Decred Journal – January 2023

We cannot be mere consumers of good governance, we must be participants! The Decred stakeholders voted on 8 proposals this month, Timestamply got a major facelift and Bison Relay received quality of life improvements.

Image: Decred Owl by @OfficialCryptos

Highlights for January:

- A remake of the Timestamply site to facilitating timestamping on the DCR chain has been approved for funding and is already available to test.

- 8 proposals were published on Politeia and by publication time voting has concluded for all of them, 5 were approved and 3 rejected.

- Bison Relay received a quality of life update with many fixes and improvements, v0.1.3.

Contents:

- Bison Relay v0.1.3

- Development

- People

- Governance

- Network

- Ecosystem

- Outreach

- Events

- Media

- Markets

- Relevant External

Bison Relay v0.1.3

New v0.1.3 release has brought many bug fixes and quality of life improvements discovered during early community testing. AppImage builds are now available for Linux users.

Get the latest release at the new download selector or directly from GitHub.

Head to the Bison Relay section for a detailed list of changes in v0.1.3 and beyond.

Development

The work reported below has the "merged to master" status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

dcrd

dcrd is a full node implementation that powers Decred's peer-to-peer network around the world.

- Modified the method that prunes expired transactions from the mempool to accept the current best height as opposed to looking it up internally. This is part of a bigger effort to make mempool state easier to reason about by removing hidden assumptions.

- Updated the Docker image to newer versions of Go and Alpine Linux.

- Configured the Docker container to forward SIGTERM signal to the running dcrd instance so it shuts down gracefully when a container is stopped.

- Improved and extended Docker documentation.

- Optimized selection of peers in the address manager to mitigate high CPU use discovered by testing the DEX with an SPV DCR wallet.

dcrwallet

dcrwallet is a wallet server used by command-line and graphical wallet apps.

- Added a

watchlastoption to limit initially watched addresses, which in turn improves startup resource usage and performance. This will benefit very large wallets with many old addresses that are not expected to be used again.

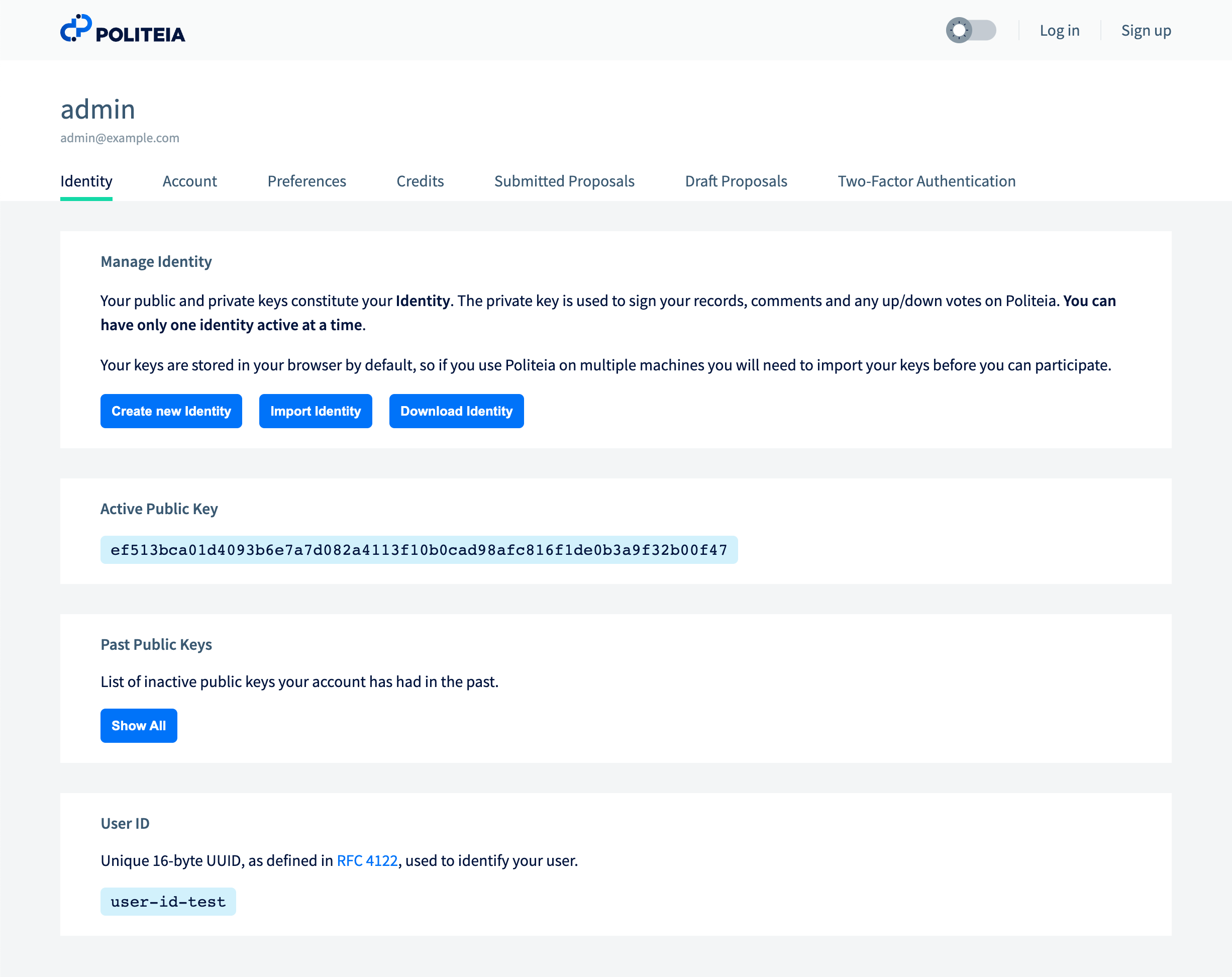

Politeia

Politeia is Decred's proposal system. It is used to request funding from the Decred treasury.

All changes below are towards the GUI remake on the new plugin architecture.

Re-implemented pages:

- User Details pages. All visual feedbacks, modals, and messages have been refactored, common UI elements extracted for reuse, several UI and responsiveness issues fixed, minor design improvements.

- User session pages, including Signup, Login, Logout, Password Reset, and Verify Email.

- Admin pages for Unvetted Proposals and Search for Users.

- Proposal pages including Edit and Raw pages.

- There is a master issue tracking which pages have been reimplemented.

Other changes:

- Refactored the high-level Politeia app to use the new toolkit for wiring the plugins together.

- Added validation to all forms on Politeia, including error messages, and form submission control.

- ~5 other fixes in the GUI and the pi-ui library.

Image: User account page in the Politeia GUI remake.

cspp

cspp is a server for coordinating coin mixes using the CoinShuffle++ protocol. It is non-custodial, i.e. does not hold any funds.

- Capture IP address and message type when sending to client fails.

- Fixed a protocol bug which caused signature validation failures if the client and server used different sizes of the integer type, such as a 32-bit client connecting to a 64-bit server. This fix is a breaking change to the protocol (clients will need to upgrade to use the fix).

- Updated to latest dcrd modules.

