Stablecoins on Decred

For many people in our community and the wider crypto space, stablecoins are the holy grain. Stablecoins are the one tool that could connect this space to traditional finance and a broader array of merchants. To this point, we’ve seen the worst of stablecoins! Centralised, high fees, not-stablecoins that unpeg from their assets. And finally, my favourite, stablecoins that outright implode into a death spiral, taking down a massive subset of the industry.

Another thing to consider, that most overlook, is they tend to add a lot of worthless bloat to a network. My thoughts are, they would be better suited as either a separate chain or as part of a layer 2 solution that’s opt-in rather than forced on. Decred could defiantly facilitate this functionality on its Lightning Network.

To date, there have been no truly decentralised stablecoins, with low fees, that have stayed pegged to their asset and haven’t bloated the network they’re attached to. Is a decentralised, peer to peer stablecoin even a possibility?

On the latest episode of ‘Decred and the state of the market’, it was suggested that a few years ago, possibly 2018, a pseudonymous developed published a paper on how Decred might achieve stablecoins as part of its protocol. In the same crypto-punk behaviour demonstrated by Satoshi himself, the developer disappeared shortly after taking with them their expressed blueprint. Fortunately for us, @Tivra, had downloaded a copy of this document and has maintained it for us to read and discuss today.

Although algorithmic stablecoins are nothing new to this space. A Decred specific implementation should get the mind racing with possibilities. After reading, don’t forget to leave your thoughts and comments. Is this something you’d like to see on the Decred network?

(Please note calculations read better from the attached .pdf)

Stablecoins: an Outline

I. Stablecoin Objectives

- Convertibility

The SBC can be exchanged for an alternative liquid asset of equivalent value at any time. Likewise, the alternative asset can be exchanged for SBC of equivalent value at any time. - Parity

The SBC maintains a fixed price in terms of a real world asset. - Stability

Market participants expect the SBC to maintain its current parity and convertibility properties in future periods with extremely high probability. - Decentralization

An absence of barriers to participation in SBC use and governance and the absence of external dependencies on centralized systems.

5. Transparency

- Real-time public reporting at all stages of the governance process

- Delays between proposal, finalization, and execution steps in this process.

II. Proposed Approach to Stablecoins

The most efficient means of achieving these objectives is by managing debt issuance and redemption at the protocol level within an existing PoS cryptocurrency. The protocol would allow for creation of new units of cryptocurrency and new units of SBC to take place as needed to support issuance and redemption. Stakeholders in this cryptocurrency supply price information to the protocol through a PoS mining process. Based on this price information, the protocol would execute forwards and backwards conversions between the two currencies on demand and imposes a variable interest rate on SBC holdings.

The intuition for these systems is as follows. PoS cryptocurrencies are a form of equity analogous to shares in publically traded corporations. Corporations sell convertible USD bonds that are backed by the following conversion right: The company is obligated to exchange bonds for freshly-issued shares whenever a convertible bondholder demands it. Likewise, a PoS cryptocurrency protocol could sell convertible SBC such that the protocol is obligated to exchange SBC for cryptocurrency units of equivalent value whenever a SBC holder demands it. This conversion right places a floor on the market price of circulating SBC. To create a price ceiling, the protocol could allow conversion of cryptocurrency units into SBC of equivalent market value as well. With backwards and forwards convertibility in place, the protocol can peg the SBC’s price to that of any real world asset using a price feed.

III. Management of Equity Dilution Risk

Cryptocurrency holders assume additional price volatility risks in order to insure SBC holders against price fluctuations. Following a downward price movement, new cryptocurrency equity is minted and sold off to withdraw outstanding SBC from the market. This dilutes existing holdings placing additional downward pressure on the cryptocurrency’s price. Following an upward price movement, new SBC are minted and sold off to withdraw outstanding cryptocurrency equity from the market. This concentrates existing holdings placing additional upward pressure on the cryptocurrency’s price.

Let’s examine how volatility risks relate to the amount of leverage in the system, defined as the ratio of value held in SBC debt to the cryptocurrency’s current market capitalization. Let μ𝑡 and μ𝑡+1 denote this ratio during the periods 𝑡 and 𝑡 + 1, respectively. Furthermore, let 𝛥%𝑀𝑡+1 denote the percent change in the cryptocurrency’s market capitalization between periods 𝑡 and 𝑡 + 1 and let 𝛥%𝑝𝑡+1 denote the concurrent percent change in cryptocurrency’s unit price. I assume that new units of cryptocurrency and SBC are issued and retired as necessary to maintain a constant level of leverage in the system, μ𝑡 = μ𝑡+1. The amplification of price volatility can then be expressed as shown in Equation (1).

𝛥%𝑝𝑡+1 = (1 + μ𝑡)𝛥%𝑀𝑡+1

Equation (1) tells us that price volatility is amplified by a percentage μ𝑡.

This should be acceptable to shareholders if μ𝑡 is kept small, say 0 < μ𝑡 < 0.2. To address this problem, it is necessary to have a mechanism that incentivizes shareholding and debt to equity conversions when μ𝑡 is high.

