Decred Journal – November 2022

November saw the unwinding of FTX, which lead to a wave of contagion, making the non-custodial & "proof of reserves" advantages of DCRDEX more salient. Decred, unfazed by this, continued active development throughout the ecosystem, including big improvements to DCRDEX

Image: Untitled by @Exitus.

November's highlights:

- There were new bug-fixing releases of Decrediton (v1.7.6) and DCRDEX (v0.5.7).

- The big crypto news in Nov 2022 was the unwinding of the FTX fraud, with their ceasing to process withdrawals leading to a wave of contagion which affected a number of high profile exchanges and funds. These events should make the non-custodial and "proof of reserves" advantages of DCRDEX more salient.

- @dcrtimestampbot on Twitter has been re-activated following the successful approval of the proposal to fund it. This comes after the high profile use of the Decred chain for timestamping in the Brazilian national elections concluded in October, where Lula and Haddad, the former Mayor of São Paulo, timestamped their plans for governance on the Decred chain to combat fake news.

Contents:

- Decrediton v1.7.6 Release

- DCRDEX v0.5.7 Release

- Development

- People

- Governance

- Network

- Ecosystem

- Outreach

- Events

- Media

- Discussions

- Markets

- Relevant External

Decrediton v1.7.6 Release

This release fixes a few issues with the DEX (module updated to v0.5.6), plus 1 fix for Windows:

- DEX: Fixed processing of certain Bitcoin Taproot transactions.

- DEX: Fixed wallet unlocking in some mixed Decred wallet setups.

- DEX: Fixed misleading sync status in built-in Decred wallets.

- Fixed domain name resolution using alternative DNS servers configured in Windows.

Get the latest release on GitHub. As always, we recommend to verify the files before running.

DCRDEX v0.5.7 Release

The standalone DEX app is slightly ahead of the Decrediton version noted above, including these changes since v0.5.6:

- Fixed a case where the client could fail to complete order cancellation, resulting in the order remaining in the book on the server.

- Added automatic cancellation of orders received from the server that the client does not know about, fixing a few edge cases.

This release also comes with a signature made by @chappjc's key 761D6A0BEB286C9B6A65DD053F857EEA746C64D1, making it possible to verify DEX downloads until they are available as part of the next core software release.

The latest DEX app can be downloaded here.

Development

The work reported below has the "merged to master" status unless noted otherwise. It means that the work is completed, reviewed, and integrated into the source code that advanced users can build and run, but is not yet available in release binaries for regular users.

dcrd

dcrd is a full node implementation that powers Decred's peer-to-peer network around the world.

Merged in master:

- Update peer attempt timestamp before trying to connect to it.

- Simplified how raw transactions and their additional descriptions are stored in the mempool.

- Tweaked memory management to spend less CPU time doing garbage collection. With this dcrd can perform the initial chain sync up to 10% faster at the cost of using more memory. A nice side benefit is that advanced sysadmins can now tune this behavior using an environment variable.

- Enabled and set as default new peer-to-peer protocol version that no longer uses the

rejectmessage. The message was inherited from the original btcsuite codebase and was used to signal that a transaction or a block is "rejected" by a peer. Using this message for pretty much anything was unreliable or incorrect and a proposal was made to remove it. Peers negotiating to this new protocol version will no longer sendrejectmessages and consider it a violation if they receive it. Any peers negotiating to an older version will not be punished for sendingrejectand it will be ignored by newer nodes. - Added new IPC events to notify the parent process of the address and port assigned to dcrd. In configurations where dcrd is controlled by another process like Decrediton or an automated test runner, that parent process needs to know which addresses and ports dcrd uses for its P2P interface (talking to the public network) and RPC interface (local communications with wallets and other clients). This change provides a reliable way to discover dcrd's ports when they are randomly assigned by the operating system and not configured by the parent process.

- Always respond to

getheadersrequests from peers. Previous logic would not respond togetheadersif the local chain was not considered to be fully synced with the network. In the old "blocks first" syncing model it helped to avoid some undesirable corner cases, like unnecessarily downloading blocks. It had downsides too, like a node could appear to be unresponsive or stalled to its peers, while being active and simply not having any interesting data to share. In the current "headers first" syncing model this limitation is no longer necessary, and serving up headers before the peer is known to be current no longer leads to undesirable behavior.

RPC server:

- Optimized WebSocket client disconnection handling and fixed spurious messages when WebSocket clients disconnect.

- Modified the lifecycle of WebSocket clients to use contexts, which is more flexible for the calling code.

- Added cancellation support for the

getworkrequest and optimized handling of multiple concurrentgetworkrequests. This should benefit some mining configurations.getworkis used by mining software to continuously poll the node for new work which is then distributed to mining hardware. It is a very common method for coins that have mining, however Decred miners are encouraged to use the more efficientnotifyworksubscription.

The RPC testing framework has been moved to the new repository called dcrtest. The framework connects to a dcrd instance and drives it via the RPC interface. It is used to write integration-level tests which exercise features and behaviors of the fully compiled dcrd binary. Living in a separate repository now, it provides nicer functionality in terms of selecting a specific version of dcrd to test against by making use of Go's module system instead of always compiling the latest master branch. This allows consumers of the testing framework, such as dcrlnd, to provide more quality assurance by testing against release versions of dcrd as well as the latest master.

dcrwallet

dcrwallet is a wallet server used by command-line and graphical wallet apps.

- Updated the major version of the

decred.org/dcrwalletmodule to version 3, updated all dependencies of current in-progress modules from dcrd to their corresponding major versions, removed unused code. - Allow piping the answers to the

--createprompts to work properly for not only the initial passphrase prompt, but the confirmation as well. This helps to automate wallet creation (e.g. by piping all answers from a text file). - Hex seed wallet restoration no longer requires an additional newline. This also helps non-interactive (automated) deployments of dcrwallet.

- Added RPC requests to allow Decrediton to get and update the pending TSpend policies.

Decrediton

Decrediton is a full-featured desktop wallet app with integrated voting, StakeShuffle mixing, Lightning Network, DEX trading, and more. It runs with or without a full blockchain (SPV mode).

- Upgraded DCRDEX module to v0.5.6 (bug fixes for BTC and DCR) and added an icon to the DEX window.

