How to safely store and backup your Decred - Q&A session

Crypto was built, so people could self custody their assets and not rely on third-party services, like banks, exchanges or brokers, to do it for them. This is sometimes referred to as “Being your own bank”.

LISTEN TO THE PODCAST:

In the crypto space, you’ll hear a lot about “not your keys, not your coins”. But what does this mean? And what is the safest way to store your Decred to prevent losing funds?

Choosing the correct wallet

For small holdings, wallets like the Trust wallet will do a good job of protecting your coins. But as your holdings increase, you’ll want to use a wallet that has higher levels of security. When it comes to self custody of your Decred, currently, there is no better option than Decrediton. However, for those searching for a mobile option, in the near future, CryptoPower could also be a good option.

Writing down your seed phrase

Both Decrediton and CryptoPower use the same seed phrase method. Which means you’ll be able to move your wallet between the two-platforms if needed. Although, it’s not recommended to run multiple versions of the same wallet. One area this could come in useful, is if you’re having unavoidable problems with one of the platforms. You’ll be able to easily move to the other without issue.

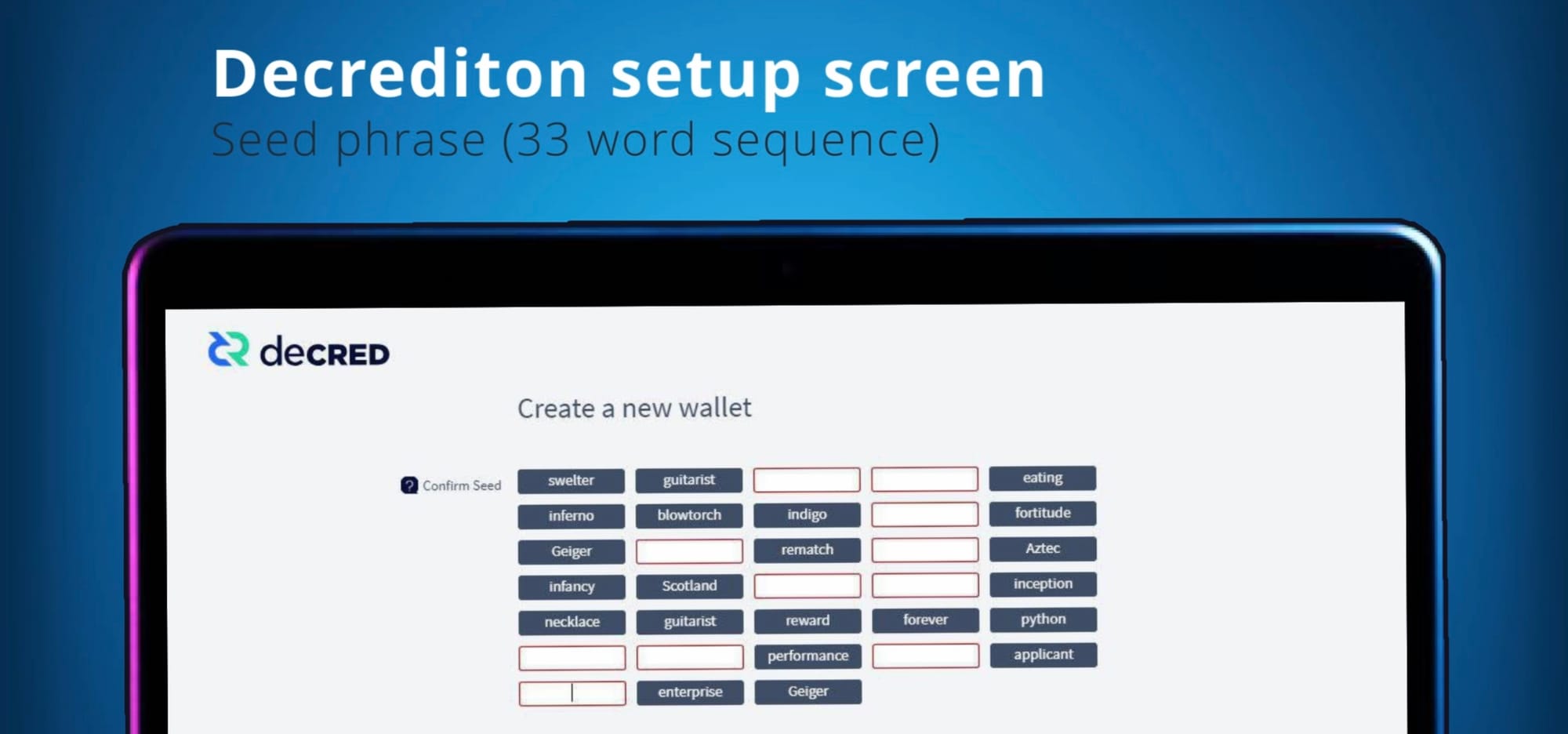

When first opening Decrediton, during the creation process, you’ll be presented with a 33 word sequence known as a seed phrase. Write this down, check to make sure it’s correct, and store in a safe place. Your seed phrase is the only way you’ll be able to restore your wallet if your device gets broken, lost or stolen.

An important note to make at this point is, only you have access to this seed phrase. No one at Decred can access it, and no one from the Decred team will ask for it. Backing up your wallet seed phrase and storing safely is your responsibility.

This seed phrase is essentially the private key. You will be able to use it to restore your wallet, private keys, transaction history, and balances. Without it, you will lose complete access to your wallet. Keep it safe and out of the hands of others.

As a final note, if warranted, you could take additional precautions with a steel backup, which essentially safeguards your seed phrase from being damaged or destroyed. For instance, in a fire or through shredding.

Digital seed phrase backups

Typically, it’s not a good idea to keep digital copies of your seed phrase. You should avoid storing in the cloud or in a password protector. In the past, these methods have proven to be insufficient at protecting seed phrases.

You should also avoid taking screenshots of your seed phrase. Generally speaking, storing seed phrases digitally can open your wallet up to a multitude of attacks.

As a rule of thumb, “write down on paper and keep it safe”.

Hardware wallets

Some people like hardware wallets, as they’re dedicated devices, not used for any other purpose than storing crypto. These can indeed be good and do offer an extremely high level of security. These devices still require the need to manually back up a seed phrase. Some even offer seed phrase services, which are custodial backups.

Personally, I prefer a dedicated computer that is only used for storing crypto and has no other software or hardware usage.

Self custody or custodial services?

Crypto was built, so people could self custody their assets and not rely on third-party services, like banks, exchanges or brokers, to do it for them. This is sometimes referred to as “Being your own bank”. Over the years, custodial services like banks, pension funds, insurance services and other financial institutions haven’t always acted in the best interests of their customers.

There have been many instances where customers, for one reason or another, have been prevented from accessing their funds or, in the worst-case scenario, funds have been permanently lost or confiscated.

To self custody your crypto assets, means you are in complete control, and are no longer reliant on others. There are no rules that prevent you from spending, swapping or moving your assets as you see fit. The responsibility for safeguarding your assets is yours and yours alone.

Comments ()