Institutional investors are embracing crypto/digital assets while maintaining moderate optimism.

The last two years have been hard for the crypto market. Investors have been on a constant rollercoaster ride that mostly ended in a value decrease for various coins. It's been a period marked by regulatory scrutiny, and bloody crashes, like the FTX one. Yet, amidst all the chaos the adoption of cryptoactives is still growing.

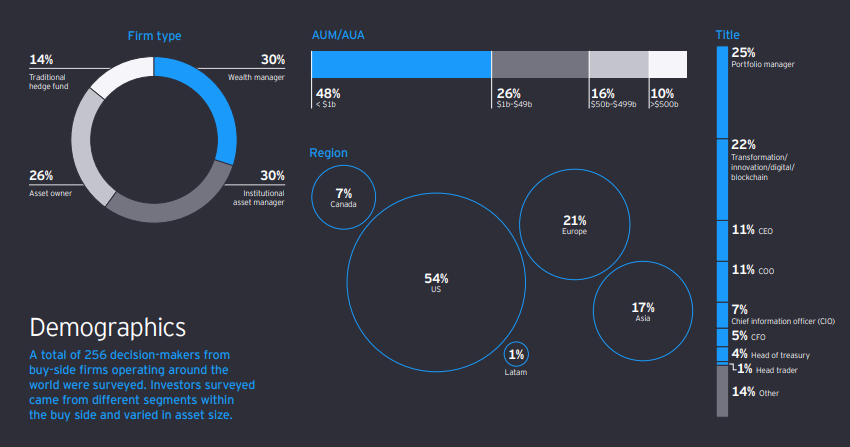

Currently, it is estimated that 10.2% of the world's population owns digital assets. Many were attracted by the price surges, entering the market in 2020 and 2021 and staying with this asset class, despite the declines, demonstrating optimism in these markets. Institutional investors, including large ones, are also increasing their allocations. A new study by EY-Partheon showed how more than 250 institutions work/think when the subject is cryptocurrencies.

Institutional investors are embracing crypto/digital assets while maintaining moderate optimism. That's because a considerable portion of these institutions believe in the long-term benefits of digital cryptographic assets.

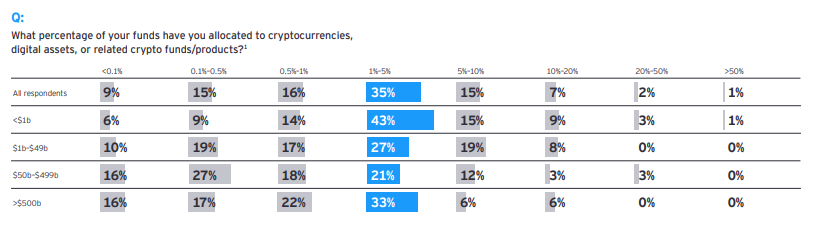

According to the study, institutions see value in diversifying assets. For instance, 35% of the respondents allocate between 1% to 5% in digital assets or related products. As for those respondents assigning more than 1% of their portfolio, the number goes up to 60%.

Respondents with smaller amounts of money to manage tended to put a bigger part of their investments into these products. But what's interesting is that 45% of institutions with over $500 billion in assets said they invest more than 1% of their total portfolio in these assets. This shows that a substantial amount of traditional institutional money is going into this space. The most popular investment among institutions is spot cryptocurrency, with Bitcoin (BTC) and Ethereum (ETH) being the most commonly chosen options. Notably, it's worth mentioning that 60% of institutions currently invested in spot crypto are also diversifying their investments beyond BTC and ETH. Looking ahead, institutions plan to allocate more funds to various vehicles, with a particular focus on crypto-tracking funds, in addition to spot cryptocurrency.

While some institutional investors are cautious with their digital asset investments, overall, investors are quite optimistic about the future of blockchain and digital assets. They see them as a way to diversify their portfolios and as having growth potential.

In 2022, 25% of investors increased their holdings, while 49% kept their holdings the same. In 2023, 38% of respondents plan to increase their holdings, while 52% expect to maintain their current holdings. Looking ahead, in two to three years (2024-25), 69% of investors anticipate increasing their holdings in digital assets and related products, with 24% expecting to keep their holdings unchanged.

How to invest in crypto

After a year of big losses, it finally seems that the crypto market is stabilizing. Investing in crypto can be exciting but scary sometimes, especially for newcomers. Finding trustworthy information sources and projects is a crucial step. Cypherpunktimes is a website powered by Decred that offers weekly articles about the market, coins, news, and new technology. Here you can find a lot of good content to keep you informed to go through this possible new good phase of the market.

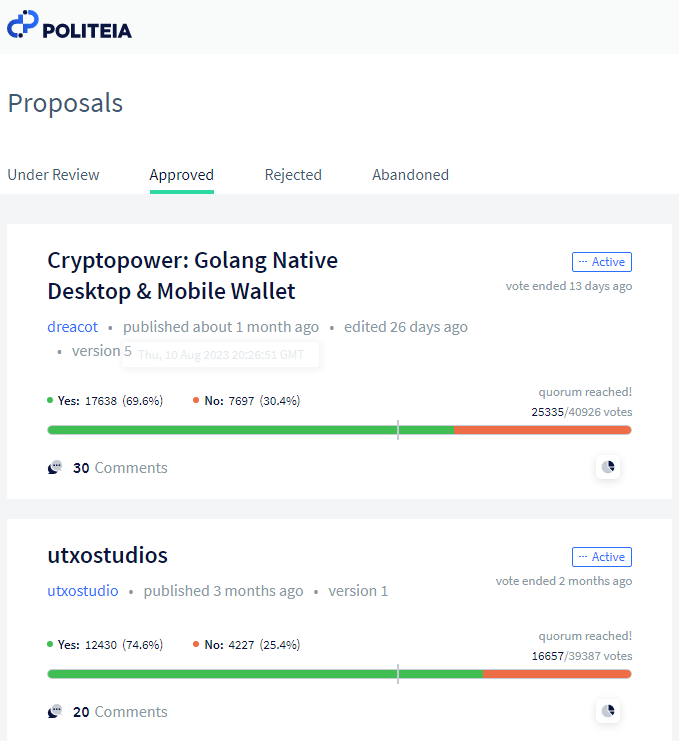

Search for cryptocurrencies that have real-world use cases and useful applications. Decred for example has Timestamply, a tool that allows you to create a Proof-of-Existence for a file, and has been used by the Brazilian president. The project also counts on Politeia, a platform that proposes a new form of decentralized democracy.

Even with the optimism of big investors in the long term you have to be well informed about the project you invest in. Avoid making impulsive decisions based on short-term price fluctuations, and head for projects that present solutions.

Which projects do you find to be promising? Leave a comment with your favorite!

Comments ()