While Ethereum prominence in DeFi and decentralized contracts has fuelled its adoption, Decred's approach to governance and decentralized applications presents an attractive alternative for those seeking community-driven development.

In 2013, a young Russian developer called Vitalik Buterin conceived the Ethereum blockchain in a white paper. He described a new way to build decentralized applications beyond the niche of cryptocurrencies, creating a platform that included the concept of smart contracts. This document gained the attention of the cryptocurrency community, attracting developers and enthusiasts for this project that turned out to be the crypto with the second largest market cap, behind Bitcoin.

The groundbreaking network proposed by Vitalik went beyond smart contracts, being also a pioneer in crypto Initial Coin Offer (ICOs), Decentralized Finance (DeFi), and even NFTs. Ethereum played a central role in shaping the crypto market, its progress is an important indicator of the market's health.

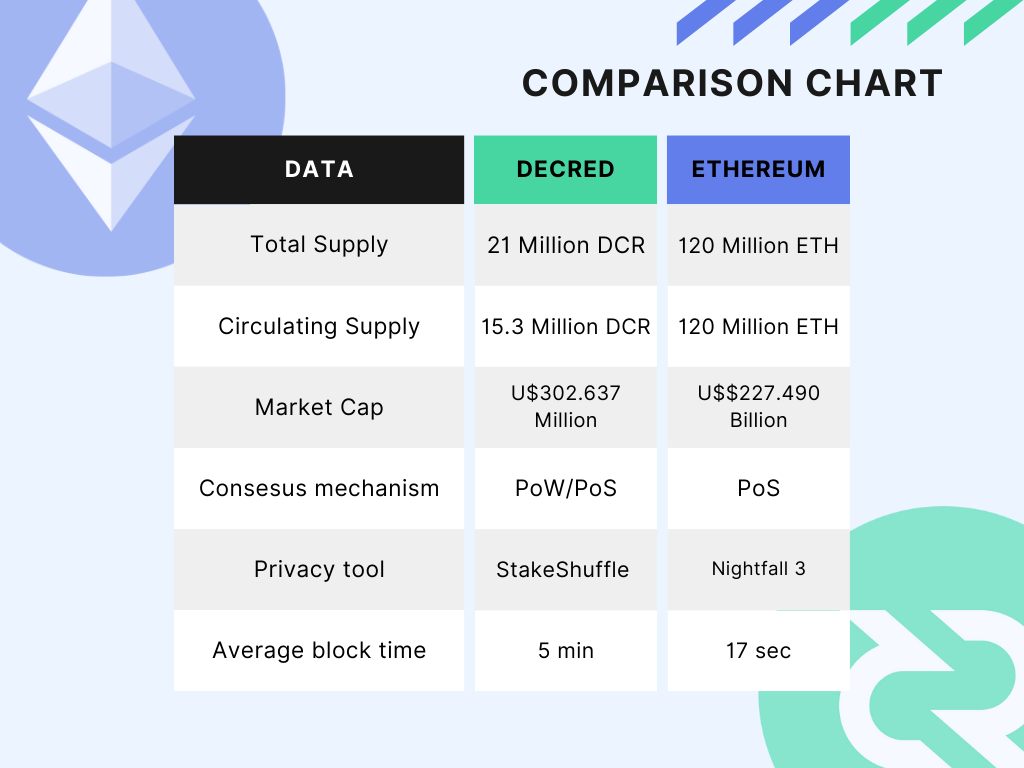

On the other hand, Decred emerged in the crypto market in 2016 as a community-driven network, initiated by a group of Bitcoin developers. Created to address some of Bitcoin's flaws, Dcered introduced a hybrid consensus mechanism combining proof-of-work (PoW) with proof-of-stake (PoS). A community-based project, that allows stakeholders to participate in deciding the future of the project. This strong emphasis on governance makes Decred an appealing alternative in the crypto market.

