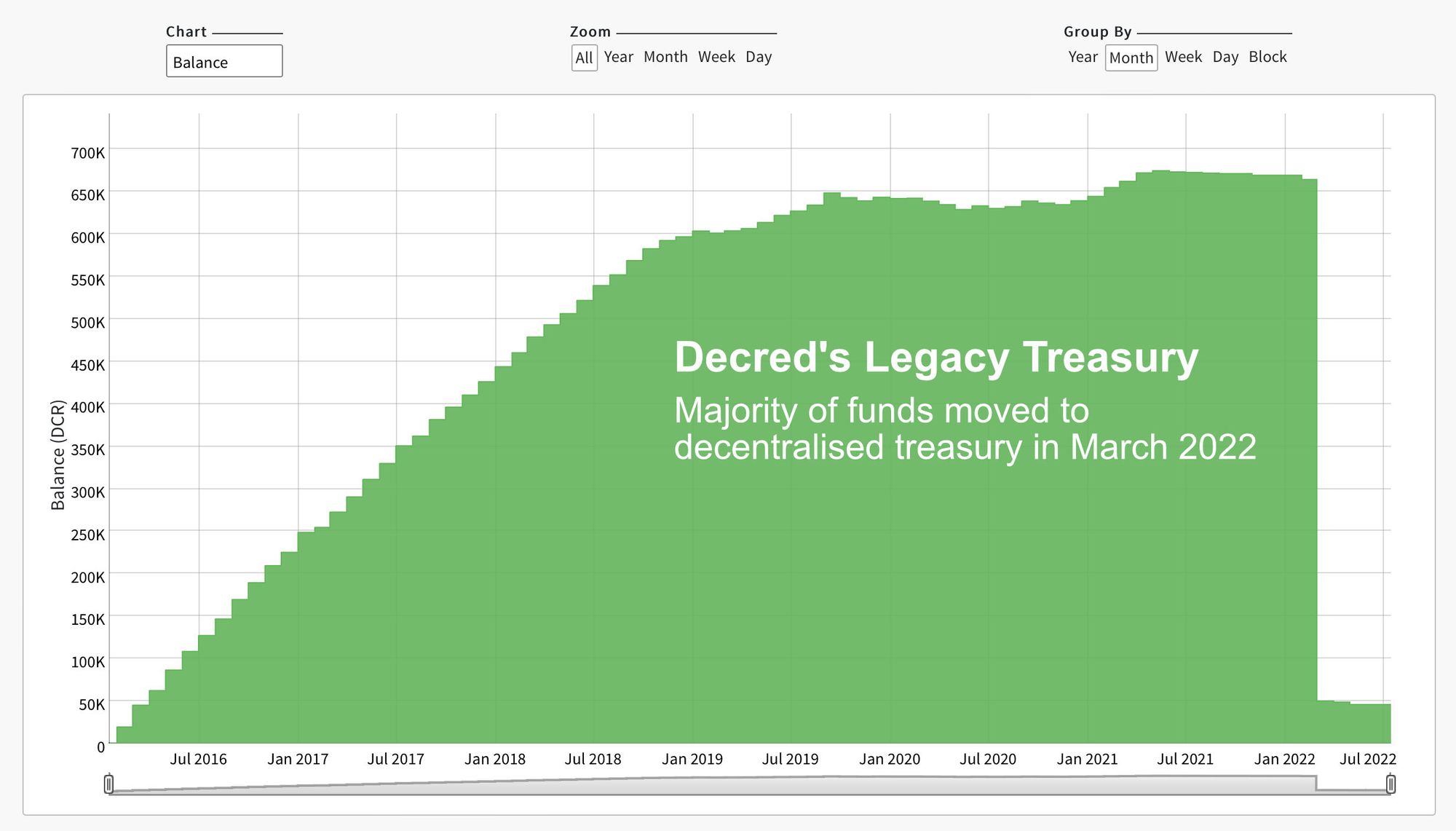

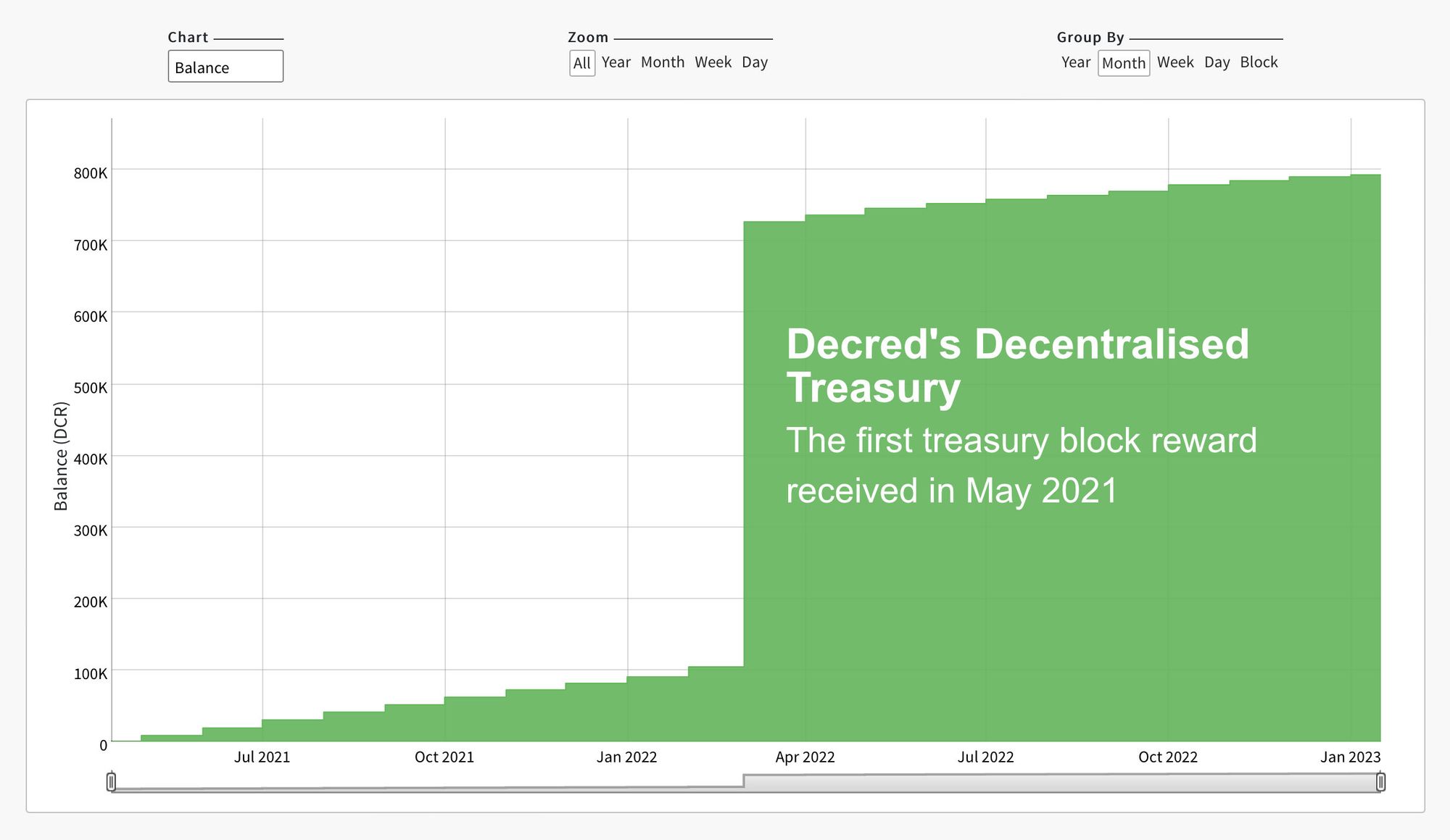

The treasury

In March 2021, Decred began the move to a fully decentralised Treasury, which completed in May 2022. At the beginning of 2022 the legacy treasury held 669,459 dcr by January 2023 the new decentralised treasury and legacy treasury combined holds over 838,000 dcr worth approximately $20 million.

Another factor that most people overlook about Decred is its ability to weather a storm by being able to self fund its projects and initiatives. Whilst other projects across crypto and the wider markets are cutting jobs in the tens of thousands, Decred continues to slowly grow its team and fund innovation. A big reason for this is the Decred stakeholders are very critical when spending money from the treasury, and proposals undergo a good amount of scrutiny to make sure the work proposed is a good fit for the project. In 2022, the treasure received approximately 130,000 dcr and spent approximately 30,000 dcr.

Decred's Legacy Treasury (top) and Decentralised Treasury (bottom)

Moving forward

2023 is likely to be an exciting year for Decred as a few of its projects reach a level of maturity that sees them ready for general use. DCRDEX will lead the way with its version 1 release and bring to market Ethereum pairs and ERC20 token trading, including pairs for USDC and Tether USDT. Along with this is the market maker bot that will enable liquidity providers to run various algorithms, including arbitrage trading across exchanges. Furthermore, it’s likely that production will begin for the mesh network implementations for both Coinshuffle++ mixing servers and the DCRDEX servers. Which will increase the resilience and decentralisation for these projects ten-fold.

The innovation, I’m most looking forward to in 2023, is Bison Relay becoming a mobile app and offering storefronts and content pages. My hope is, Bison Relay will become a fully fledged mobile wallet app for both iOS and Android, filling this current void. Bison Relay already offers SPV wallet functionality that enables user's to fund, open and close Lightning Network channels. With a few more uncovered wallet features, it’s not hard to see that Bison Relay will be an incredibly impressive and secure mobile wallet. A wallet that can cater for a multitude of services, including on-chain transaction; cheaper, faster LN transactions for smaller payments; and a whole host of other experiences that enable Decred to grow exponentially.

Disclaimer — Please note the above research is not financial advice, and you should always do your own due diligence before investing your money. Investments can go down as well as up, and cryptocurrencies are typically volatile assets.

The views expressed in this article are that of the author and based on the author's own research and investigation. The author is happy to receive comments, feedback and suggested edits for this article to help evolve the open nature of the discussion.

Comments ()