Decred — An economic breakthrough

A history of humanity shows that different commodities have functioned as money for different periods of time. From the age of barter to the gold standard to modern day government regulated fiat currencies, humans have used different monetary assets to preserve and exchange value.

Table of Contents:

- The characteristics of money.

- Tokenomics — The blending of blockchain technology and monetary economics.

- A look at the differing tokenomics of Bitcoin, Ethereum, and Decred.

- Decred retains Bitcoin’s economic scarcity, and expands the applications for cryptocurrencies.

- Decred redefines an asset class with unique features as a store of value, medium of exchange, and a productive asset.

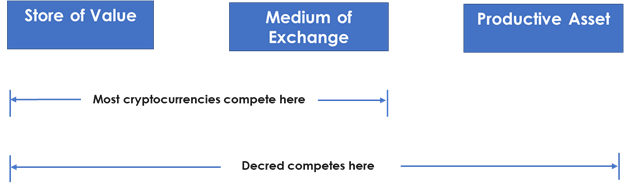

Where other cryptocurrencies compete in a zero sum game, Decred competes in new dimensions.

A history of humanity shows that different commodities have functioned as money for different periods of time. From the age of barter to the gold standard to modern day government regulated fiat currencies, humans have used different monetary assets to preserve and exchange value.

In monetary economics, the most important functions of money are to be a store of value and to be a medium of exchange. The world’s largest stores of value (gold, collectibles and real estate) are driven by their scarcity, and the most common mediums of exchange (e.g. fiat money) are driven by the ease of their usability. Traditional economic assets tend to fall under either the store of value category or a medium of exchange category, but rarely do they excel in both. The most common form of what we consider “money” today — fiat money — excels as a medium of exchange but falls short as a store of value. This is why we move out of cash into productive assets like stocks, bonds, and income generating real estate.

The 2008 release of Bitcoin represents an innovation in monetary economics as a digital collectible that is both scarce and highly usable. While Bitcoin is the world’s most well known cryptocurrency today, the 2016 release of Decred expands Bitcoin’s design with additional economic incentives.

This paper looks at how the protocol design for Decred ($DCR) iterates on the best properties of Bitcoin with additional characteristics as a store of value, medium of exchange, and a yield producing asset.

Cryptocurrencies are as much of an economic phenomenon as they are a technological phenomenon. Technological progress in cryptocurrencies is enabled by having a talented developer pool, technical adaptability, and financial support. Economic progress in cryptocurrencies, by contrast, relies on a different set of ingredients. The monetary adoption of cryptocurrencies comes from incentives for long term desirability and day to day utility. The strongest cryptocurrencies will be those that address both technical resilience and behavioral economics.

Cryptocurrencies aren’t competing to build a better PayPal. They’re competing to create a better form of money.

Monetary economics is a study of money and why certain commodities (e.g gold and silver) emerge as acceptable mediums of exchange. The characteristics of mediums of exchange were famously addressed in Carl Menger’s 1892 paper On the Origins of Money. Menger identifies saleability as a defining characteristic which drives goods to become universally accepted as a medium of exchange. He describes saleability as function of having a permanence in needs, i.e. ongoing use. While cryptocurrencies currently offer scarcity as means of inflation protection, the market hasn’t found an application for recurring uses of tokens as a medium of exchange.

Decred is a unique cryptocurrency which goes beyond scarcity with additional ways to entice long term ownership and repeating uses of its $DCR token.

The differing tokenomics of Bitcoin, Ethereum, and Decred

Google monetizes its searches better than Twitter monetizes its tweets. Where traditional businesses use business models for profit generation, cryptocurrencies employ tokenomics to capture value from their network usage.

Tokenomics covers the economic incentives of digital tokens, and how token usage can lead to value accrual. Here’s a comparison of how Bitcoin, Ethereum and Decred apply varying approaches in their protocol design:

Bitcoin is the current gold standard for cryptocurrencies. It is an apolitical scarce monetary asset much like a digital gold, but with greater divisibility and portability. Bitcoin has a fixed maximum supply of 21 million tokens, each of which are subdivisible into 100 million units.

Software products need mechanisms for upgrades. Bitcoin is the most secure public blockchain today, but it will need technical feature upgrades over the coming decades, many of which will be major decision points. If Bitcoin adoption reaches a billion plus people, its lack of governance will present risks whenever there are diverging decision gates. Bitcoin’s network has already seen community forks over different approaches for transaction speed, and the near future will require upgrades to privacy, with no clear preferred solution.

From an economic perspective, Bitcoin offers inflation protection and seizure resistance as a store of value. Where Bitcoin is highly divisible and portable, it does not provide incentives for day to day use. While Bitcoin is great to protect against inflation and property rights confiscation, it doesn’t generate ongoing yield or solve for near term applications as a medium of exchange. The lack of ongoing yield has given rise to an emerging market of secondary providers like BlockFi, who offer interest bearing services in exchange for custodial risk.

Bitcoin’s lack of yield has interesting implications. While a big part of $BTC value comes from its ability to minimize confiscation and counterparty risk, Bitcoin users are handing over custody of their $BTC to centralized interest providers. Markets want cash flow and they are looking for it elsewhere.

Where Bitcoin leads all cryptocurrencies as a store of value candidate, Ethereum has the world’s largest blockchain developer ecosystem. The 2014 creation of Ethereum was a technological improvement on Bitcoin as a programmable smart contract platform which trades off the monetary hardness of Bitcoin for increased technical programmability.

