The dynamic nature of the crypto market, shaped by influential figures such as Elon Musk, has led to the emergence of numerous memecoins. approach them with caution!

Elon Musk, owner of X, formerly known as Twitter, criticized the brands that chose to stop advertising on the platform after posts on his profile were deemed anti-Semitic. The comment was made during an interview at The New York Times' DealBook Summit last Wednesday, the 29th. The speech drew a lot of media attention, even impacting the cryptocurrency market, just like many other Musk speeches.

Musk spoke to interviewer Andrew Ross Sorkin about the possibility of being blackmailed with ads and money by the brands. "Don't advertise," he said. Following that, he used profanity against advertisers, saying, "Go f*** yourselves," which he repeated twice. "That's how I feel about the ads."

The Elon Musk statement that gave origin to the GFY token

It's not a novelty that Elon Musk's speeches/tweets have a lot of impact on the Crypto community. But is his influence getting out of control? The billionaire's statement triggered the creation of hundreds of new meme tokens, some reaching market capitalizations exceeding 20 million dollars.

The token "GFY," an abbreviation for "Go f*ck yourself," led the movement. It was launched shortly after Musk directed controversial words towards advertisers. Since Musk made the statement, more than 300 GFY tokens have been created on various networks, including Ethereum and BNB Chain. Is the creation of those coins good for the market? Or are they just an attempt to win easy money?

On one hand, memecoins can bring humor and lightheartedness into the crypto community, attracting new people and fostering engagement. In a previous article about the PEPE memecoin, I wrote that if a coin like DOGE has a U$10 billion market cap value it's because a lot of people have a perception of value over it.

Yet, on the other hand, the fast creation of these coins, many times without any underlying utility, technology, or value proposition, raises flags about their speculative nature. While these coins often gain popularity rapidly due to social media hype or online communities, investors should be mindful of risks involving memecoins. Priority should always be given to projects that have a respected community with ideas and a solid foundation. Here are some of the key reasons why:

1)Fundamental value

Researching and analyzing projects before investment is essential to find out the presence of clear use cases, underlying technology, and tangible goals. The value of serious projects is derived from their practical applications within the cryptocurrency space. The technological foundation of a project enhances its prospects for long-term sustainability, distinguishing it from meme coins driven primarily by hype.

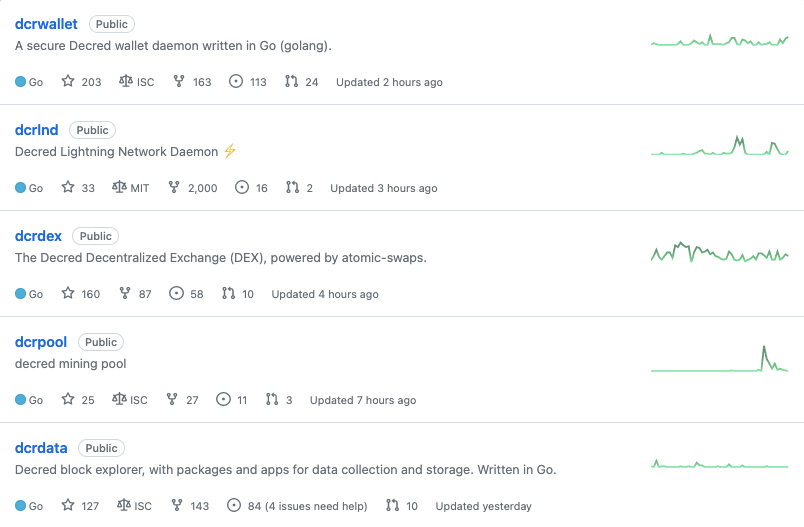

Decred is a great example of a project that created its value by building a complex blockchain, with many different applications, such as DCRDEX, a decentralized exchange; Politeia, the project's governance platform; and timestamply, a tool to facilitate proof-of-existence.

2)Educational Value

Investing in solid projects such as Decred, Firo, and Polygon provides an opportunity to learn about blockchain technology. These projects offer extensive documentation and media resources, including YouTube videos, explaining their mechanisms and objectives. Acquiring this knowledge enhances one's ability to make well-informed investment decisions.

While memecoins may capture attention due to their viral nature and potential for quick gain, they are not known for their compromise with investors education. Of course there are some exceptions, like DOGE, that nowadays have an extensive documentation in its website explaining details and technology of the network.

3)Continuous improvement

Innovation and development are two factors used to distinguish good projects within the cryptocurrency space. These projects are often supported by dedicated teams of experienced developers and communicators, committed to advancing technology and addressing real-world challenges. The continuous work of innovation contributes to the project's longevity and relevance in a never-stopping landscape.

The crypto market is dynamic, and viable projects understand the importance of staying ahead of the curve. Development teams need to monitor market demands, introducing updates and features that align with the industry revolution.

Moving Foward

The dynamic nature of the crypto market, shaped by influential figures such as Elon Musk, has led to the emergence of numerous memecoins. Although memecoins contribute humor and quickly build a sense of community, it is crucial to approach them with caution. The speculative and often unpredictable nature of memecoins requires investors to exercise prudence in their engagement with these assets.

While these tokens may offer swift community growth and entertainment value, their inherent risk factors, include extreme price volatility and limited utility. Investors should prioritize a careful analysis of the fundamentals, community dynamics, and potential long-term viability of memecoins before considering them as part of their investment portfolio. This approach helps build a more informed and strategic approach in the crypto landscape.

Comments ()