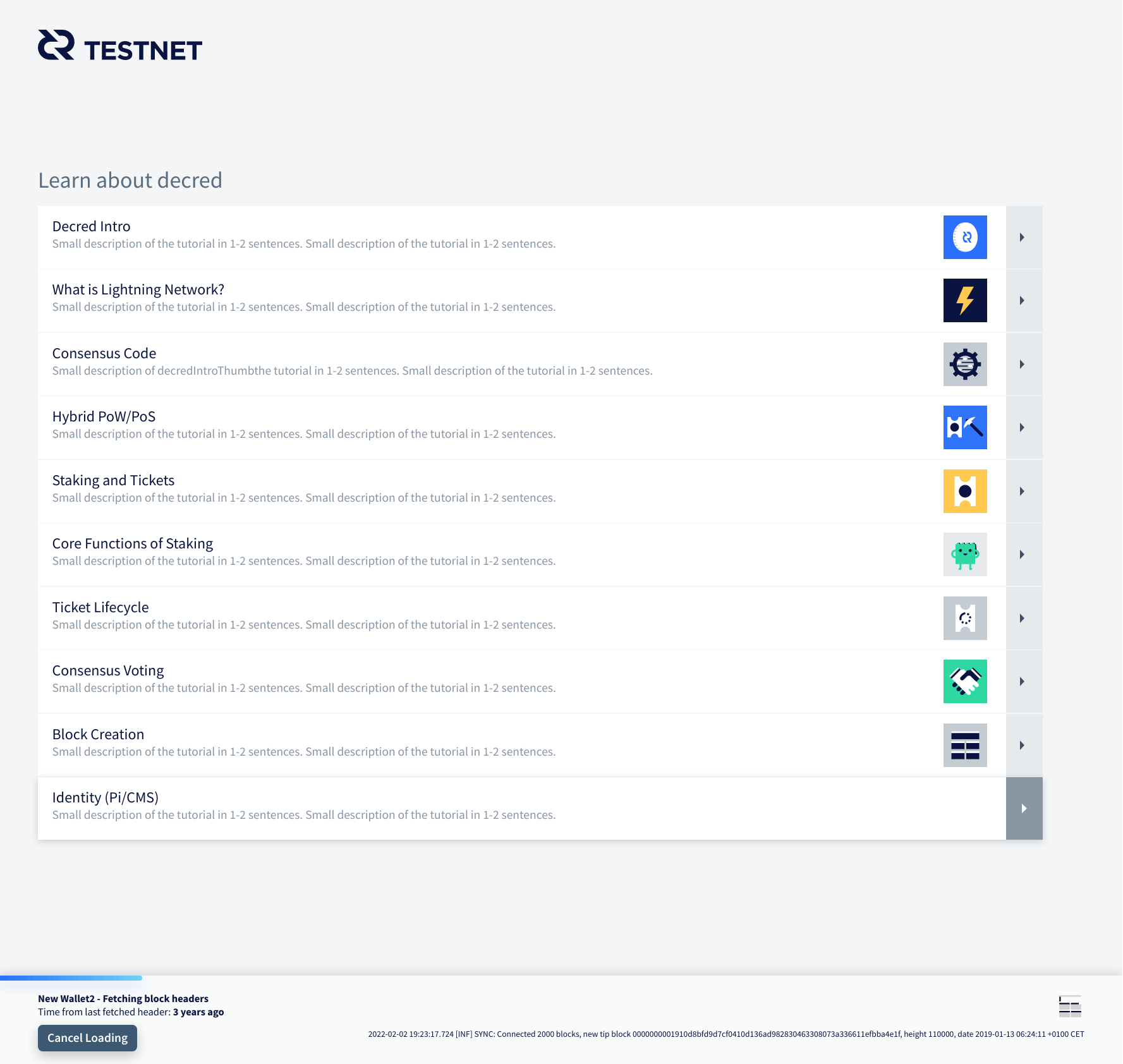

Towards the next release on master, the Wallet Launcher has been redesigned:

- Added onboarding tutorials to the launcher.

- Added gradients to the wallet cards. Each wallet's gradient is saved in the config.

- Moved the redesigned progress bar to the bottom.

- Removed the

RescanWalletcomponent. The rescan progress is now integrated into the progress bar and the onboarding tutorials list is displayed during the progress. - Introduced a new progress bar indication of the fetching block headers process.

- Added a Trezor wallet setup option.

- Added an Automated Wallet Launching modal. User choice is saved to config.

DEX:

- Removed Bitcoin wallet setup steps in favor of the built-in BTC wallet provided by the DEX module. Added tests for DEX views and actions.

- When changing wallet passphrase, users can enter their DEX app password to make the DEX aware of the new wallet passphrase. This fixes confusing passphrase change UX for those using the DEX via Decrediton.

- Fixed problem where DEX window wouldn't launch after reloading UI.

UX upgrades:

- Added links to ticket spent and VSP fee on the transactions details page. These links now open locally in Decrediton instead of sending to dcrdata. If the linked transaction is not yet in memory (e.g. it is too old), it will be fetched from dcrwallet in the background.

- Added a launch step to resend vote preferences to recently upgraded VSPs. Consensus vote choices sent to a VSP running older software are lost because the VSP is not aware of the new consensus votes. If such VSP upgrades, it may be necessary to resend vote choices to it, so it could vote on latest consensus agendas with the tickets it manages.

- Added links to documentation in the form of question mark blurbs throughout the wallet.

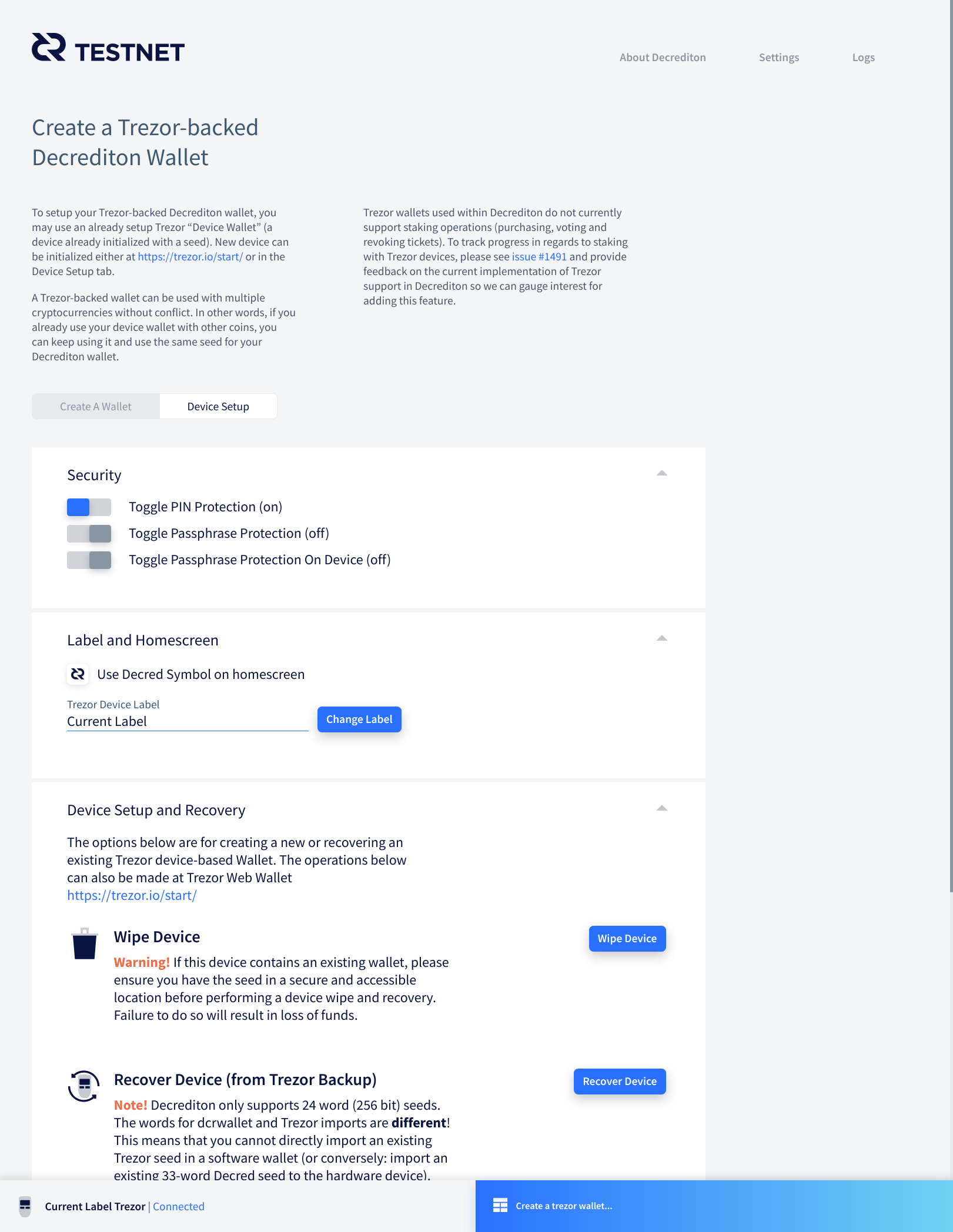

- Redesigned the Trezor pages.

- Improved the flow of purchasing one mixed ticket by automating the steps: disable the mixer, buy the ticket, re-enable the mixer.

- Voting preferences now update asynchronously. Developer @bgptr reports that the process has become 3 times faster on mainnet (3 seconds vs 11 seconds). The error handling was also improved.

Other changes:

- Renamed package

win32ipctodcrwin32ipcto avoid confusion with a suspicious remote package of the same name. It was determined that there was never any risk to Decred software from this other suspicious package and Decrediton's module was always loaded from locally built assets. - Revamped transaction processing code to improve performance and enable automated testing.

- Removed all legacy stakepool related code. Also cleaned up the code structure relating to ticket purchases and auto buyer. The privacy tab now properly shows that mixes are created every 10 minutes, not 20.

- Added basic and advanced translations for Greek.

- Apply proxy settings to dcrd and dcrwallet when the proxy type is SOCKS5. With this, users can configure dcrd and dcrwallet to communicate over the Tor network.

- Increased coverage of automated UI tests.

- Dependency upgrades, including a switch to Node 16 and Electron 18.

Fixes:

- Fixed undesired locking of the wallet account used by the auto ticket buyer.

- Fixed blockchain download time estimation during syncing.

- Fixed the missing relocking after a successful or failed ticket purchase, autobuyer or running mixer, etc. Account locking status is now shown on Accounts page for easier tracking.

- Fixes to Transaction views: truncate long addresses and account names, show ticket's spending transaction, fixed block hash display, fixed some tickets incorrectly reported as Solo.

- Fixed inability to close inactive channels in the Lightning Network tab.

- Fixed issue where focus was lost between seed words when restoring a Trezor wallet.

Dev tools and docs:

- Documented how to install and upgrade Electron devtools.

- Added scripts to analyze bundle size.