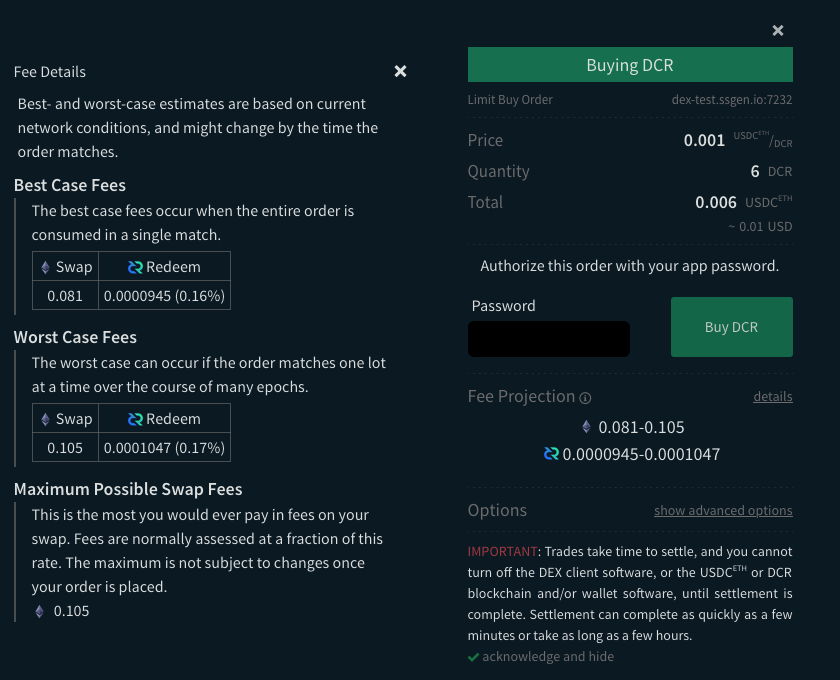

DCRDEX

DCRDEX is a non-custodial, privacy-respecting exchange for trustless trading, powered by atomic swaps.

Client changes:

- Updated numerous web dependencies.

- Updated Docker config: optimized base images, switched DEX client to run as non-root user, and excluded unneeded files. Among other things it helps to integrate the DEX client into Umbrel.

- Allow to acknowledge and hide the warning that reminds to keep the DEX client running until all trades settle.

- Improved checkbox UX with uniform style across all forms.

- Show which wallet is missing if it was not found on startup.

- Added consistent border to all input fields, drop downs, and checkboxes.

- Save some user preferences across page switches/refreshes and DEX client restarts. Things like hide/show left market dock or select chosen wallet on the Wallets page.

Client fixes:

- Fixed confusing sync progress jumps after losing connections with all SPV peers.

- Improved detection and handling of refund transactions that have been broadcast manually by the user (outside of the DEX client).

- Fixed launch failure on 32-bit systems.

- Fixed directory paths that blocked built-in SPV wallets created in v0.5 from upgrading in the upcoming v0.6.

- Fixed ~4 concurrency bugs.

Server fixes:

- Avoid a deadlock after receiving maker's redeem ack.

- Added a sanity check to never send swaps with zero fee rate.

Ethereum:

- Removed the recently added

authrpcinterface. It was found to be unnecessarily limiting by not having methods to inspect the mempool and calculate the most recent balance. At the same time not much was gained from using it in the DEX. For DEX use cases, it makes more sense to connect to Geth with either IPC or--http/--wsflags. In the future, authenticated RPC support may still be needed for getting Ethereum data from trusted third party RPC providers. This could greatly simplify testing because running an Ethereum full node is too difficult. - Always check block header timestamp to determine sync status. Since Ethereum's "Merge" event, Geth will report the current block and highest block as the same number, so the difference between them can no longer be used to determine sync progress. Instead, DEX will compare last block header time to user's system clock, and if the block is old enough the chain will be assumed as not synced.

- Improved display of Maker Redemption in cases when the exact transaction is not known.

- Added DEX server ability to connect to Geth over HTTP and WebSocket interfaces.

- Added timeouts to RPC requests so that very long requests to RPC providers could expire and be cancelled.

- Do not consider pending (unmined) transactions when calculating balance if the RPC provider lacks the required methods to do so.

- Only check swap fees after they get some confirmations (speed optimization).

- Fixed wallet config not being saved after the Reconfigure operation.

- Fixed missing Settings button for ERC-20 tokens.

- Fixed min/max fee estimates shown for swaps with "token" assets. Fees for swapping tokens are paid in base asset. For example, when buying DCR for USDC, fees for the USDC side of the trade are paid in ETH.

Other changes:

- Updated the Fundamentals spec page (latest version here).

In progress:

- DigiByte (DGB) support.

Image: Improved fee estimation for tokens in DCRDEX.

Documentation

dcrdocs is the source code for Decred user documentation.

- Added on-chain governance and Politeia paragraphs to Project History page. Also added timeline points.

decred.org

dcrweb is the source code for the decred.org website.

- Tidied up i18n language files by replacing escaped quotation marks to reduce the possibility of mistakes.

- Updated Hugo version.

Bison Relay

Bison Relay is a new peer-to-peer social media platform with strong protections against censorship, surveillance, and advertising, powered by Decred Lightning Network.

GUI changes in the v0.1.3 release:

- Added build scripts for Linux (AppImage and tar) and Windows (MSIX).

- Subscribing and unsubscribing to posts made asynchronous. This properly handles the case where the target user is offline and will take long time to reply to the subscription request.

- Added proper launcher icons for various operating systems.

GUI fixes in v0.1.3:

- Error messages can now be copied and pasted in bug reports.

- Opening new channels will be prevented while there are pending channels being opened. Improved error messages will better explain reasons why channels cannot be opened (it confused new users during onboarding).

- Fixed server address on the new config page.

- Fixed error when trying to transfer a large paid download.

- Fixed missing autofocus on the Password field shown after app startup. Also the password can be submitted with the Enter key now.

- Fixed unclickable links in post comments, context menu staying open, and images not showing in posts list.

- Fixed odd trailing character after links.

Command-line app changes in v0.1.3:

- Added

/timestatscommand that reports timing statistics for LN payments and sending outbound messages. - Show advertised addresses for LN nodes queried with

/svrnodeand/queryroutecommands. - Subscribing and unsubscribing to posts made asynchronous.

Command-line app fixes in v0.1.3:

- Fixed file send being logged to wrong window and fixed result of

/winlistcommand. - Clear certificate field when setting a custom LN liquidity provider address.

- Fixed error when trying to transfer a large purchased file.

Server changes in v0.1.3:

- Support listening to multiple addresses for connections.

GUI app changes merged in master towards next release:

- Improved unread indicators and sorting in the chat list.

- Added Go back button to Advanced Settings and Restore views.

- Upgraded to newer Dart and Flutter libraries and pinned their hashes for more reliable builds.

- Fixed rendering of line breaks.

Command-line app changes in master:

- Added an API for controlling brclient from third party tools. This allows for writing bots (such as the Matrix bridge bot) and other integrations. See API documentation and examples here.

bisonrelay.org website:

- Added download wizard that guides users to correct downloads. It even works with JavaScript disabled.

- Updated Hugo version.

- Added a button linking to latest release notes.

Other stuff:

- Two-way Bison Relay to Matrix bridge is live in #br, #random and #trading chat rooms.

- @davecgh explained what happens when you "just" send a message on Bison Relay (how Rendezvous Points work, how server is unable to know who is talking to who, etc.)

- @BisonRelay is a new Twitter account for announcements.

- @BisonDigest is a new Twitter account for reposting the best content for Bison Relay.