From a tokenomics perspective, Ethereum uses $ETH as a currency of applications on the Ethereum platform. Contrasting with Bitcoin’s design which uses $BTC as sole currency in its applications, Ethereum’s protocol design enables other businesses to create their own ERC tokens on top of its base layer. While this makes Ethereum applications easier to scale, it creates a susceptibility of a free rider problem, where intermediary tokens can siphon economic value without using $ETH as a medium of exchange. In economic terms, this is an example of value creation without value capture.

$ETH is like gas for an Ethereum car, where the car can also run on alternate forms of energy.

Bitcoin employs a single token model to capture the entirety of economic activity in its network, whereas value capture in Ethereum is distributed across multiple tokens.

Contrasting with Bitcoin’s fixed supply of 21 million tokens, Ethereum does not have a defined maximum supply. The pre-sale launch of Ethereum saw 60 million $ETH created for contributors, 12 million $ETH created towards a development fund, and an annual issuance capped at 18 million $ETH per year. Scarcity in an Ethereum ecosystem is also driven by DeFi applications which use $ETH as a collateral.

The Ethereum ecosystem has shown a demand for tokens with governance rights. As of fall 2019, governance bearing ERC tokens like $MKR and $ZRX have been able to accrue considerable value, rising to be top 50 crypto market caps in their own right.

Decred’s token design follows the Bitcoin model, where economic activity is tied to a single base token ($DCR), and which also shares a 21 million max supply. Where both cryptocurrencies share similar characteristics of scarcity and divisibility, Decred expands Bitcoin’s design with additional behavioural incentives. Where other cryptocurrencies focus on scarcity as an incentive for value retention, Decred has solved for additional use cases as a store of value and as a medium of exchange.

Decred has novel features to incentivize long term token retention:

- Ongoing yield: Decred provides staking rewards (ongoing cash flow) for people who agree to lock away their $DCR for an average of 28 days. Decred currently yields a ~10% return, which is higher than the return in most investment classes. Decred’s staking process has already shown product market fit, with over 50% of circulating $DCR supply being locked away. The yield from staking will gradually decrease over time, which is designed to reward early “buy and hold” behaviors. As a contrast to Bitcoin, Decred’s design does not require intermediaries and third party risk to generate cash flow.

- Decision making rights: Decred employs a novel governance process where its network can function without a centralized planning committee. Decentralized networks need a mechanism for community decision making, and Decred entrusts this power to any one willing to stake their $DCR. Where ownership of other crypto assets tends to be a passive monetary bet, $DCR is already functioning as a governance token for consensus upgrades and community funding decisions. A continued need for decision making creates a perpetual source of demand for $DCR, with people looking to participate in networks governance.

Decred doesn’t need to directly compete with fiat currencies to emerge as a medium of exchange. It creates new applications for cryptocurrencies where $DCR can be used on a recurring basis.

- Payments for community contribution: $DCR is the currency of payments in a larger ecosystem where contractors of a Decentralized Autonomous Organization (DAO) contribute to the Decred network. Whereas other cryptocurrencies rely on a voluntary peer to peer application of their native token, Decred has a self funding community treasury which always pays its contributors in $DCR. This treasury is worth ~$10 million today, but could potentially be worth exponentially more in the future. This creates a marketplace where $DCR is the facilitator of commerce.

- Blockchain time-stamping as a service: Where other cryptocurrencies focus on a sole monetary application, the Decred ecosystem also provides time-stamping as a blockchain solution. The use of time-stamping to identify the authenticity of digital documents is one of the most promising long term applications of blockchain technology, and Decred already has a working product to support this use case. Much like traditional businesses focus on product market fit before moving to monetization, Decred’s time-stamping solution (dcrtime) is free today, with an opportunity to be attached to new business models where $DCR is related to time-stamping as a service.

- Cross chain interoperability with a Decentralized Exchange (DEX): Cross chain compatibility is a saleable characteristic for cryptocurrencies. Today the most important trading pairs for cryptocurrencies are those with fiat money, but the future is likely to be a multicoin world where government issued digital currencies exist alongside free market digital tokens. There are fees and friction points associated with cross currency trading today, so Decred is building a Decentralized Exchange (DEX) to enable trustless cross-chain interoperability without a for-profit motive. Bitcoin removes political gatekeepers in the traditional fiat based system, but Decred also solves for rent seekers in the cryptocurrency world.

Decred — Redefining an asset class

Robert Greer’s 1997 paper “What is an Asset Class, anyway” proposed that most assets can be categorized as superclasses of store of value assets, consumable/transformable assets, and capital assets. Building on this framework, asset functions can be viewed by their ability to preserve, utilize, and create economic value.

Bitcoin improves upon Gold’s best features with portability and unseizability. Decred improves upon Bitcoin’s design with additional features as a productive asset.

Cryptocurrencies are a form of free market digital money. Unlike fiat moneys which are mandated by government decree, cryptocurrencies need economic incentives to encourage loyalty and retention. In a commoditized market for open source money, Decred is the only cryptocurrency to account for switching costs. If you leave the network, you’re not just selling a currency. You’re also surrendering your claim on voting rights, cash flow yield, and access to a burgeoning treasury.

Where Bitcoin is valuable as a store of value contender and Ethereum is valuable as a technological enabler, Decred competes in both technology and economic vectors with one of a kind tokenomics.

Acknowledgements: Thank you to Richard Red, Jake Yocom-Piatt, Permabull Nino, Checkmate, BlackBear, and Jonathan Zeppettini (aka jz_bz) for providing feedback on earlier versions of this writing.

Disclaimer: This is meant for informational purposes, not as investment advice.

Comments ()