Image: Redesigned Decrediton launching. Decreducate youtself while your wallet is syncing.

Image: Redesigned Trezor setup in Decrediton.

Politeia

Politeia is Decred's proposal system. It is used to request funding from the Decred treasury.

All changes below are towards the GUI remake on the new plugin architecture.

- Added a navigation service to the

corepackage.coreis a basic building block and its services can be used from any plugin or a Politeia-like app. - Dynamically update page title according to proposal's name.

- Added a reusable "Go Back" link component and fixed legacy errors.

Other:

- Build and test against Node 18 and 19.

- Added tests for common UI components.

- Added a toolkit to simplify configuration and composition of plugins and their services.

- Added GitHub Actions workflow to build and test the new GUI remake separately from the existing GUI app.

- Implemented initial Submitted Proposals view in the user Account page.

- Fixed handling of some errors returned from server, and fixed/updated related end-to-end tests.

vspd

vspd is server software for running a Voting Service Provider. A VSP votes on behalf of its users 24/7 and cannot steal funds.

- Added a

vote-validatortool. This allows VSP admins to verify that their vspd deployment is voting correctly according to user preferences. - Include Git commit in app version string.

- Added a reusable HTTP client module for vspd API consumers. This will be useful for dcrwallet, dcrwebapi, and testing tools such as v3tool.

- Build system improvements.

Lightning Network

dcrlnd is Decred's Lightning Network node software. LN enables instant and low-cost transactions.

- Updated the latest dcrd and dcrwallet test versions. This required fixing the simnet miner to account for the ticket exhaustion error that could happen during mining.

- Added the option to switch the gap policy when generating new addresses to Wrap instead of the default one in dcrwallet. This fixes an issue where trying to generate an address for lnwallet to open or close a channel would result in an error.

DCRDEX

DCRDEX is a non-custodial, privacy-respecting exchange for trustless trading, powered by atomic swaps.

- Fixed a bad revision of goleveldb that came from go-ethereum by manually downgrading it.

- Fixed another issue with big Taproot transactions on Bitcoin mainnet by upgrading btcd again.

- Fixed unmixed account not being unlocked in some mixed account configurations, in order to prevent failure of swap refunds.

- Fixed built-in DCR wallets reported as ready too soon.

- Cancel orders that the client doesn't know about. This fixes a variety of edge cases encountered in the wild where the client could lose some of its orders (e.g. by using a corrupt database file, failing to save orders, etc.).

- Fixed bug where orders would be retired/non-existent on the client but still booked on the server. It could happen if the client initiates trade order cancellation, fails to respond to a preimage request from the server (e.g. by briefly disconnecting), and incorrectly marks the trade order as revoked, while in reality the cancellation has failed and the trade order is still booked on the server.

Next are the changes merged in master towards the next major release.

Client, user-facing changes:

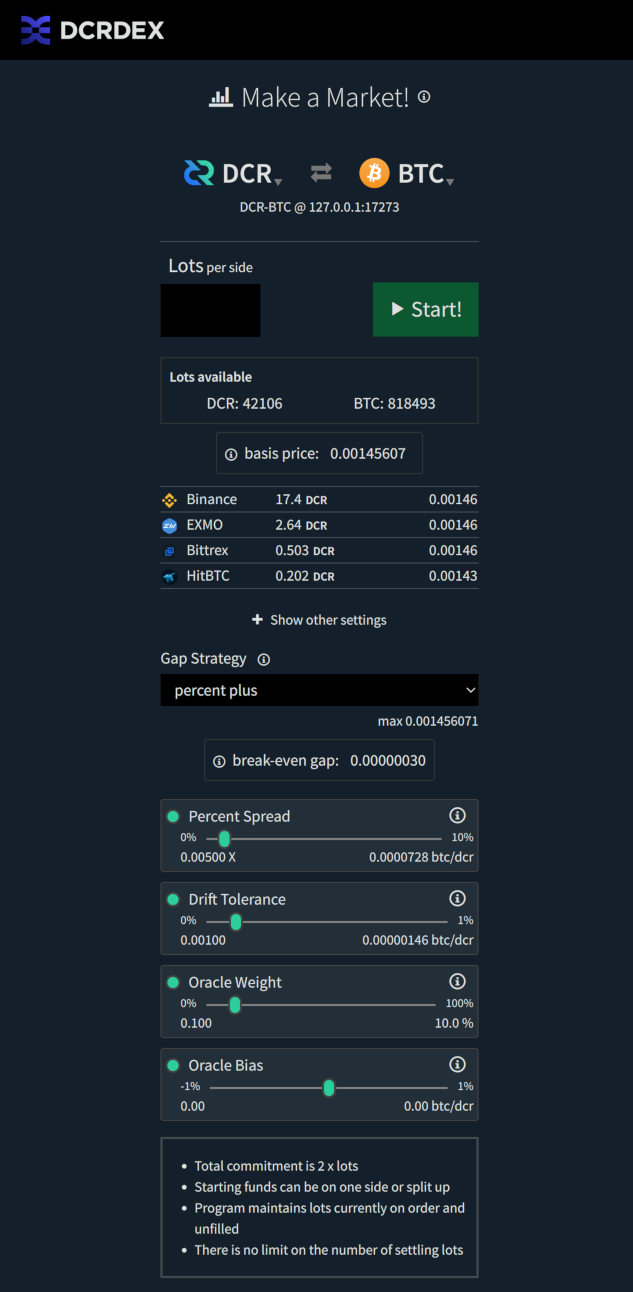

- A market-maker bot has been added. The bot uses some internal and (optionally) external signals to calculate an ideal buy and sell price and a "break-even spread", which is the spread at which a buy-sell sequence's tx fees equal its profit. These values can be used as inputs into one of 5 "gap strategies", which determine the target spread. The code is structured to support more trading routines in the future. UI was added to create, configure and monitor existing market maker bots.

- Added support for "self-governed" trades when the server is down. Clients need a way to complete started trades even if the server goes down or mysteriously loses the market information.

- Database path is now logged on startup.

- Made order placement more responsive. The order form will close sooner and order submission will continue in the background.

- Show or hide advanced order options by default.

- Fixed bug where fiat rates weren't being displayed. Frequency of fetching fiat rates has been reduced to avoid hitting the rate limits.

- ~6 smaller fixes and tweaks.

Client, BTC wallet:

- Users can now see and manage the peers that the BTC SPV wallets are connected to, as well as add new peers.

Fidelity bonds (client and server):

- Implemented more foundational building blocks: added messages to manage bonds, changed server's account management to a tiered system, updated server's database to track client bonds. There will be no invalidation of bonds due to bad behavior, and instead a user's tier is a balance between bond "strength" and their conduct score. Misbehaving users may need to lock more funds in additional bonds to restore their tier and trade again.

Server:

- Fail fast if transaction index is not enabled for Bitcoin-like assets. It is essential for DEX operation, without the index the DEX will fail to look up transactions.

- Fixed calculation of DOGE fees.

Image: Your market-maker bot assistant in DCRDEX.

dcrdata

dcrdata is an explorer for Decred blockchain and off-chain data like Politeia proposals, markets, and more.

- Fixed a bad goleveldb revision that was breaking dcrd's database code.

- Fixed various frontend bugs, importantly ones relating to treasury spends and adds.

Rosetta

dcrros is a middleware service that provides access to the Decred network via Rosetta API.

- Upgraded to Decred release v1.7.5.

- Switched the stable version of the Dockerfile to use the recently tagged v0.2.0 version of

dcrros. - Started the next development cycle for v0.3: upgraded to latest dcrd packages, updated CI config, switched to the new dcrtest for running integration tests.

Other

In the research department, @matheusd published OP_PEEL: Unilaterally exitable coin pools. OP_PEEL removes several limitations of the previous MRTTREE concept for building multi-owner Decred tickets on the Lightning Network.

The main goal for introducing OP_PEEL is to build multi-user pools of funds, rendered as a single on-chain UTXO, such that any individual participant of the pool can unilaterally extract back its shares without requiring full or even partial group coordination protocols for the redemption stage of the contract.The OP_PEEL concept may be a good way to implement multi-owner tickets (aka "ticket splitting"), but other applications could build on it as well.

People

Welcome the new first-time contributors:

- @Xk9eboF6 (Decrediton translations in Greek)

- Blockchain Jew (Decred Magazine author)

- Hassan Maishera (Decred Magazine author)

In the latest installment of Decred Magazine Q&A developer @cli_query shared his path from foreign exchange trading to diving into crypto and Decred.

The feeling was extraordinary, being able to do work for and be paid by a decentralized protocol is extremely powerful. The fact that you simply need to provide honest work and add value to the community was mindblowing to me.