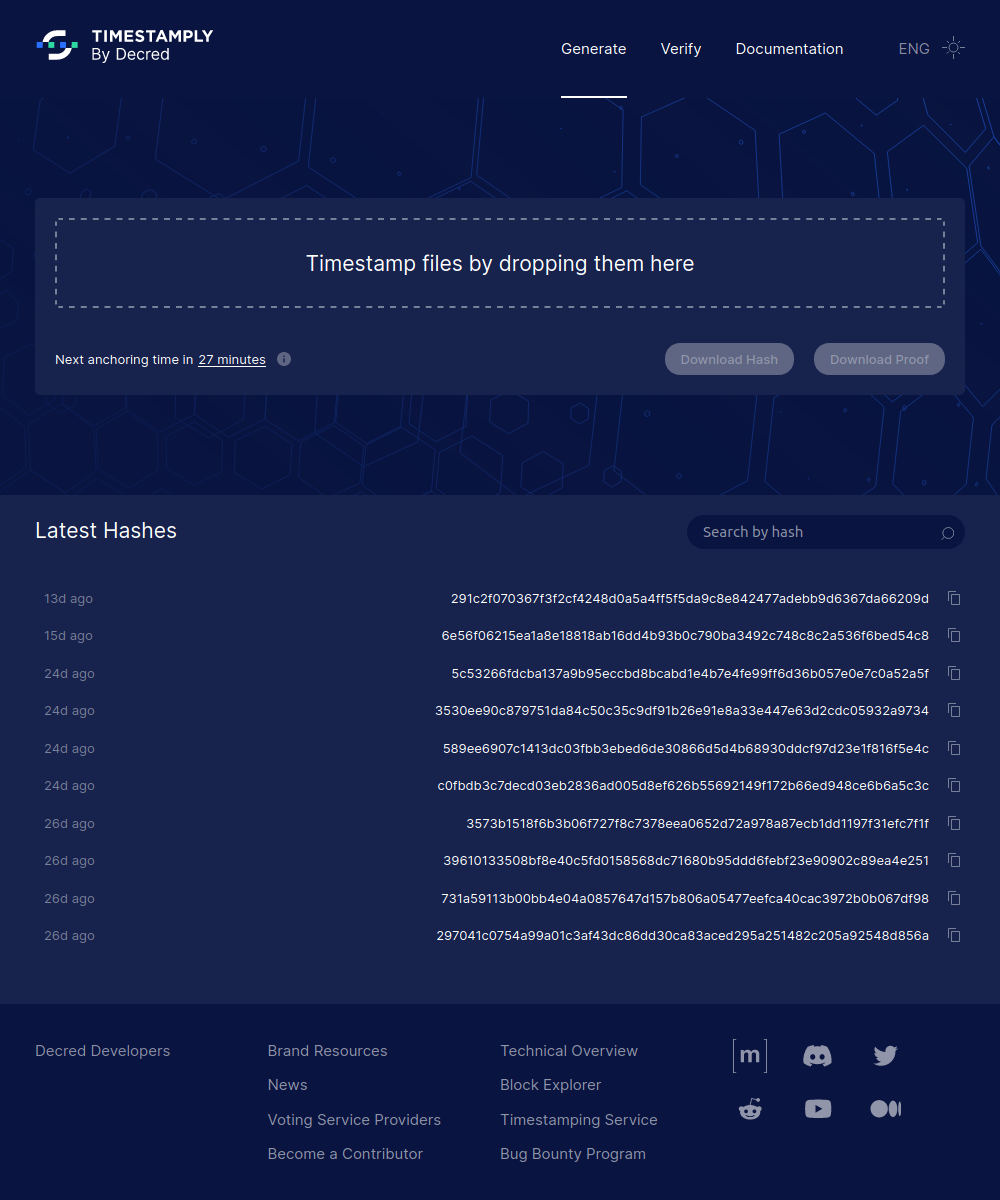

Timestamply

Timestamply is a free service for timestamping files powered by Decred blockchain. A timestamp proves that a certain file has existed at a certain moment of time. This has a range of applications in protecting data integrity.

dcrtimegui was rebranded as Timestamply and the app received a full redesign. Some of the new features include:

- New graphical design matching Decred design standards developed for Decrediton, Politeia and the last decred.org update.

- Light and dark modes.

- Multiple languages, including initial Portuguese translation.

- Separate Timestamp and Verify pages.

- Display of next anchoring time (it wasn't clear that anchoring is done hourly).

- Latest Hashes section.

- Improved UX for downloading multiple proofs.

- List of hashes timestamped and verified by the user.

- Transaction confirmations progress for each hash.

- Improved drop zone.

Timestamply redesign arrived soon after the app has received some attention from Brazilian politicians who timestamped PDF files with their governance plans, to combat misinformation spreading via fake versions of the files.

The proposal to fund the new version has been approved and it is awaiting deployment to timestamp.decred.org. Until then users can try the upcoming version on the test website. Be aware that the test website uses a different database and may not find hashes timestamped by the current version of the app.

Image: Timestamply's new design.

Other

- Bug Bounty program reported that 20 submissions have been processed in 6 months of the latest proposal led by @jholdstock. Only 1 was severe enough to warrant a payout.

- Bug Bonuty website got an update for the Hall of Fame adding participants and correcting scores, and general housekeeping to cleanup unused code and simplify future updates.

People

Community stats as of Feb 2 (compared to Jan 4):

- Twitter followers: 53,268 (-124)

- Reddit subscribers: 12,663 (+15)

- Matrix #general users: 742 (+4)

- Discord verified to post: 926 (-3)

- Telegram users: 2,816 (-56)

- YouTube subscribers: 4,640 (+0), views: 222K (+1K)

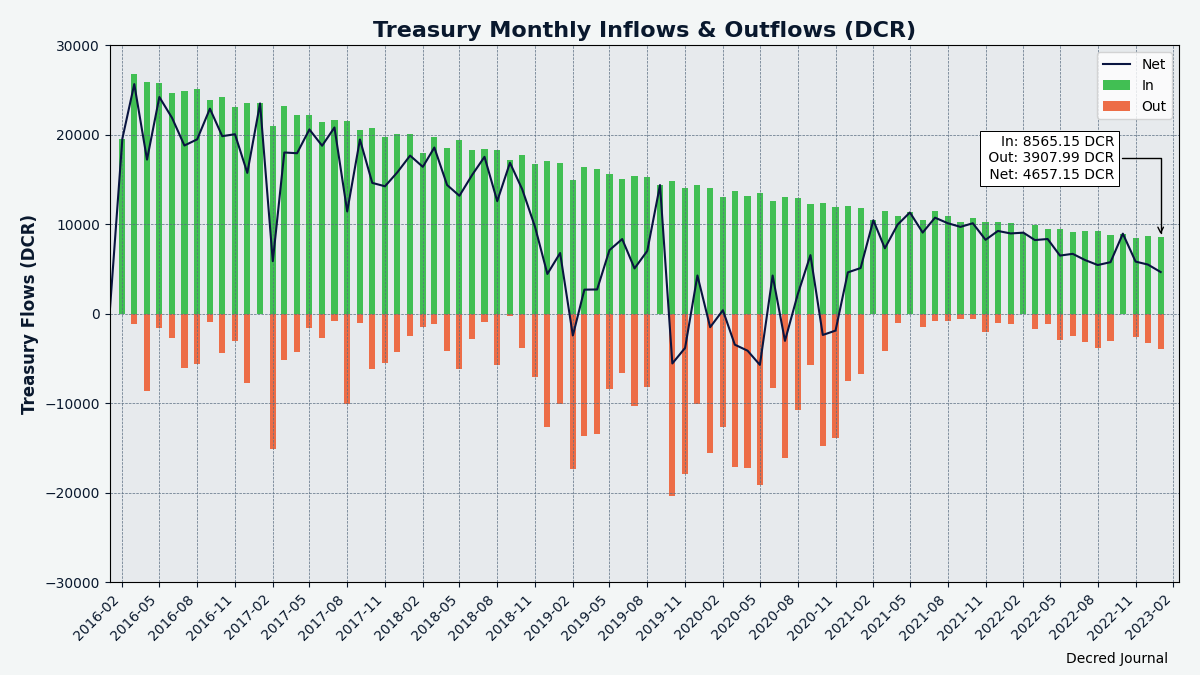

Governance

In January the new treasury received 8,564 DCR worth $189K at January's average rate of $22.05.

The treasury spend tx mined on Jan 3 had 24 outputs and was reported last month as making payments to contractors for (mostly) the November invoices, ranging from 5 DCR to 1,270 DCR. It was approved by 6,967 votes (all Yes) with voter turnout of 54%, out of the 12,909 tickets that had a chance to participate during the shortened 9-day vote. In total it spent 3,907 DCR worth approx. $86K at November's billing rate of $21.92.

