FTX’s Collapse Intensifies The Need For Decentralized Exchanges

The cryptocurrency market has seen perhaps its wildest year since Bitcoin was launched in 2009 and it could leave the cryptocurrency space in a far worse situation after the dust clears.

What happened on November 11, 2022, was crazy, even for the cryptocurrency market standard. The cryptocurrency market is known for its volatile nature, and events drive prices up and down all the time.

However, FTX’s collapse on November 11, 2022, is a bitter pill for the cryptocurrency space to swallow. The collapse shows the need for decentralized exchanges (DEXes) now more than ever.

FTX’s Crash: Here Is What We Know So Far

The cryptocurrency market has seen perhaps its wildest year since Bitcoin was launched in 2009. It began with the crash of the Terra project earlier this year. The FTX debacle is the second-most significant crash this year, and it could leave the cryptocurrency space in a far worse situation after the dust clears.

FTX’s troubles began after CoinDesk claimed it had acquired Alameda Research's balance sheet. Alameda Research is the hedge fund owned by FTX’s CEO and founder, Sam Bankman-Fried. The sheet further revealed that a massive chunk of Alameda's assets ($5.8 billion of the $14.6 billion reported) were in FTX's exchange token, FTT.

However, the giant red flag was that FTT had remarkably low circulating liquidity relative to Alameda and FTX's holdings. After the information came to light, rival exchange Binance announced that it would liquidate $584 million worth of FTT tokens over the coming months.

FTX’s trouble promptly led Binance to agree to a deal to acquire FTX and take on its liabilities. However, a few days later, Binance called off the deal after looking at FTX’s books, revealing that it could do nothing at that point.

By Friday, FTX had filed for Chapter 11 bankruptcy alongside numerous companies affiliated with FTX, including FTX US and Alameda Research. Bankman-Fried resigned from his role as the CEO, and the company was handed to Chicago-based attorney John J. Ray III.

Centralized Exchanges Are Prone To Hacks

FTX’s collapse wasn’t the only situation we have seen in recent years.

Centralized exchanges are also prone to hacks. Since the days of Mt. Gox, the cryptocurrency space has seen numerous crypto exchanges lose billions of dollars to hacks.

The Mt. Gox hack took place in 2011, and 750,000 Bitcoins were lost in the process. Although the crypto exchange no longer exists, victims of the hack are yet to fully retrieve their funds.

In January 2018, Coincheck was hacked and lost NEM coins worth around $534 million. The Coincheck hack was considered the biggest theft in the history of the crypto space at the time. The crypto exchange was able to continue operating after it was acquired by the Japanese financial services company Monex Group a few months after the attack.

Following the death of the owner of Canadian cryptocurrency exchange QuadrigaCX in 2018, users lost millions of dollars because he was the only one who had the private keys to the exchange’s storage wallets. Reports also later emerged that QuadrigaCX’s owner was also irresponsible with user funds.

BNB Chain, the blockchain of Binance, the world’s leading cryptocurrency exchange, was hacked in October 2022 and lost around $570 million in the attack. However, the cryptocurrency exchange was able to recover most of the funds and keep the loss at around $100 million.

If Binance, with its status as the leading crypto exchange in the world, is not immune from hacks, then keeping all your funds in centralized exchanges is definitely a risky move.

It Is Time To Focus On Decentralization

The decentralized finance (DeFi) ecosystem is growing. However, centralized entities still control a large chunk of the cryptocurrency market. In its October report, Citi revealed that DEXs are responsible for 18.2% of spot-trading volume, implying that centralized exchanges still control around 80% of spot trading volume in the cryptocurrency space.

With the recent FTX collapse, it has become even more important for decentralized exchanges and protocols to take the helm. One of the core tenets of cryptocurrency and blockchain is decentralization, and it is time the industry starts practicing what it preaches.

A major reason why people should use decentralized exchanges is control over their funds. “Not your keys, not your coins.” This says has never held more water than at this moment.

Centralized exchanges are in control of your funds when you store your coins with them. Centralized exchanges controlling your funds can impose many constraints and even financial losses on you.

If FTX users held their funds in decentralized exchanges or on hardware wallets, billions of dollars wouldn’t have been lost. The non-custodial nature of decentralized exchanges means that funds are completely under your control, and no central authority like centralized exchanges can freeze or limit your access to them.