Community stats as of Dec 2 (compared to Nov 1):

- Twitter followers: 53,734 (-220)

- Reddit subscribers: 12,634 (+2)

- Matrix #general users: 729 (+3)

- Discord users: 1,878 (+21), verified to post: 936 (starting to track it again)

- Telegram users: 2,894 (+32)

- YouTube subscribers: 4,640 (+0), views: 219K (+1K)

Governance

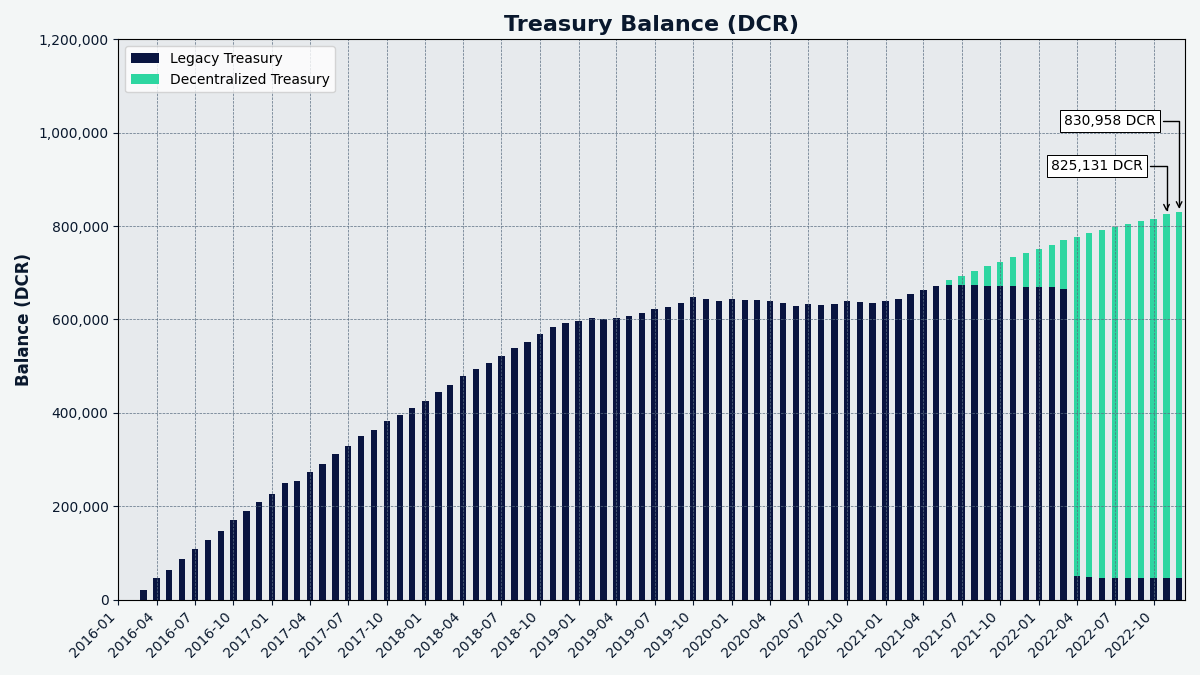

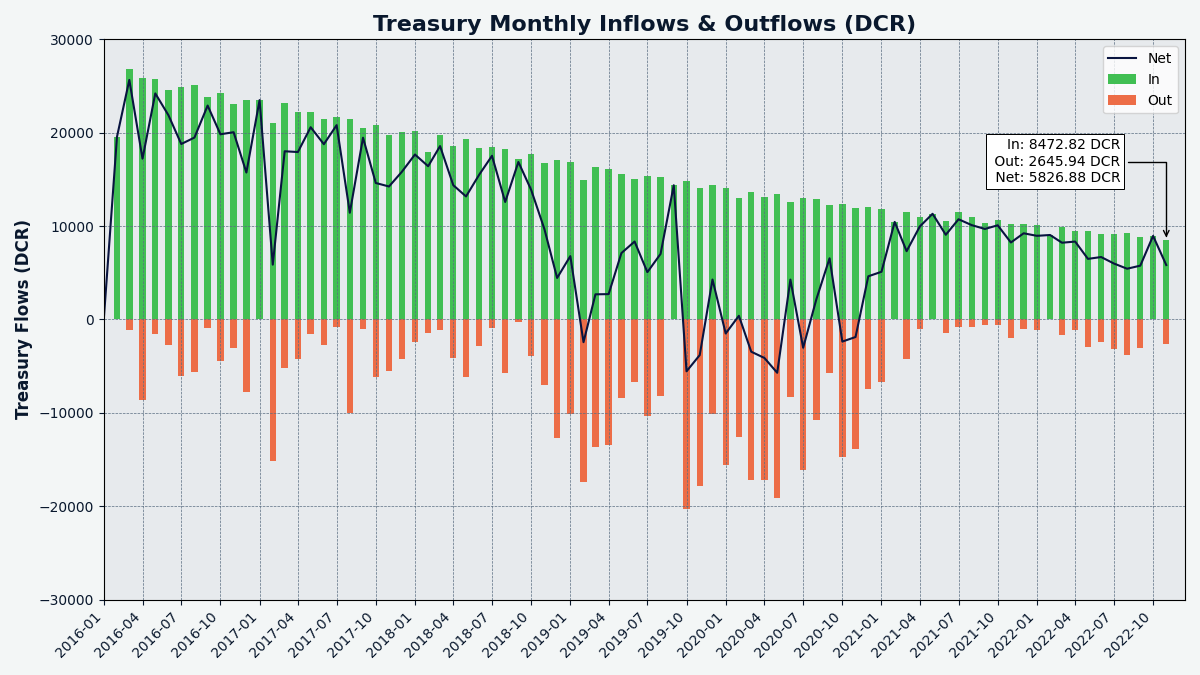

In November the new treasury received 8,473 DCR worth $186K at November's average rate of $21.92. 2,646 DCR was spent to pay contractors, worth $58K at November's rate, or $70K at October's billing rate of $26.27.

The treasury spend tx had 25 outputs making payments to contractors, ranging from 3 DCR to 1,108 DCR. It was approved on Dec 5 with unanimous yes votes. This was a fast approval (also called "short-circuit approval" in the spec) in 10 days instead of the maximum 12 days of voting. Voter turnout was 49% with 7,037 yes votes out of 14,339 eligible votes that had a chance to vote in the shortened voting period. More detailed view of the treasury spend transaction can be found at the staging instance of dcrdata and will soon arrive at the main instance of the block explorer.

As of Dec 10, combined balance of legacy and new treasury is 830,186 DCR (17.8 million USD at $21.48).

Image: Treasury balance history.

Image: Treasury monthly inflows and outflows.

The proposal to fund @dcrtimestampbot Twitter bot with $1,950 was approved with 91.4% yes votes and turnout of 33%. One day after the approval @cli_query posted an update on Politeia saying that the bot is active under the new ownership.