All spend transactions from the new treasury can be found here.

As of Jan 30, combined balance of legacy and new treasury is 840K DCR ($19.4 million USD at $23.03).

Image: Decred Treasury monthly inflows and outflows.

There were 8 proposals published on Politeia in January.

- The Decred Video Content 2023 proposal requested a budget of $45,600 to continue producing video content, including @DecredSociety's "Decred and the state of the market" livestream, @Exitus' News Updates, @karamble's video/gif animations, and @Tivra's Twitter Spaces. It was approved with 83% Yes votes and 55% turnout.

- The Decred Arabia Communications and Content 2023 proposal requested a budget of $13,000 to continue the team's efforts for another year, it was approved with 75% Yes votes and 49% turnout.

- The Decred Content and Asset Translations 2023 proposal requested a budget of $33,000 for a year of translation work, it was approved with 88% Yes votes and turnout of 44%.

- The Timestamply proposal requested $17,300 for work done on a web application for the DCR Timestamp Service, it was approved with 88% Yes votes and turnout of 48%.

- The DCRDEX integration on Umbrel proposal requested a budget of $1,960 for integrating DCRDEX with the Umbrel platform for self-hosting open source software, making it much easier for Umbrel users to install DCRDEX. It was approved with 84% Yes votes and turnout of 47%.

- The Rick Red Revival: Research and assorted other tasks proposal requested a budget of $32,500 for a mix of contribution types by @richardred: research, testing, software write-ups, Politeia moderation, funny stuff and miscellaneous helping out. The proposal was rejected with 56% Yes votes and turnout of 30%.

- The Alphaday Grant Application proposal requested $2,400 to build a dashboard which would gather various types of information about Decred in one place, it was rejected with 17% Yes votes and turnout of 25%.

- The Sponsorship in Motorsports proposal requested $26,033 for full car sponsorship of a Honda Civic Type R in a series of race events, it was rejected with 9% approval and turnout of 22%.

See Politeia Digest issue 55 and issue 56 for more details on the month's proposals.

Network

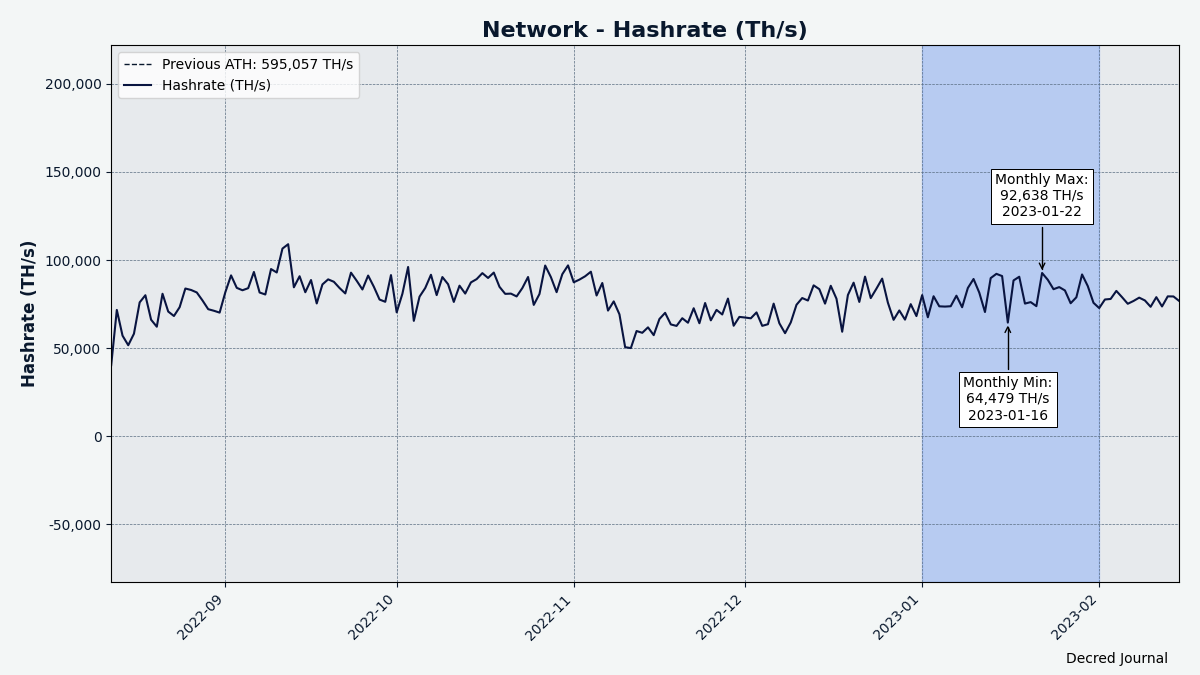

Hashrate: January's hashrate opened at ~80 Ph/s and closed ~76 Ph/s, bottoming at 64 Ph/s and peaking at 93 Ph/s throughout the month.

Image: Decred hashrate.

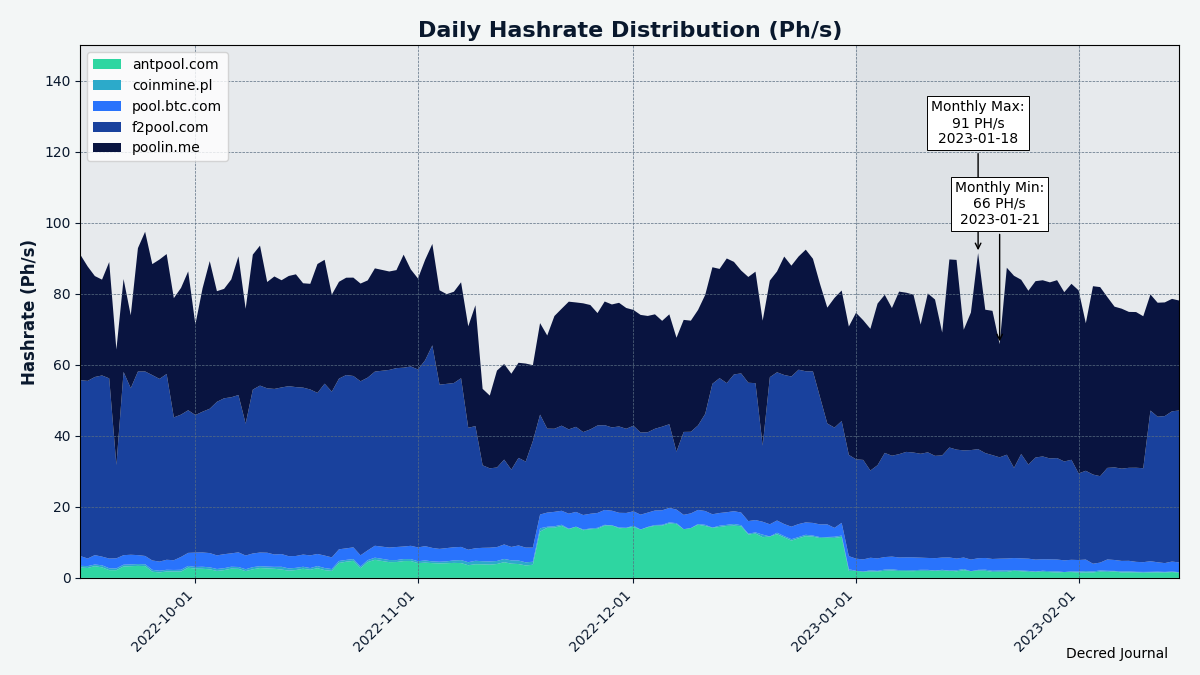

Distribution of 81 Ph/s hashrate reported by the pools on Feb 1: Poolin 64%, F2Pool 30%, BTC.com 4%, AntPool 2%, CoinMine 0.4%.