In this comparison article, we will dive into the networks of Decred and Ethereum, highlighting the distinct features that set them apart. In the end, we hope to have a meaningful understanding of their characteristics and how they became important to the crypto world.

Operation

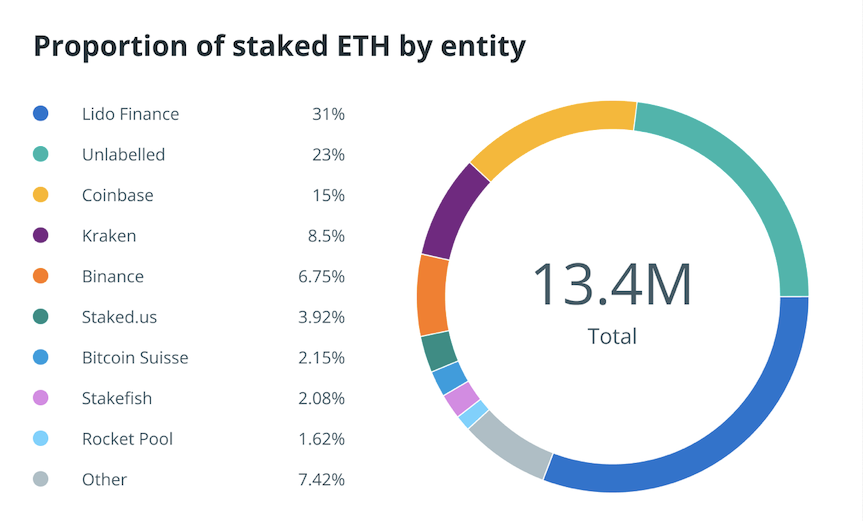

In 20222, Ethereum officially switched from Proof-of-Work(PoW) consensus to the Proof-of-Stake(PoS) mechanism, which is believed to be less energy-intensive and provides solutions for scalability issues. A PoS network is a system that uses staked currency to secure itself. Every validator node has to "lock up" a security deposit of ETH on the blockchain to participate in the consensus/governance process. This mechanism incentivizes nodes to align with the community behavior, helping to keep the network safe and efficient.

But what is a Validator?

A validator plays a critical role in a Proof of Stake consensus algorithm. Its primary responsibility is to participate in the consensus-building process by voting on the validity of the block transactions. This group effort ensures that only legitimate blocks get added to the blockchain. Each validator node maintains an identical copy of the blockchain's history. Utilizing this shared history, they collectively check the validity of new blocks and their transactions. Through group consensus, the validator nodes vote on the legitimacy of these blocks before incorporating them into the main chain. This ensures the integrity and consistency of the blockchain network.

In the Ethereum PoS system, every validator needs to stake a specific amount of the network's native tokens, which in this case is 32 ETH. This staking requirement serves as an incentive for validators to act in the best interest of the network. Mutual interest benefits the project, validators are interested in upholding the system's integrity and reliability, as they risk losing investment if they attempt to undermine the network.

Decred also has Proof of Stake as its main consensus mechanism but also uses Proof-of-Work to create a hybrid model that provides a balance of security and stakeholder influence in the Decred network. Decred unites those two mechanisms by taking the usual mining by PoW and adding five validators who stake DCR. When three of those five validators vote that the block work is correct, the block will be validated as part of the Decred blockchain.

Decred has recently approved the change of block rewards for PoW/PoS. Before the change, the subsidy split was:

10% to PoW Miners

80% to PoS Stakeholders

10% to the Decred treasury

Now the block rewards will be divided in the following manner:

1% to PoW Miners

89% to PoS Stakeholders

10% to the Decred treasury

This change was voted on Politeia to face the ongoing problem with malicious mining cartels, which were exploiting the incentive alignment between PoW and the project, using their mining subsidy as a weapon to hinder the growth of the project by the constant dump of recently mined DCR.

Another important change voted in the proposal, is the change of the PoW algorithm from BLAKE256 to BLAKE3. This adjustment aims to brick existing ASICs miners, making the mining of DCR more accessible, since now GPUs will be able to mine them. This proposed mining change should further reduce the energy footprint of Decred, a goal long pursued, that will bring more sustainability to the project.