Network

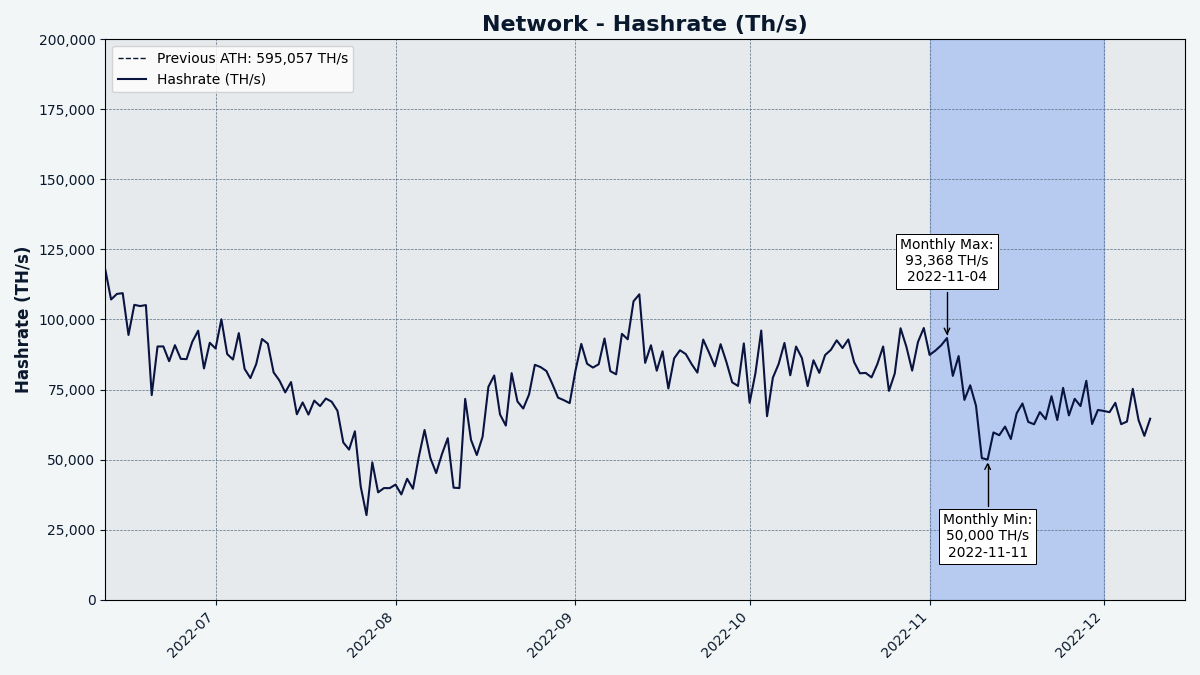

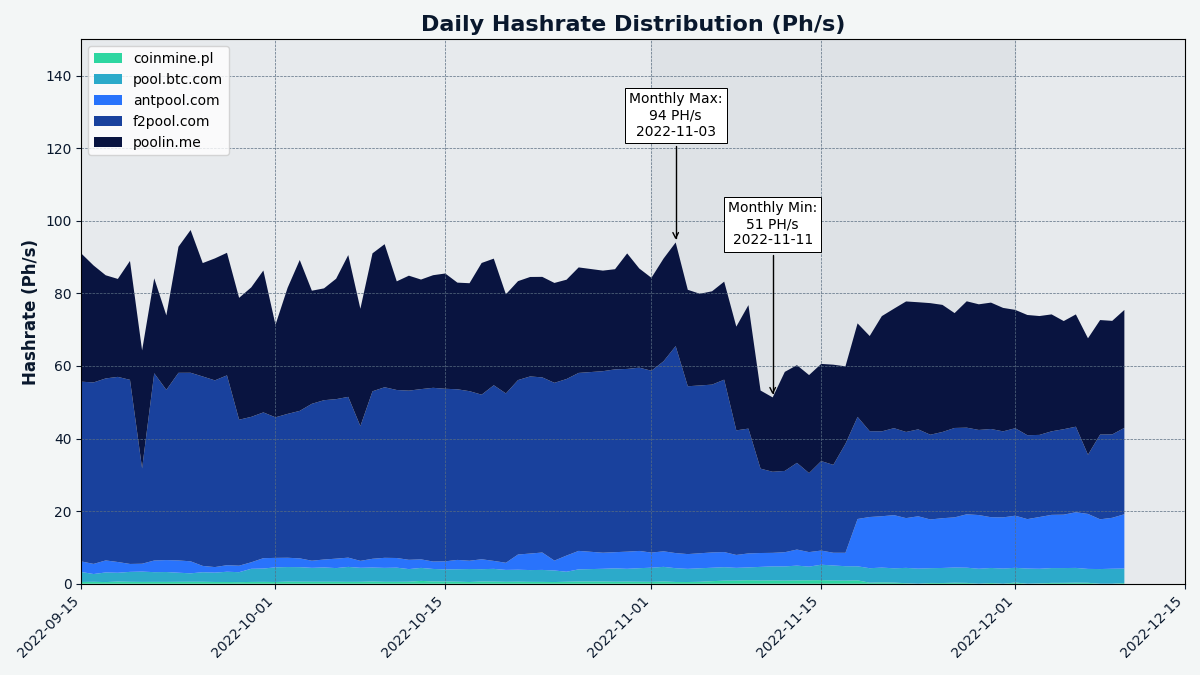

Hashrate: November's hashrate opened at ~87 Ph/s and closed ~68 Ph/s, bottoming at 50 Ph/s and peaking at 93 Ph/s throughout the month.

Image: Decred hashrate.

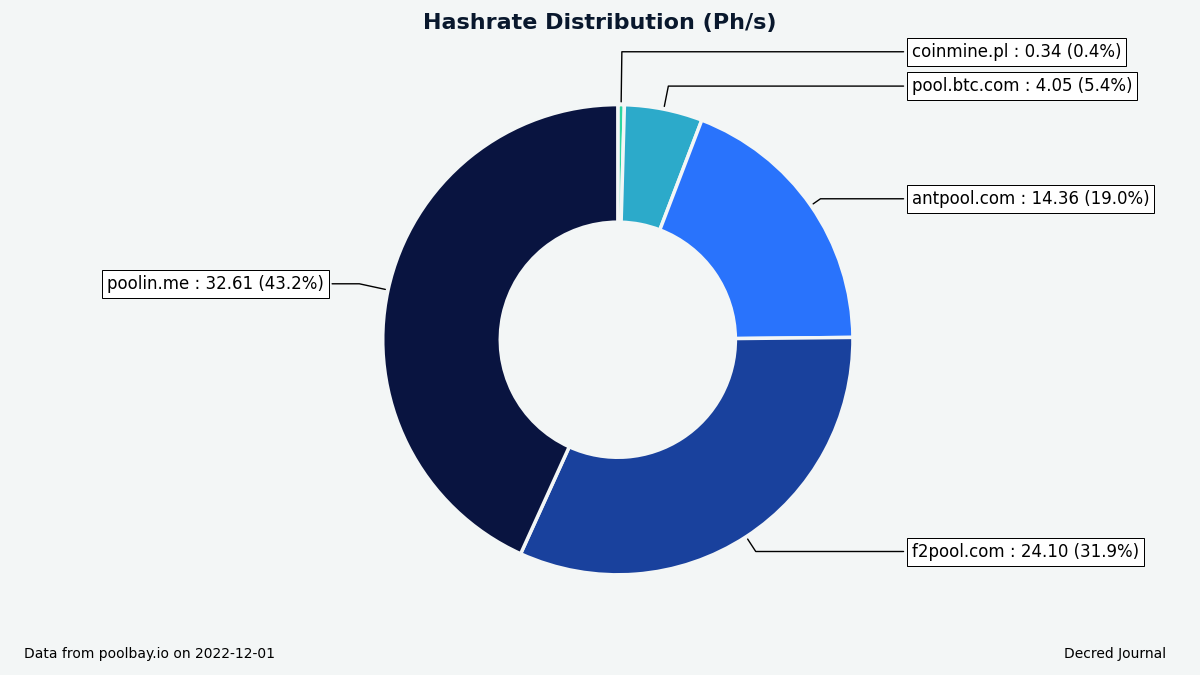

Distribution of 75 Ph/s hashrate reported by the pools on Dec 1: Poolin 43%, F2Pool 32%, AntPool 19%, BTC.com 5%, CoinMine 0.4%.

Distribution of 1,000 blocks actually mined by Dec 1: Poolin 51%, F2Pool 32%, (likely) AntPool 10%, BTC.com 6%, CoinMine 0.2%.

Image: Pool hashrate distribution.

Image: Historical pool hashrate distribution.

Staking: Ticket price varied between 226-237 DCR, with 30-day average at 231.5 DCR (-2.2).

The locked amount was 9.44-9.55 million DCR, meaning that 64.1-65.1% of the circulating supply participated in Proof of Stake.