Distribution of 1,000 blocks actually mined by Feb 1: Poolin 61%, F2Pool 31%, AntPool 4%, BTC.com 3%, CoinMine 0.4%.

Image: Historical pool hashrate distribution.

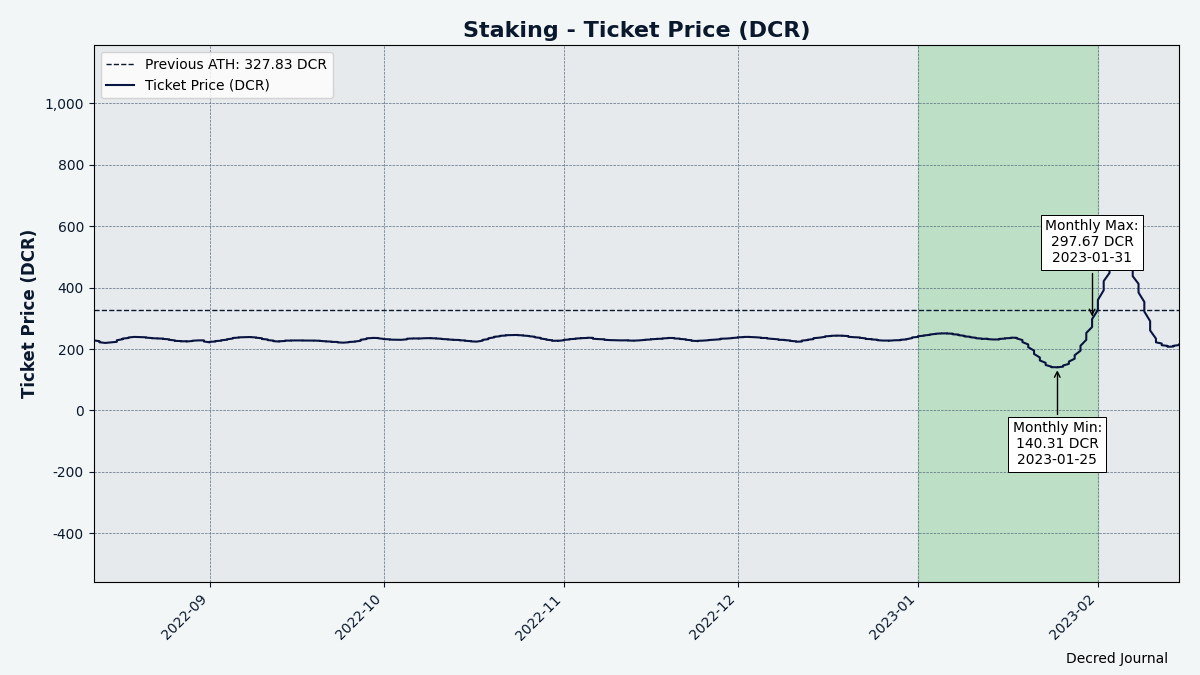

Staking: Ticket price varied between 140-298 DCR, with 30-day average at 212.5 DCR (-22.3).

Image: Ticket price went wild.

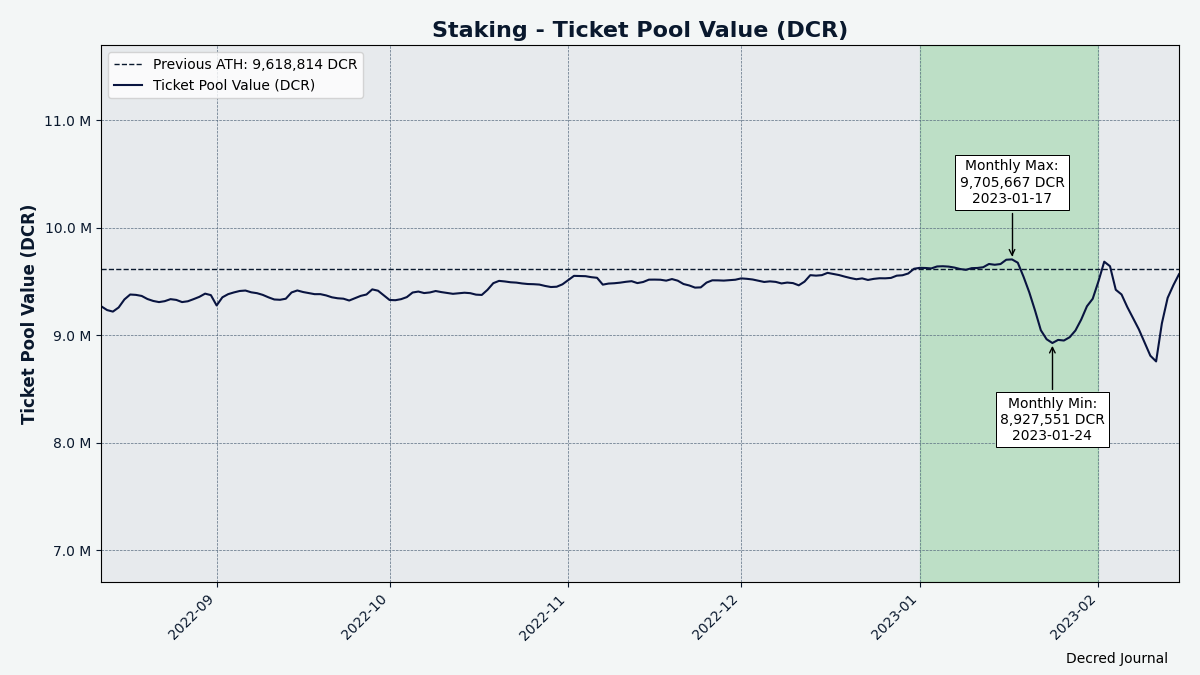

The locked amount was 8.93-9.71 million DCR, meaning that 59.9-65.2% of the circulating supply participated in Proof of Stake.

Image: Drop and recovery of DCR locked in PoS.

A sharp drop in ticket buying volume has sent the ticket price down to 140 DCR, this level was last observed in October 2022 during a similar drop. The amount of DCR locked in tickets reduced by ~780K DCR to 8.93 million DCR.

Such a low ticket price has triggered very high ticket buying which has sent the ticket price on the wildest price swing we have seen so far. 48,624 tickets have been bought in January - the highest monthly since the very first month of Decred, February 2016.