Funding

The Ethereum Foundation is self-funded. The foundation is a non-profit organization created to support the development and marketing of the platform. Several programs, curated by the community, offer funding for the different projects of the network.

Some of these grant programs include:

The Ethereum Support Program (ESP)

Dedicated to fortifying the core foundations of Ethereum and empowering future innovators. ESP focuses on enhancing infrastructure, broadening the array of tools accessible to Ethereum builders, advancing knowledge of cryptographic primitives, and fostering growth within the builder ecosystem through community development and educational initiatives. The projects and initiatives support adhere to the principles of being free, open-source, non-commercial, and geared towards creating positive-sum outcomes for the Ethereum community and beyond.

Academics Grants Round

This program invites researchers, think tanks, Ph.D. students, and all interested in advancing knowledge around the Ethereum network to submit academic proposals. Ethereum has approved impressive budgets for this grant fund, supporting research teams from all around the world.

The Decred project has also found a way to fund its development and marketing. The project created a decentralized treasury. 10% of all block rewards get directed to this fund, which actively finances development, marketing, and every other initiative approved by stakeholders' votes on the Politeia platform. This self-funding model made with transparency and sustainability is one of Decred's differentials.

Decred's funding mechanism is designed to align with the open-source principles that drive the project. Through the Politeia platform, treasury funds are allocated for project advancements, subject to discussion and voting by the community. This unique approach of decentralized funding is unprecedented in the open-source realm. Integrating this funding model with Decred's innovative approach to work, the project aims to unleash the full potential of its contributors. The united effort of combining a new paradigm of work with an efficient funding system strives to unlock innovation and drive Decred toward realizing its true potential.

Transactions and Privacy

Ethereum transactions are not encrypted by default, just like Decred, meaning transaction details are visible on the blockchain. One of the latest privacy tools for Ethereum is Nightfall 3, which combines zero-knowledge proofs (ZK or ZKP) with an innovative transaction verification model called optimistic rollup, aiming to boost efficiency and lower transaction costs. The result is a powerful protocol known as ZK-Optimistic Rollup.

In the new Proof of Stake (PoS) system, validators/miners confirm the authenticity of each ETH transaction by staking a collateral of 32 ETH. Staking serves as proof of their participation and commitment to the system. In case a validator provides incorrect confirmations, their collateral can be forfeited. Once the transaction obtains all the required confirmations, the transfer is finalized, and the recipient's wallet will reflect the received ETH.

The time it takes for an Ethereum transaction to be completed can vary depending on several factors, such as the platform you’re sending to and whether it’s from a wallet to a wallet or a wallet to an exchange. Wallet-to-wallet transfers usually take between 15 seconds to 1 minute, while wallet-to-exchange transfers can take between 5 and 30 minutes.

The Decred blockchain also contains a public ledger of all Decred transactions, including the amount sent in each transaction, as well as its senders and its recipients. The Stakeshuffle mixed protocol is a privacy tool developed to improve users' security. The protocol is available to everyone who has Decred's Digital wallet (Decrediton) to anonymize their addresses and obfuscate the ownership of DCR.

The best application for DCR owners to trade is DCRDEX, Decred's decentralized exchange. Users can trade coins like Bitcoin, Ethereum, USDC, Litecoin, Digibyte, Doge, and other cryptos with no arbitrary fees. DCRDEX follows Decred's ethos letting only users profit from their financial activity.

Moving Foward

While Ethereum prominence in DeFi and decentralized contracts has fuelled its adoption, Decred's approach to governance and decentralized applications presents an attractive alternative for those seeking community-driven development.

The choice between Decred and Ethereum depends on the user's goals. Whether seeking a platform for decentralized finance, tokenization, or building a community ecosystem, Decred and Ethereum offer valuable contributions to the blockchain technology and crypto market.

Comments ()