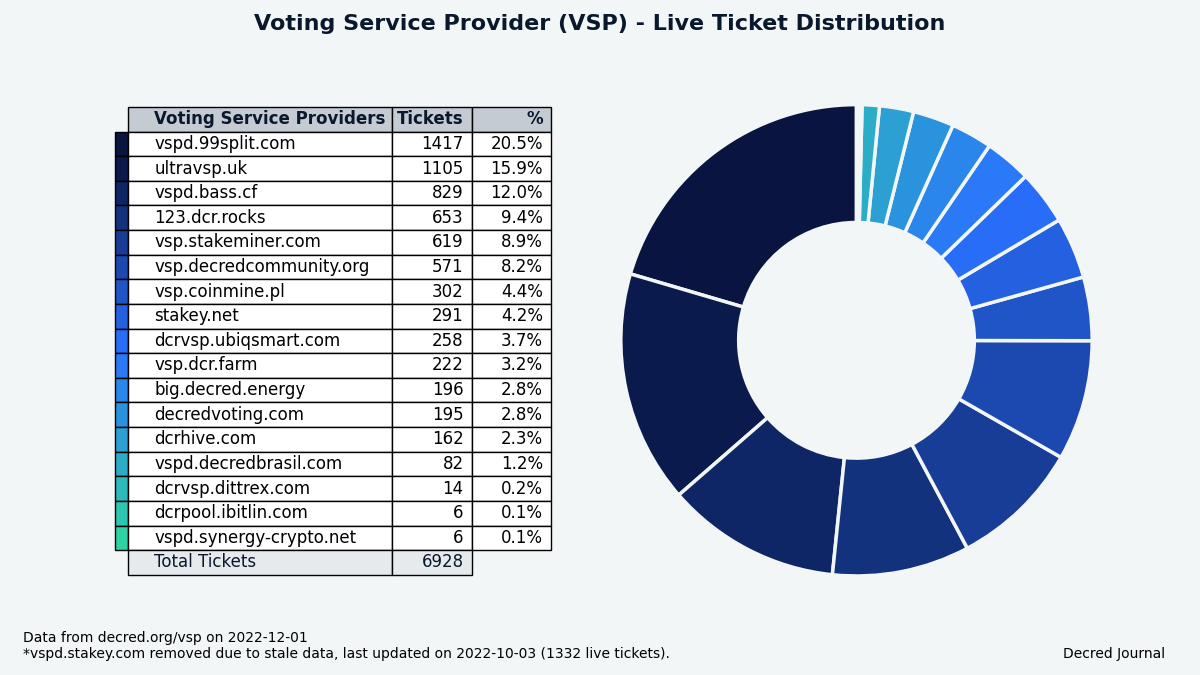

VSP: The 17 listed VSPs collectively managed ~6,930 (+130) live tickets, which was 16.8% of the ticket pool (+0.1%) as of Dec 1. Note: these figures exclude vspd.stakey.com, which is having API issues and reports outdated data.

Biggest gainers in November are ultravsp.uk (+497) and decredvoting.com (+83).

Image: Distribution of tickets managed by VSPs.

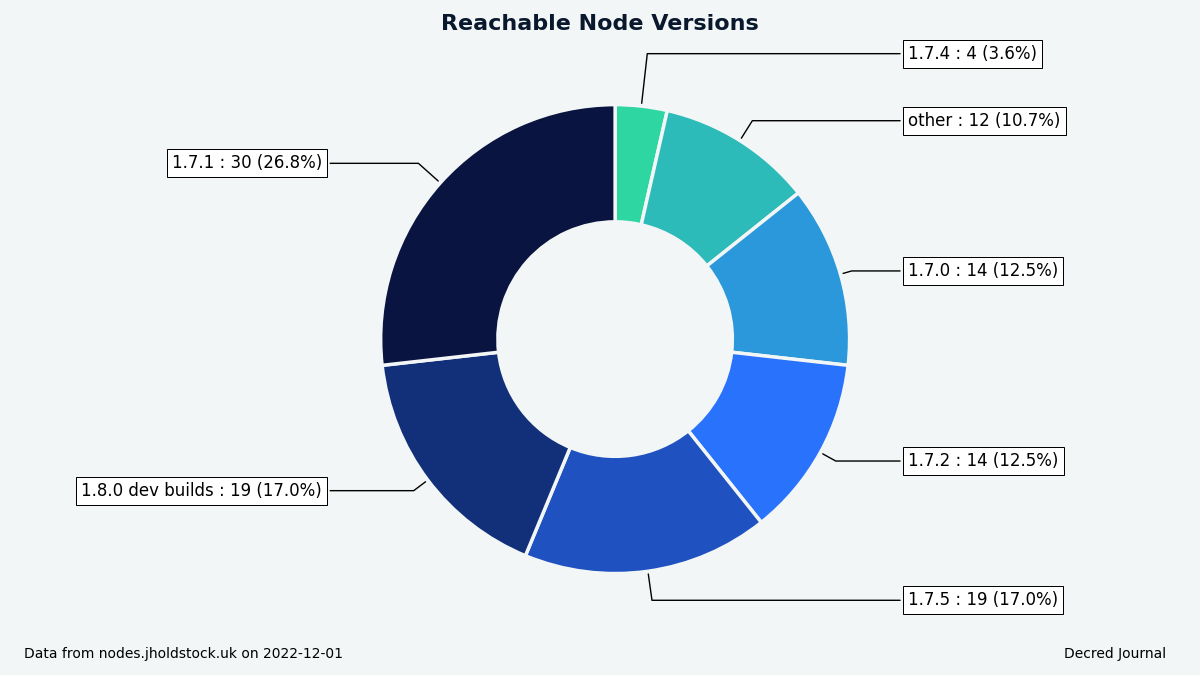

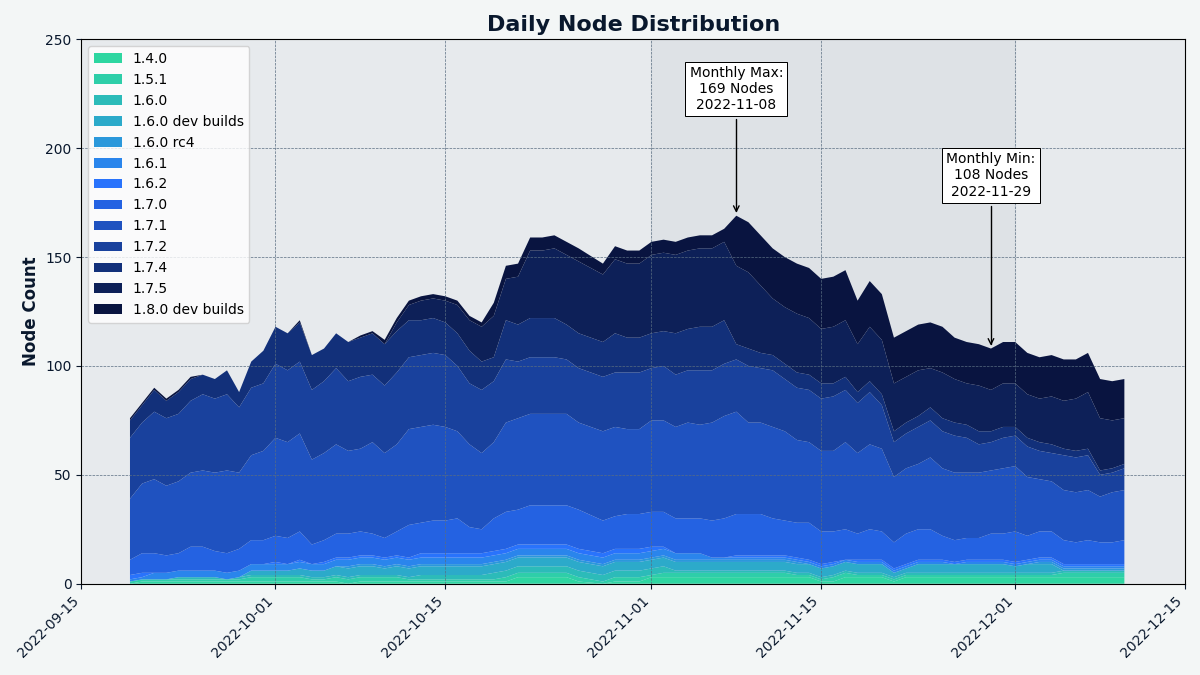

Nodes: Decred Mapper observed 112 dcrd nodes on Dec 1: v1.7.1 - 27%, v1.8.0 dev builds - 17%, v1.7.5 - 17%, v1.7.2 - 13%, v1.7.0 - 13%, v1.7.4 - 4%, other - 11%.

Image: Reachable dcrd node versions.

Image: Historical dcrd version distribution, data from nodes.jholdstock.uk.

The share of mixed coins varied between 61.0-61.1%. Daily mixed amount varied between 265-445K DCR.

Decred's Lightning Network explorer has seen 67 nodes (-2), 104 channels (-8) with a total capacity of 40.6 DCR (-6.3), as of Dec 1. Thanks to @karamble for providing the data while the LN map is undergoing maintenance.

Thanks to @bochinchero for improving the charts and adding new ones. Full chart sets are available here for reuse.

Ecosystem

Decred announcements will now be mirrored in the Fediverse at @decred at dcr.pw. Give it a follow if you use Mastodon or another instance compatible with ActivityPub.

Fediverse folk have a total of 3 Decred services now: a Mastodon instance at citadel.stakey.net for social networking (invite link), a PeerTube instance at tube.decredcommunity.org mirroring YouTube videos, and the latest @decred for following project announcements. Since they all speak the ActivityPub protocol, it is possible to get both text announcements and new videos in the same account's timeline.

Tweet timestamping bot is active again. Mention @dcrtimestampbot in your tweet and the bot will save it to IPFS, timestamp on Decred blockchain, and reply with links to view the proof and the saved copy. Currently the bot is limited to saving only one tweet (i.e. no threads) that directly mentions the bot. This can be used to make a statement and protect it from modifications. Python hackers willing to help improve the bot can find the source code here.