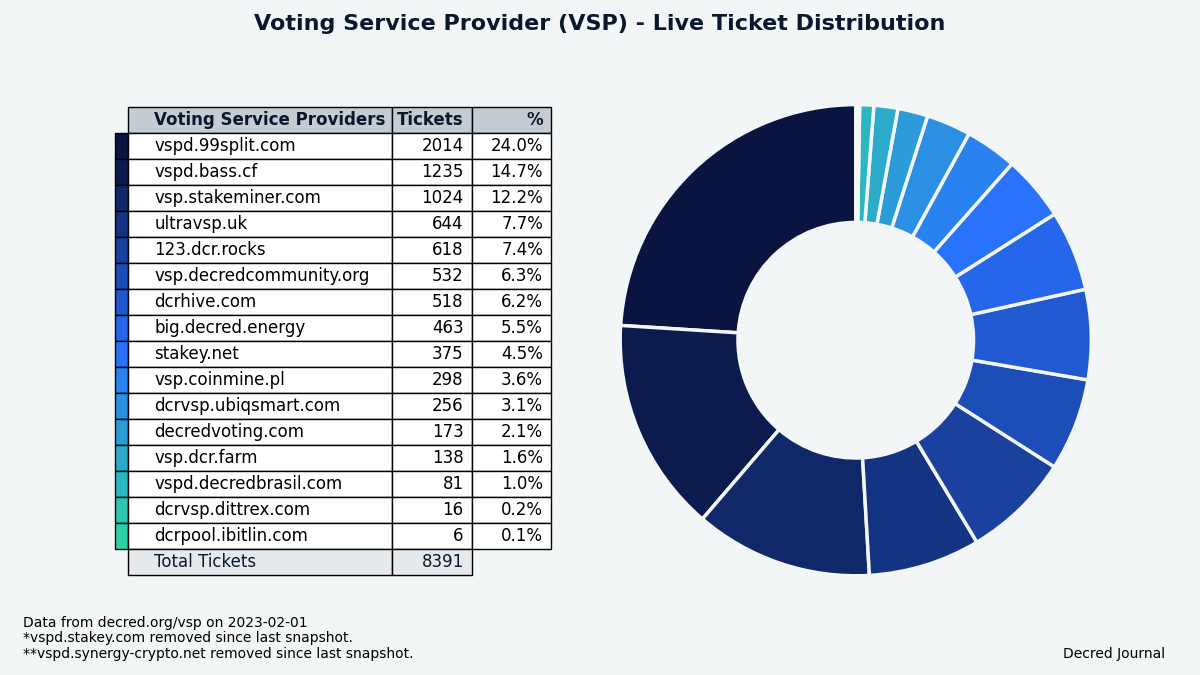

VSP: The 16 listed VSPs collectively managed ~8,390 (+1,270) live tickets, which was 18.8% of the ticket pool (+1.6%) as of Feb 1. At the time of the snapshot the ticked pool had ~44,670 tickets, a whopping 9% above the target 40,960.

Biggest gainers in January are vspd.99split.com (+419), dcrhive.com (+328) and vsp.stakeminer.com (+319).

Image: Distribution of tickets managed by VSPs.

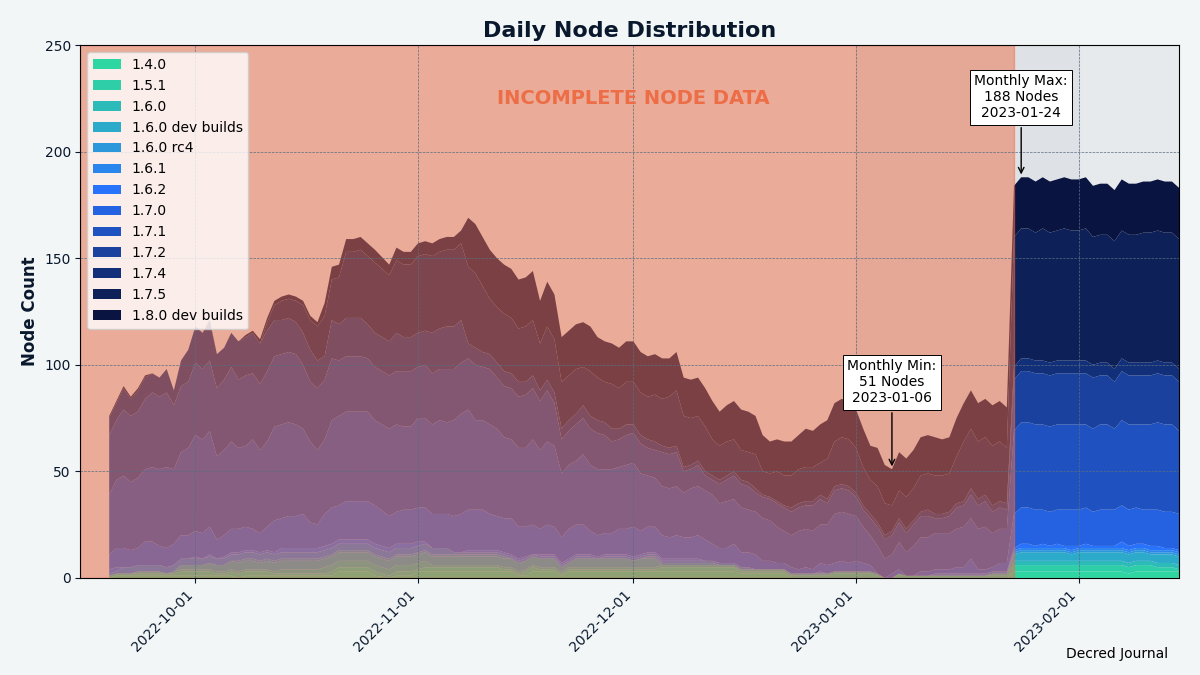

Nodes: Decred Mapper observed 187 dcrd nodes on Feb 1: v1.7.5 - 33%, v1.7.1 - 21%, v1.8.0 dev builds - 13%, v1.7.2 - 13%, v1.7.0 - 9%, v1.7.4 - 3%, other - 8%.

Image: Historical dcrd version distribution, data from nodes.jholdstock.uk. NOTE: Data until Jan 2023 was incomplete.

We have discovered that the node counts we have been reporting since June 2022 were incomplete. A possible cause for this is that Decred Mapper was relying on the GetAddr request, and many nodes stopped responding to that request for some reason. GetAddr is part of the network gossip protocol, it is how nodes discover other nodes. Responding to it is optional, so getting no response is not a bug. Node counts reported by Decred Mapper were correct on Jan 26.

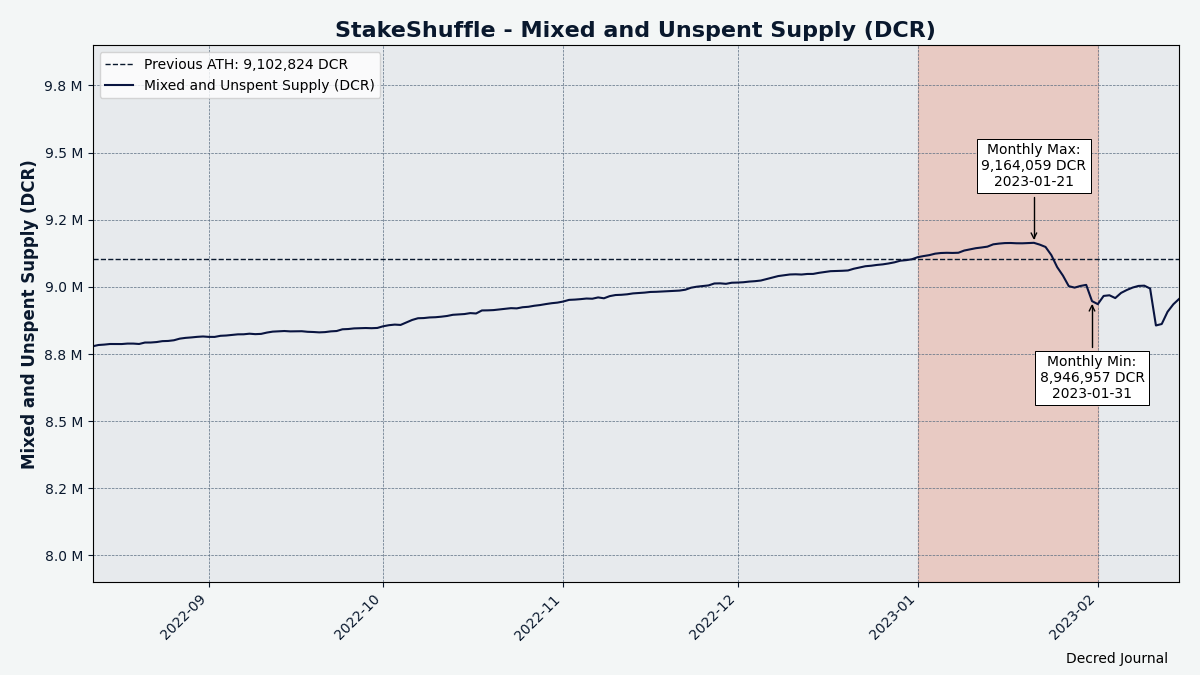

The share of mixed coins varied between 59.9-61.6%. Daily mixed amount varied between 140-611K DCR.