FTX went down, and billions of user funds were gone. That is not the case with decentralized exchanges. If a decentralized exchange goes down, your funds will be unaffected as you’ve retained possession of your coins and tokens.

Asides from decentralization, financial inclusion is one of the other reasons why many of us are in the crypto space. Due to increasing regulatory pressure, many centralized exchanges have begun restricting access to users in certain countries.

Decentralized exchanges provide a way for individuals in any location to trade cryptocurrencies. This is because, unlike their centralized counterparts, decentralized exchanges are not run by a central authority and are, therefore, not subject to the same regulation as centralized exchanges.

Privacy is another huge selling point for the cryptocurrency sector. By using more centralized entities, we are giving up the privacy aspect of the deal. Centralized exchanges are classed as money service providers (MSPs) in several countries. This means that customers are required to undergo know-your-customer (KYC) and anti-money laundering (AML) checks before they can carry out certain transactions.

Providing your personal information to third-party entities is risky because you have no control over what happens with your data. Also, you don’t know which authorities— domestic or foreign — gain insight into your information.

With decentralized exchanges, privacy is guaranteed. There are no registration requirements for using DEXs other than having a wallet address.

P2P-Powered DEXs Over AMM-Powered DEXs

While we promote the use of decentralized exchanges (DEXs), we particularly recommend the use of peer-to-peer decentralized exchanges.

AMM-powered DEXs have proven to be vulnerable to attacks. Over the past few months, we have seen numerous DEX attacks, and all have been AMM-powered DEXs.

In June, Maiar exchange, a DEX on the Elrond blockchain, suffered a hack that resulted in the attacker stealing $113 million from the platform. Uniswap, the leading DEX in the world, also suffered a Bugs and Re-entrancy attack in April 2020, losing $500k in the process. The Balancer automated market maker protocol also lost $500k in an attack in June 2020. The hack was facilitated by a dydx flash loan attack, and Balancer protocol lost $500,000 worth of ETH coins.

These DEXs use intermediary coins to process transactions, while some of them use liquidity providers (LPs). Although they are decentralized exchanges, they are still prone to attacks, similar to centralized exchanges. Hence, user funds are not completely safe on these platforms.

On the other hand, P2P-powered DEXs are more secure. Peer-to-peer is at the heart of cryptocurrency innovation, providing users with a higher level of security, privacy, and anonymity in transactions.