Decred wallets for Android and iOS have been removed from Google Play and Apple Store locations announced in the v1.7.0 release (May 2022), as well as the APK downloads from the Android release. The source code is still available on GitHub.

Binance has increased the personal quota for their Simple Earn offering for DCR from 15 DCR to 300 DCR per person, and also bumped up the yield from 2.5% to 3.5%.

Poloniex has completed its 10-month-long maintenance of the DCR wallet which started 2 days after the v1.7.0 release. Deposits and withdrawals are working again and there is a new DCR/USDT trading pair.

Join our #ecosystem chat to follow Decred ecosystem updates.

Warning: the authors of the Decred Journal have no idea about the trustworthiness of any of the services above. Please do your own research before trusting your personal information or assets to any entity.

Outreach

Monde PR's achievements:

- Pitched 1 news update

- Secured 3 media interviews

- Responded to 13 requests for comments

Secured the following news articles:

- An article in the Fintech Times on how the Decred blockchain was used to combat fake news in Brazil's presidential election featuring commentary from @jy-p. The piece was syndicated to UK Economy News.

- An article in Cointelegraph featuring commentary from @jz calling the FTX saga "crypto's Lehman Brothers moment". The piece was syndicated to 24 publications including The New York Ledger and Investing.com.

- @jy-p appeared on the Invezz Podcast talking about how the Decred blockchain was used in Brazil's presidential elections. Invezz also published an article about the interview which was syndicated to 2 publications and translated into 9 languages.

- An article in The Manual featuring commentary from @jz on the future of crypto following the FTX collapse. The article was syndicated to Canada Today.

- An article in The Fintech Times featuring commentary from @jy-p on sustainable crypto alternatives to mining. The piece was syndicated to 5 publications including UK Economy News and NYC Crypto.

- @jy-p appeared on the Cryptonews.com Podcast talking about how blockchain can provide solutions to political voting, spending and privacy. The interview was syndicated to 7 publications including Daily Crypto and Smart Investor.

Events

Upcoming:

- @arij has been chosen as a panelist for the 17th edition of the Entrepreneur's Evening hosted by JCI Casablanca, Morocco, with the topic "Female Entrepreneurship", where she will share her experience working with Decred project and how it is to work in the blockchain domain as a woman. The event is scheduled for December 20.

Media

Selected articles:

- New use for blockchain: Setting the record straight in political battles by Francis Bignell for Fintech Times

- Decred's stand on censorship in the blockchain by @BlockchainJew

- Brazil new president used Decred blockchain to improve his campaign! by @Joao

- FTX - Playing with other peoples money - @jy-p's Twitter thread reposted as a Decred Magazine article

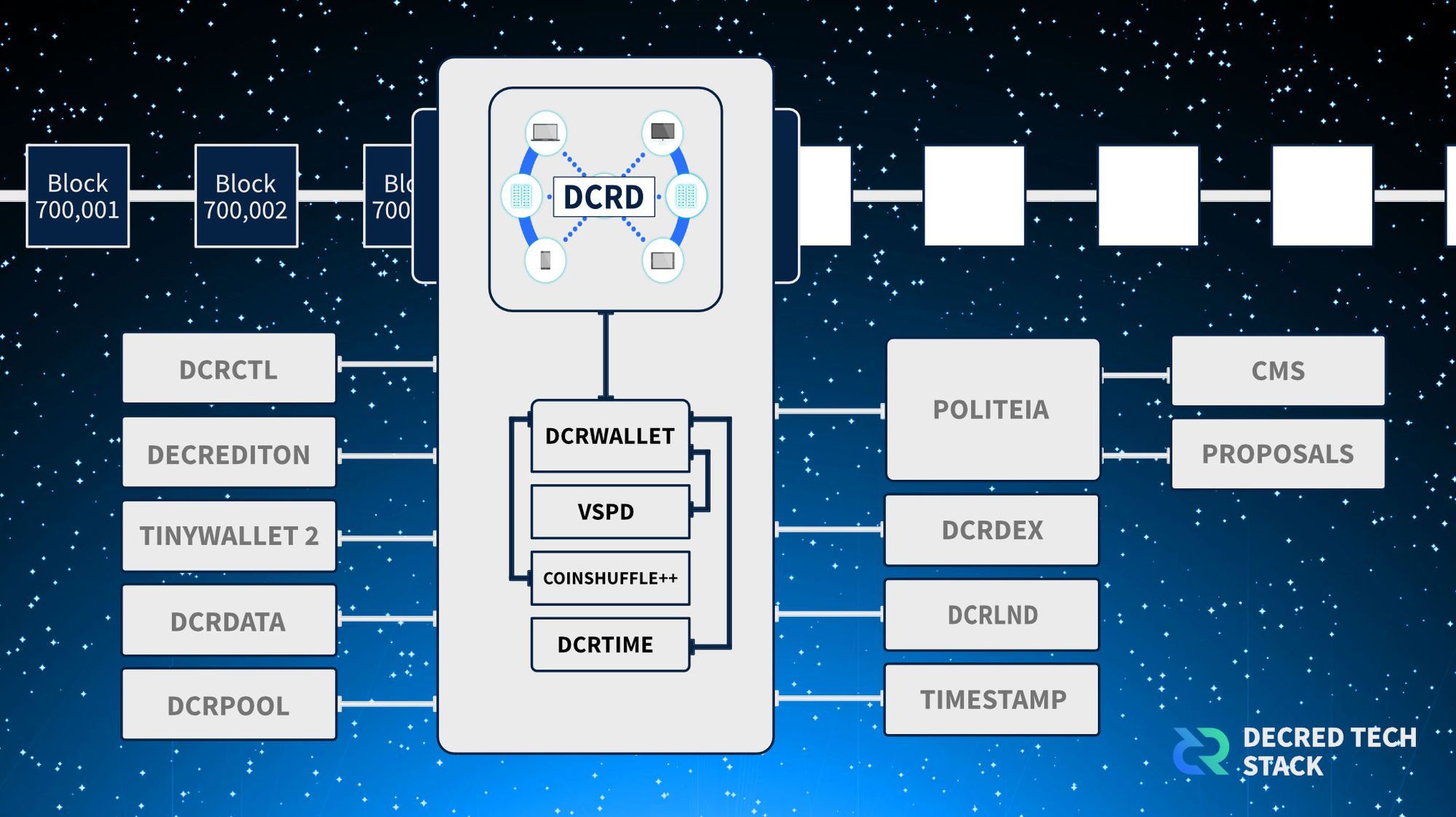

- Decred's technology stack overview by @phoenixgreen

- Decred grows with good governance by @OfficialCryptos

- Reviewing DEX security by @BlockchainJew

- cli_query Developer Q&A by @phoenixgreen

- Decred vs Litecoin: best alternatives for Bitcoin? by @Joao

- FTX's collapse intensifies the need for decentralized exchanges by @HassanMaishera

Decred Magazine engagement stats for November:

- Total number of articles on DM: 349

- Newsletter subscribers: 77

- Total newsletters sent: 16

- Active social media campaigns: 16

- Completed social media campaigns: 24

- Social media posts: 147

- Likes: 823

- Re-tweets: 198

- Social media followers across all platforms and accounts: 1,040

Image: Decred technology stack overview.

Videos:

- Decred Community Roundtable - Decred as an interoperable market place by @Exitus and @phoenixgreen, feat. @h3la1, @MadScrilla1, @c12hz, and @DCR_Uncle

- DCRDEX completing a P2P trade - DCRDEX Fundamentals by @phoenixgreen

- Blockchain & elections, Jake Yocom-Piatt, Decred by Dan Ashmore for Invezz - also on YouTube and as a podcast

- Trading scenarios - DCRDEX Fundamentals by @phoenixgreen

- DCRDEX access fiat on and off ramps - DCRDEX Fundamentals by @phoenixgreen

- Jake Yocom-Piatt, co-founder of Decred, on blockchain fixing political voting, campaign spending and privacy by Matt Zahab for CryptoNews Podcast ep. 182. Also available as a full text transcript and as a podcast.

Many Decred videos are available in audio format on Decred Magazine podcast on Anchor and all the common podcast platforms like Spotify or Apple.

Our YouTube channel now has a new short link @DecredTV. The videos are also mirrored on Odysee.

Audio:

- The first Decred Twitter Spaces meetup was held on November 21 titled Decred Open Discussion - Self-custody is king. Twitter Spaces allow users to actively have conversations in real time, with users joining and leaving as they please. Users can request the ability to speak from the hosts running the space. Currently, only users on mobile devices can speak, while web users can only listen. 333 users tuned in. The recording is also available on Anchor.