Image: Mixed and unspent DCR has dropped slightly.

Decred's Lightning Network explorer has seen 147 nodes (+17), 261 channels (+28) with a total capacity of 106.1 DCR (+5.4), as of Feb 1. These stats vary depending on the LN node. For example, @karamble's node reported 163 nodes (+19), 347 channels (+35) and 159.7 DCR (+5.7) capacity on same Feb 1.

Ecosystem

VSP list API now reports block height and estimated network proportion. Block height provides more certainty about the VSP being stalled or fully synced with the blockchain. Historical snapshots of API data are available here.

VSP stakey.com was delisted from the VSP list due to the problems with fixing its API. Voting wallets should not have been affected.

GoDCR SPV wallet was removed from the Wallets page. Download links are no longer working and this wallet is no longer supported/updated as result of the GoDCR proposal failing to pass. Source code is still available.

New Lightning Network node was launched by @kozel at ln.dcrhive.com (standard port 9735). To celebrate the launch his VSP offered a reduced fee of only 0.1% until Feb 8. In the future @kozel plans to add an LN Liquidity Provider instance, so anyone who wishes to receive inbound LN capacity to their node will be able to request it.

Join our #ecosystem chat to follow Decred ecosystem updates.

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

Outreach

Monde PR's achievements:

- Pitched 2 commentary opportunities

- Pitched 4 media opportunities

Secured the following media placements:

- @jy-p was interviewed on CryptoSlate's SlateCast podcast, talking about Decred's approach to censorship and privacy, the project treasury and hybrid consensus model.

- An article in Decred Magazine featuring commentary from @jz on how DeFi needs to be decentralized beyond name.

Events

Attended:

- @arij was invited to DevFest organized by Google Developer Group of Settat and Women Techmakers Settat-Marrakech. She talked about the Power of the Blockchain and Decred as an example, and the importance of using self-hosted wallets and not centralized exchanges. Most of the audience was developers and computer science students, some asked questions about how to work for Decred or do internships. See more details in the report.

Media

Selected articles:

- Decred lunches Bison Relay: A private, censorship-resistant social media and messaging platform (press release at decred.org)

- Future is here? A talk with OpenAI about the crypto market by @Joao

- Personal private server Umbrel by @phoenixgreen

- Decred vs Monero: Clash of privacy coins by @Joao

- Decred's Bison Relay helps users monetize all types of content by @HassanMaishera

- Decred a year in review (2022) by @phoenixgreen

Decred Magazine engagement stats as of January 2023:

- Total number of articles on DM: 392

- Newsletter subscribers: 87

- New DM Posts and newsletters sent: 21

- Active social media campaigns: 26

- Completed social media campaigns: 31

- Social media posts: 132

- Likes: 704

- Re-tweets: 129

- Social media followers across all platforms and accounts: 1,180

Please note that Decred Magazine generates much more content than @decredproject can retweet (a nice problem to have!), so follow it directly to not miss a story. There are many ways to follow DM: Twitter, Instagram, Facebook, RSS feed, or just directly check decredmagazine.com or a specific category, News or Politeia Digest.

Videos:

- Bison Relay 0.1 news feed - connecting, creating and using markdown by @phoenixgreen

- Built-in payment system - Bison Relay by @phoenixgreen - also as a text post

- Bison Relay - Manage content by @phoenixgreen - also as a text post

- SlateCast #49: Combining proof of work & proof of stake in DeFi with Decred by CryptoSlate feat. @jy-p

- Bison Relay updates to version 0.1.3 by @phoenixgreen - also as a text post

Audio:

Tivra aka @WasPraxis organized 5 new Twitter Spaces:

- 2023: The year of the privacy coin? feat. Monero community members (also on Anchor + an edited version on YouTube)

- Privacy tools for a sovereign age feat. Decred and Monero community members (Anchor)

- 5 proposals up - general discussion - speaking with proposal submitters and the community about the latest batch of proposals (Anchor)

- Why privacy is critical for a fully functional currency feat. Firo Co-Founder Reuben Yap (Anchor)

- DCR proposals space - second chat with proposal owners to discuss their aims and outcomes (Anchor)

Art and fun:

- Bison Relay TikTok promo feat. @DajanaDcr

- Decred strikes again by @OfficialCryptos

Image: "Time for a Decred hot chocolate" by @maitreludo

Other:

- Educational thread by @toddfmaki about Decred Voting Service Providers

Translations:

- Decred Journal November-December got a total of 3 new translations to Arabic (@arij, @abdulrahman4), Chinese (@Dominic) and Polish (@kozel). Thank you all for spreading the word!

- Bison Relay: The sovereign Internet was translated to Chinese by @Dominic (tweet)

Discussions:

- Can anything surpass bitcoin as the main store of value crypto?

- Brainstorming an idea for DCR paper notes

- Why CPFP is better than RBF CPFP. TL;DR RBF (Replace By Fee) opens the door for double spends, and only the sender can accelerate a low-fee transaction. CPFP (Child Pays For Parent) does not allow double spends and allows both sender and recipient to speed up the tx.

- Don't take the FUD bait.

Markets

In January DCR was trading between USDT $18.30-$24.90 and BTC 0.00097-0.00116. The average daily rate was $22.05.

While not on Decred Magazine recently, @Applesaucesome continues to post $DCR technical analysis and predictions on Twitter.

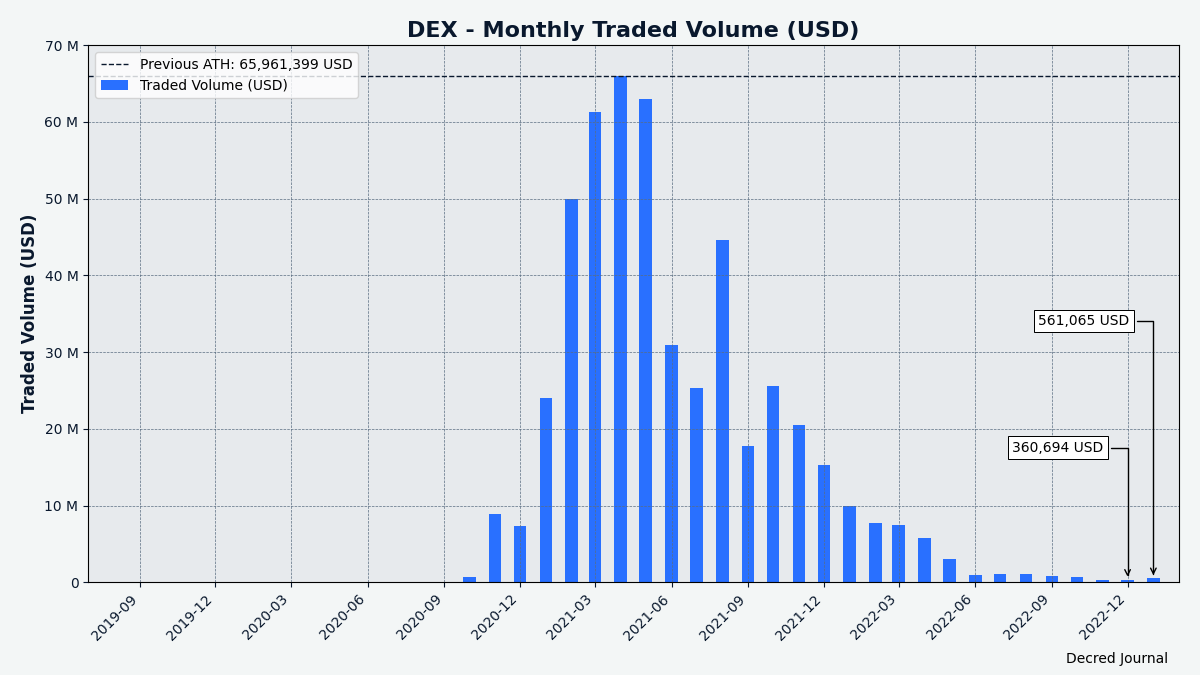

Image: DCRDEX monthly volume in USD.