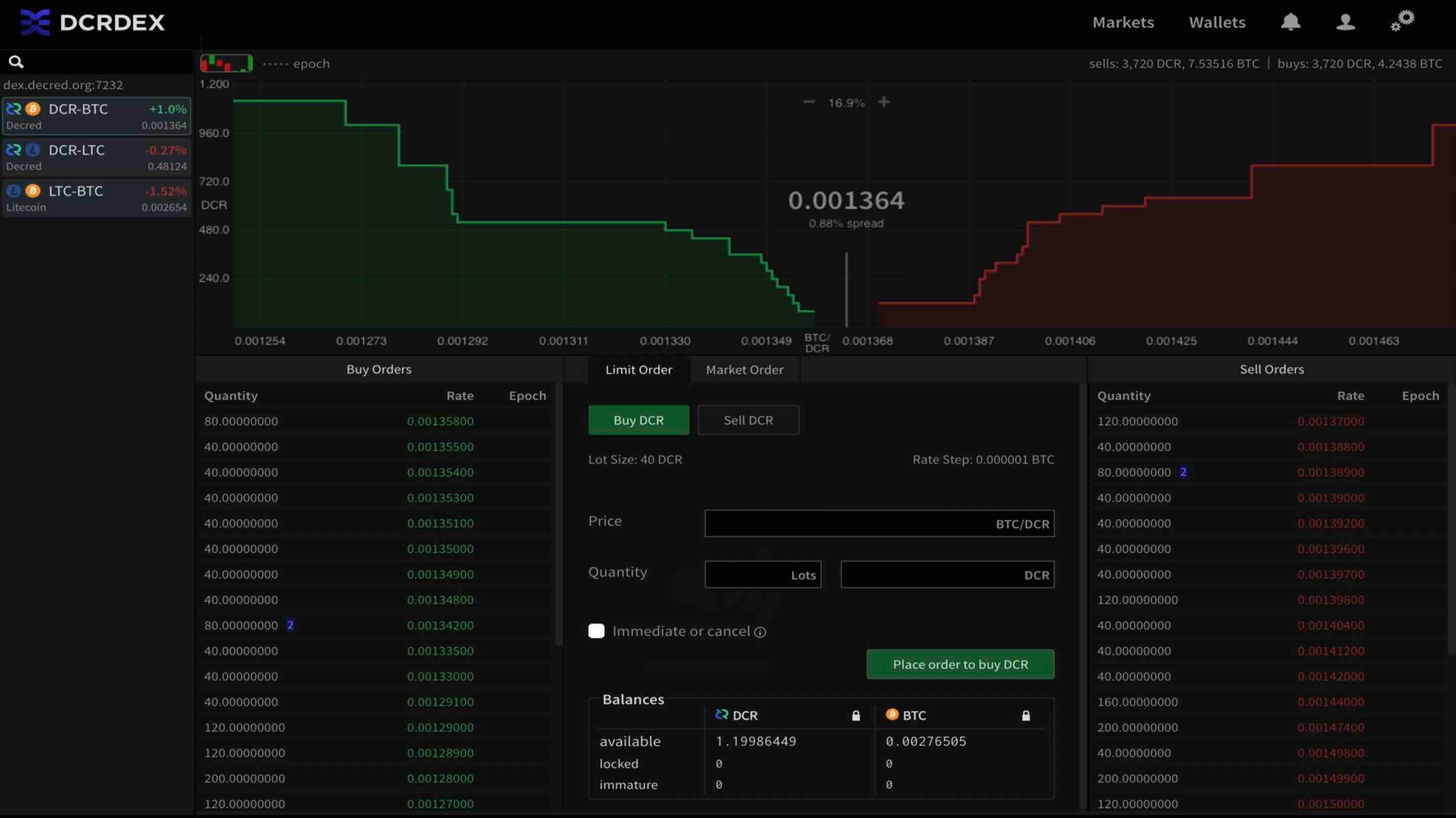

DCRDEX

An example of a P2P-powered DEX is DCRDEX. User funds are always safe on DCRDEX because server operators never take custody of client funds. Non-custodial exchange is accomplished using cross-chain atomic swaps.

“We’re holding true to the set of principles that matter the most to people who take cryptography and privacy seriously,” said Jonathan Chappelow, Lead Software Developer at Decred in a recent news release. “All trades settle directly on each asset’s decentralized network, without handing over custody of the funds to a third-party or collecting trading fees.”

These properties make DCRDEX much like a bulletin board where users trade with each other and less like a typical exchange where the exchange must take control of the funds.

The release of DCRDEX v0.5 in September included several new privacy capabilities including support for ZCash (ZEC), using zcashd. Users who are most serious about privacy can now use their ZEC full node wallet.

The latest Litecoin Core software (v0.21) is also supported, which includes private addresses (MWEB). DCRDEX now supports using mixed account configurations with Decred’s dcrwallet and Decrediton wallets, allowing Decred’s privacy features to be used automatically when trading.

DCRDEX is the only decentralized exchange of its kind, with no intermediary tokens, trading fees, escrow vaults controlled by third parties, or centralized wallet data services. Each trade is a direct peer-to-peer atomic swap, and every component is open source.

The exchange has no traditional gatekeepers. Any project can get its cryptocurrency supported by integrating it onto DCRDEX.

Decentralized exchanges are less risky for institutional investors

The advice to shift to decentralized exchanges is not limited to retail investors only. Companies and institutional investors also have to consider decentralized exchanges ahead of their centralized counterparts

Crypto services provider Matrixport revealed that some of its fixed-income offerings tied to bitcoin (BTC) had been affected by the recent collapse of FTX. The Ontario Teachers Pension Plan held around $95 million in FTX. These are just some of the few companies that were affected by FTX’s collapse.

As more institutional investors and companies enter the cryptocurrency market, the best course of action would be to use decentralized exchanges (especially P2P decentralized exchanges) and their services instead of investing their funds in centralized exchanges that have no guarantee of staying afloat.

Comments ()