Translations:

- Decred Journal September and October 2022 was translated to Arabic (@arij, @abdulrahman4). Thank you for spreading the word!

Non-English content:

- Short Decred intro by Just Crypto (Arabic)

Discussions

Selected Reddit posts:

- DCRDEX order books are fully backed at all times - u/jet_user argues it is so uncommon that it may take a thousand reminders to sink in

- New podcast w/ co-founder of Decred - Blockchain improving the political voting process discussion (19 comments)

Selected Twitter discussions:

cexes loaning customer assets out for shorts is only possible when the exchange has custody of those assets.

these loans often cut directly against the interests of the customers who own the assets, creating misaligned incentives.

the only ethical path forward is decentralized exchanges (dex) because of this incentive misalignment.

exchanges should never take custody of any assets and instead simply facilitate trades by routing messages between counterparties. [@behindtext]

Markets

In November DCR was trading between USDT 18.30-28.80 / BTC 0.00115-0.00146. The average daily rate was $21.92.

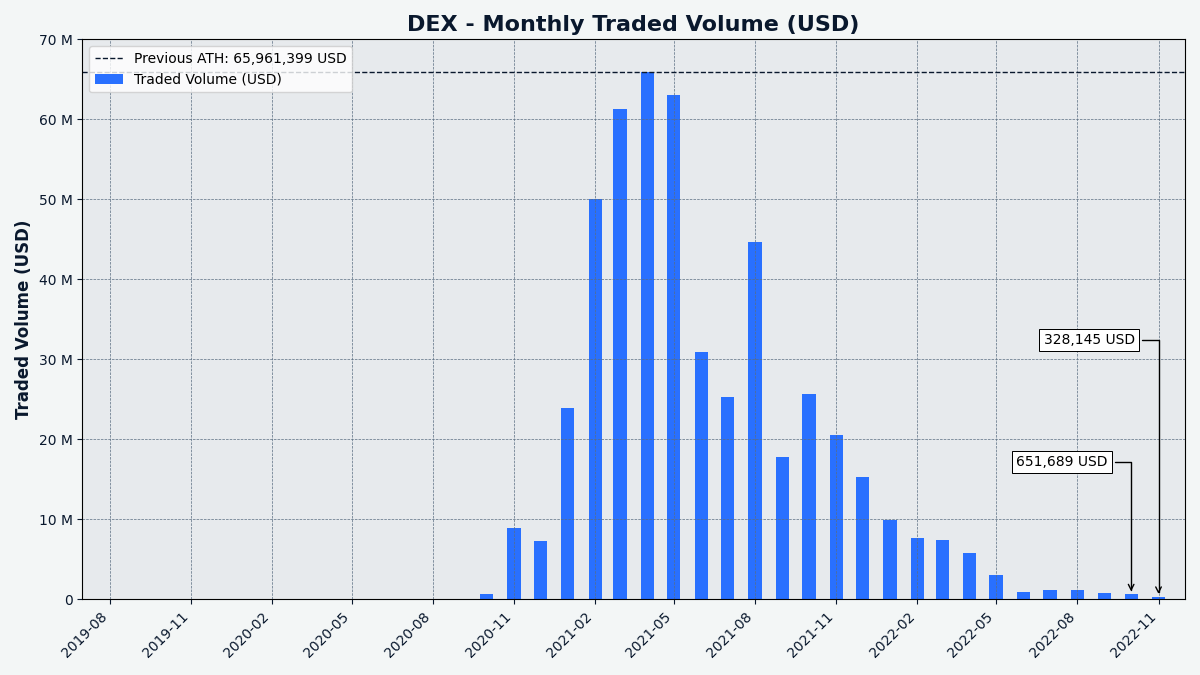

Image: DCRDEX monthly volume in USD.

Relevant External

The US Attorney's Office has confiscated over 50,000 BTC (valued at $3.36 billion) which was apparently obtained through "a sophisticated scheme designed to steal bitcoin from the notorious Silk Road Marketplace". The sophisticated scheme involved depositing BTC and then immediately (i.e. within the same second) requesting withdrawals of this amount multiple times, which would duly be processed by the Silk Road's server at the time. The BTC was confiscated from one James Zhong, along with some cash, equities and precious metals. Some of the BTC was stored "on a single-board computer that was submerged under blankets in a popcorn tin stored in a bathroom closet". Zhong had exchanged the BCH which accrued to their addresses for more BTC on an offshore cryptocurrency exchange, and this may have played a role in allowing the authorities to track him down.

The cryptocurrency exchange FTX has filed for bankruptcy protection and halted all withdrawals for its International and US sites, affecting over 1 million users. The collapse of FTX started with a story on CoinDesk about a leaked balance sheet for Alameda Research (one of Sam Bankman-Fried's companies) indicating that it was heavily reliant on FTT tokens (for the FTX exchange) which it was placing a higher than market value on. CZ of Binance fueled the fire by suggesting that Binance would liquidate its substantial FTT holdings in light of this information. Alameda tried to prop up the FTT price for some time but it dropped significantly and this made them insolvent, in the process triggering a run of withdrawal requests from increasingly panicked FTX users which ultimately FTX was unable to meet. SBF confirmed that something was very wrong by tweeting that Binance were going to step in and buy FTX to ensure all customers would be able to access their funds, an arrangement which fell apart within a day, and within a few days there were reports that SBF was looking for a $9.4 billion rescue package from investors. After declaring bankruptcy a big chunk of FTX's crypto balances started moving, it has apparently been "hacked" by a (former) insider. The appointed administrator has criticised FTX as one of the worst run companies he has ever seen (he administered Enron's bankruptcy among others). SBF has been tweeting and giving interviews intermittently throughout the saga, against the advice of his lawyers (who have dropped him as a client), and many crypto commentators have been lamenting the relatively kind treatment he has received in the mainstream press.

There have been a number of high profile crypto companies who have struggled with the contagion of FTX/Alameda's collapse and the unravelling "Sam coins". The Gemini exchange had to pause withdrawals and BlockFi first suspended withdrawals then filed for bankruptcy. The Digital Currency Group's brokerage Genesis suspended withdrawals, while the Grayscale Trust, another DCG company, saw GBTC trading at a 45% discount to BTC, as they failed to provide definitive "Proof of Reserves".

Proof of Reserves (PoR) is a way of keeping exchanges honest by publishing addresses where they hold customer funds, ideally alongside a list of liabilities, in the aftermath of the FTX collapse PoR has seen renewed attention and several exchanges have implemented versions of it to assure customers that their assets are safely held. Nic Carter has a website which outlines the concept and tracks which exchanges have implemented some kind of PoR. There have been questions raised about some of the PoR efforts of exchanges, in particular Crypto.com "mistakenly" sending over $400M worth of Ethereum to Gate.io was seen as a possible attempt to cheat by one or both exchanges.

The Cosmos Hub community voted to reject a major and controversial ATOM 2.0 whitepaper which proposed significant changes to the tokenomics and new consensus level mechanisms for the network. The vote had high turnout, with 73.4% of all ATOM tokens participating, and while 47.5% voted Yes, 37.4% voted "NoWithVeto", and any more than 33.4% NoWithVeto votes means rejecting the proposal. The proposal was described as a signalling proposal, it came from a variety of figures within the community including a co-founder, and it is likely that many of the aspects of the long document will return for specific votes on their technical implementation after feedback from the community has been addressed.

One of the MakerDAO co-founders, Nikolai Mushegian, has died after an apparent drowning incident, his body was found on a beach in Puerto Rico known for strong currents. Mushegian had been tweeting about CIA and Mossad being out to frame him or torture him shortly before his death.

The LBRY content network, best known for Odysee video app, lost its long-running case against the SEC for selling LBRY tokens as an unregistered security. The judge issued a summary judgment that the LBRY tokens were obviously securities, with comments which cast a wide net and would see the majority of crypto tokens classified as securities.

That's all for November. Share your updates for the next issue in our #journal chat room.

About

This is issue 53 of Decred Journal. Index of all issues, mirrors, and translations is available here.

Most information from third parties is relayed directly from the source after a minimal sanity check. The authors of the Decred Journal cannot verify all claims. Please beware of scams and do your own research.

Credits (alphabetical order):

- writing, editing, publishing: bee, bochinchero, Exitus, jz, karamble, l1ndseymm, phoenixgreen, richardred

- reviews and feedback: davecgh

- title image: Exitus

- funding: Decred stakeholders

Comments ()