Relevant External

The Ordinals protocol, for "inscribing" data on satoshis like a Bitcoin version of an NFT, debuted this month and received a mixed reaction from the Bitcoin community. Reactions were split between those who viewed it as an additional fun use case for Bitcoin, and those who saw it as spam invading the Bitcoin chain which should be discouraged or even censored. Adam Back was among those who immediately started thinking of ways that mining pools could mobilise to censor and prevent this use of Bitcoin, although later deleted and retracted the tweet.

In early Feb the largest ever Bitcoin transaction was mined and it was a "Taproot Wizard" Ordinal inscription, filling an entire block almost to the 4 megabyte limit. The transaction was mined by Luxor pool and paid for in a private arrangement with Udi Wertheimer, one of the Taproot Wizards. Ordinals rely on Taproot and also SegWit to work in their specific form on the Bitcoin chain, and they have some structural differences to how NFTs work on Ethereum and other chains.

Taproot itself has been billed as a privacy upgrade for Bitcoin, because it allows complex transactions, like those requiring multi-signature authorization or using time locks, to appear similar to normal transactions, in a way which does not reveal their nature. Taproot also allows some of these operations to be completed more efficiently, which means paying less for block space. Although Taproot has been live since a soft fork activated in November 2021, its usage remained low until recently, with only 0.37% of transactions using it in April 2022.

Polkadot is planning to transform its governance, aiming to improve the level of decentralization and community participation. Presently a Council is elected by token holders and appoints a Technical Committee of protocol experts, these bodies serve pivotal roles in Polkadot's governance. The new system will dissolve the Council and Committee roles. Some of their functions will be performed by community members directly, proposals will be submitted to different tracks depending on what they do, and the tracks will have their own approval thresholds and time frames, with an automated process to determine when voting starts and stops and which proposals are activated first. A "Substrate Fellowship" will take on the responsibility for assuring code quality for upgrades, but at 100+ members this will be a much larger group than the Technical Committee. The new governance system will also enable more flexible delegation of voting power, on a per proposal type basis.

Polkadot's Web3 Foundation has tweeted out its argument for why the DOT token is no longer a security, explaining the efforts they have taken to comply with US securities laws and announcing in Nov 2022 that DOT was able to morph into something which was no longer a security.

It looks like Ooki DAO is set to lose its case with the CFTC in a default judgment because nobody stepped up to represent the DAO by the deadline of Jan 11. So far CFTC has established that it can serve a DAO papers by posting it on their forum/Discord as long as they identify and serve at least one tokenholder as well, and has indicated that it considers anyone who participates in the DAO in any way to be jointly liable for its actions as an unincorporated partnership.

The SEC has piled on to Avi Eisenberg adding its own Mango market manipulation charges to those brought by the DoJ and CFTC already. As of early Feb Eisenberg was trying to negotiate bail, having been in custody since Dec 26.

The infamous 3AC co-founders are attempting a rebirth from the ashes of FTX, seeking funding to set up a company for trading the claims that crypto traders have on bankrupt exchange liquidations.

DeFi platform Moonwell on the Moonbeam chain has been figuring out how to compensate its users after a voter-approved parameter change caused all the collateral on the platform to lose 99.9% of its borrowing power and everyone got liquidated, paying 10% of their position size in penalties. 30% of the liquidation penalties went to a community fund and a proposal will be made to reimburse that portion directly, the other 70% will be covered by Gauntlet, a risk management partner of Moonwell.

Reddit has launched some new use cases for MOONs, the /r/cryptocurrency karmic rewards token. Moonplace is a series of 10,000 NFTs which each grant their holder control of a 10x10 array of pixels in a 2d public space. After 4 days all the NFTs had been minted, burning 1 million MOONs (worth ~$130,000) and causing a temporary spike in the price of MOONs. The Moonplace NFTs are on the Arbitrum Nova network, an L2 rollup scaling solution for Ethereum.

The first /r/cryptocurrency banner ad was also sold for MOONs (worth $3,350), to the 1inch decentralized exchange.

The largest ETH staking pools have been considering whether they should limit their further growth to avoid issues of centralization. Rocket Pool is on course to approve a proposal (RPIP-17) which would enshrine the objective for Rocket Pool to promote "healthy staking", with a couple of mechanisms to limit the growth in its share of pooled ETH staking, of which Rocket Pool currently controls 1.66%. Lido, which controls a much greater share of ETH staking (29%), overwhelmingly rejected a similar kind of proposal in July 2022.

Vitalik Buterin has published a blog post about stealth addresses, describing privacy as one of the largest remaining challenges in the Ethereum ecosystem. Stealth addresses would be generated by the sender from a recipient's meta-address, which only the recipient could control but which would not be associated with their on chain identity. In other words it would give the same kind of privacy as generating a new address for each receipt of assets, but without the hassle of having to generate the new addresses.

Uniswap's governance has turned into a clash of VCs as a16z and Jump are both backing their own book in a choice of which bridge to integrate for Binance Smart Chain. Jump is supporting Wormhole, and a16z's horse is LayerZero, but the twist is that a16z are technically unable to participate in the "temperature check" vote to decide which integration is coded up, but have asked that their 15M tokens be counted off the books as voting for LayerZero. Wormhole won the temperature check by 11M votes, so a16z's votes would be enough to change the outcome. Failing that, a16z could attempt to block the deployment of the Wormhole bridge by voting against it in an on chain vote (presuming they will be technically able to).

Silvergate Capital is the bank which many crypto exchanges use, and its stock has plunged by 46% after it reported outflows of $8.1 billion in crypto assets in Q2 2022, and laid off 40% of its staff (about 200 employees) to cut costs. Silvergate was viewed as a possible casualty from the FTX/Genesis contagion, spurring the run of withdrawals. Silvergate also announced that it was writing off all $196 million of its investment in Diem (formerly Facebook Libra/Zuck Bucks), having apparently realised that open source code and a tarnished brand wasn't worth much.

Aptos, which is led by former Diem developers but didn't pay Meta/Silvergate anything for their assets and instead took $200M funding from a16z and other VCs, saw a surge in its price in January which took its market cap to $2.4B, as it became the "hot new coin" for a period.

Well known Bitcoin developer Luke Dashjr was hacked and lost a considerable proportion of his BTC stack, over 200 BTC. It appears that hackers were able to compromise the Linux system being used, which granted access to Luke's PGP encryption keys as well as his BTC. The PGP keys were used to sign Bitcoin Core and Knots releases, so these should be distrusted by users until the situation is resolved and Luke Dashjr presumably publishes a new PGP key.

YouTube personality Logan Paul's role in the CryptoZoo NFT project was documented by Coffeezilla, with the conclusion that he was chief among scammers for a project which over-hyped a game that they were not realistically going to deliver. Paul threatened to sue CoffeeZilla but then withdrew those threats and apologized. Logan Paul is now the subject of a class action lawsuit over his role in CryptoZoo.

That's all for January. Share your updates for the next issue in our #journal chat room.

About

This is issue 55 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from the source after a minimal sanity check. The authors of the Decred Journal cannot verify all claims. Please beware of scams and do your own research.

Credits (alphabetical order):

- writing, editing, publishing: bee, bochinchero, Exitus, jz, l1ndseymm, phoenixgreen, richardred

- reviews and feedback: davecgh, jholdstock

- title image: OfficialCryptos

- funding: Decred stakeholders

Comments ()