A fixed exchange rate system of this type is also vulnerable to a type of flash crash, where price collapses absent any change in economic fundamentals. To understand this, note that a transient drop in market capitalization can result in a permanent dilution of shareholder equity and thus a permanent decrease in the share price. As a result, if a whale converts massive amounts of currency holdings into bonds, it can be rational for other shareholders to follow suit. The whale profits if he is successful in provoking this response, since the price of SBC is likely to spike as shareholders buy in. To bound this behavior, it is necessary to place a ceiling on the leverage ratio, denoted μ𝑚𝑎𝑥, such that any SBC liabilities exceeding this amount are immediately repudiated. This limits shareholders expected loss in a future equity dilution to

μ𝑚𝑎𝑥 . Accordingly, any discount in current share prices precipitated by manipulation like this 1+μ𝑚𝑎𝑥

cannot exceed μ𝑚𝑎𝑥 . 1+μ𝑚𝑎𝑥

To implement this, I propose that the system target a fixed long-term ratio of debt to equity, μ̌, and specify a debt ceiling, μ𝑚𝑎𝑥 > μ̌. To enforce these parameters, the system imposes a negative interest rate on SBC holdings whenever leverage exceeds the targeted amount. Let 𝑟𝑡(μ𝑡) denote an interest function that is strictly decreasing in the current debt level, μ𝑡, equal to 0 at the debt target, 𝑟𝑡(μ̌) = 0, and which diverges to −∞ as the debt ceiling is approached

lim 𝑟𝑡(μ𝑡) = −∞. μ𝑡 →μ𝑚𝑎𝑥

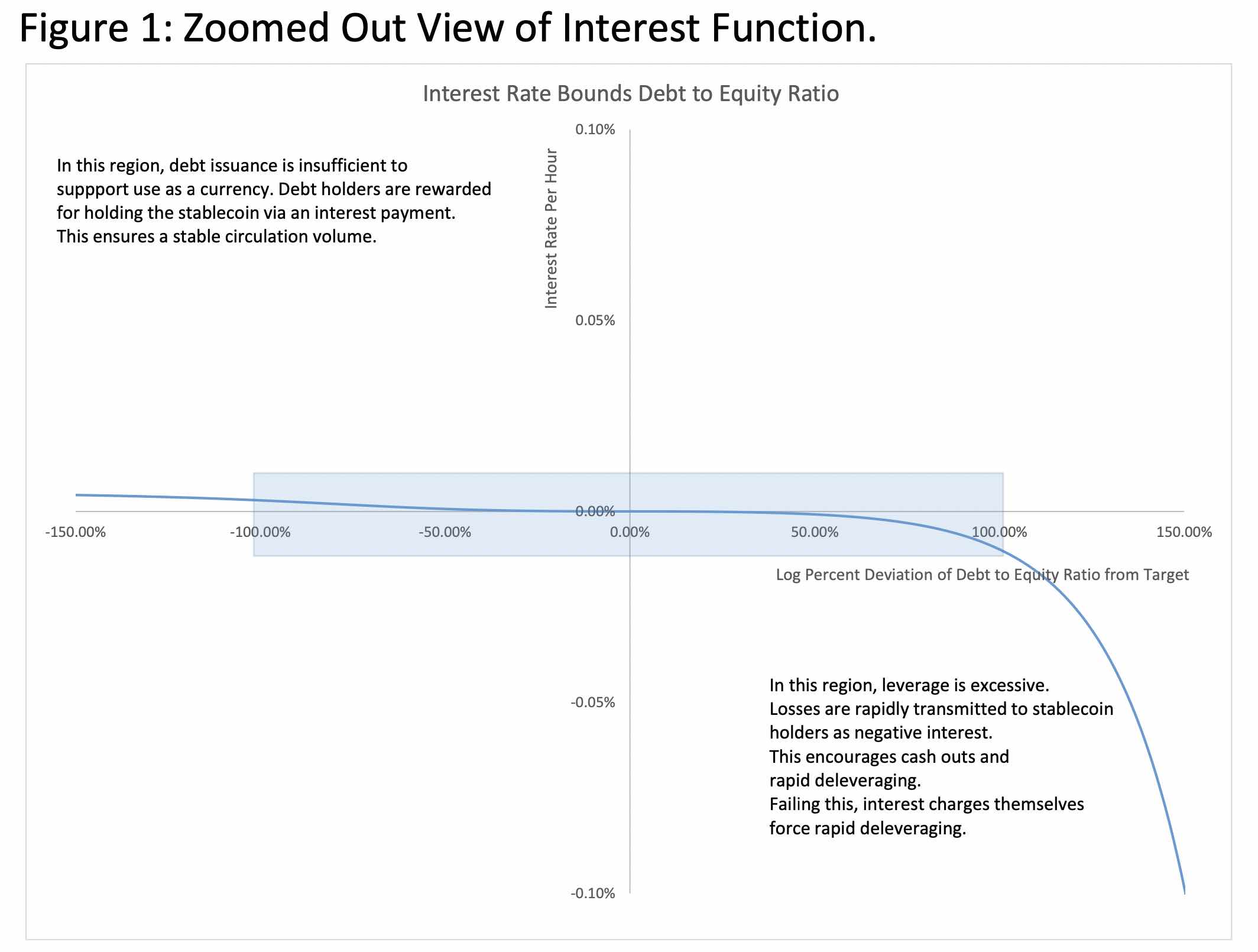

An example of a possible interest function is shown in Figure 1.

Note that as debt grows well beyond the target ratio, interest charges Increase exponentially. This ensures that debt levels are stable and fluctuate only within the blue shaded region under normal circumstances.

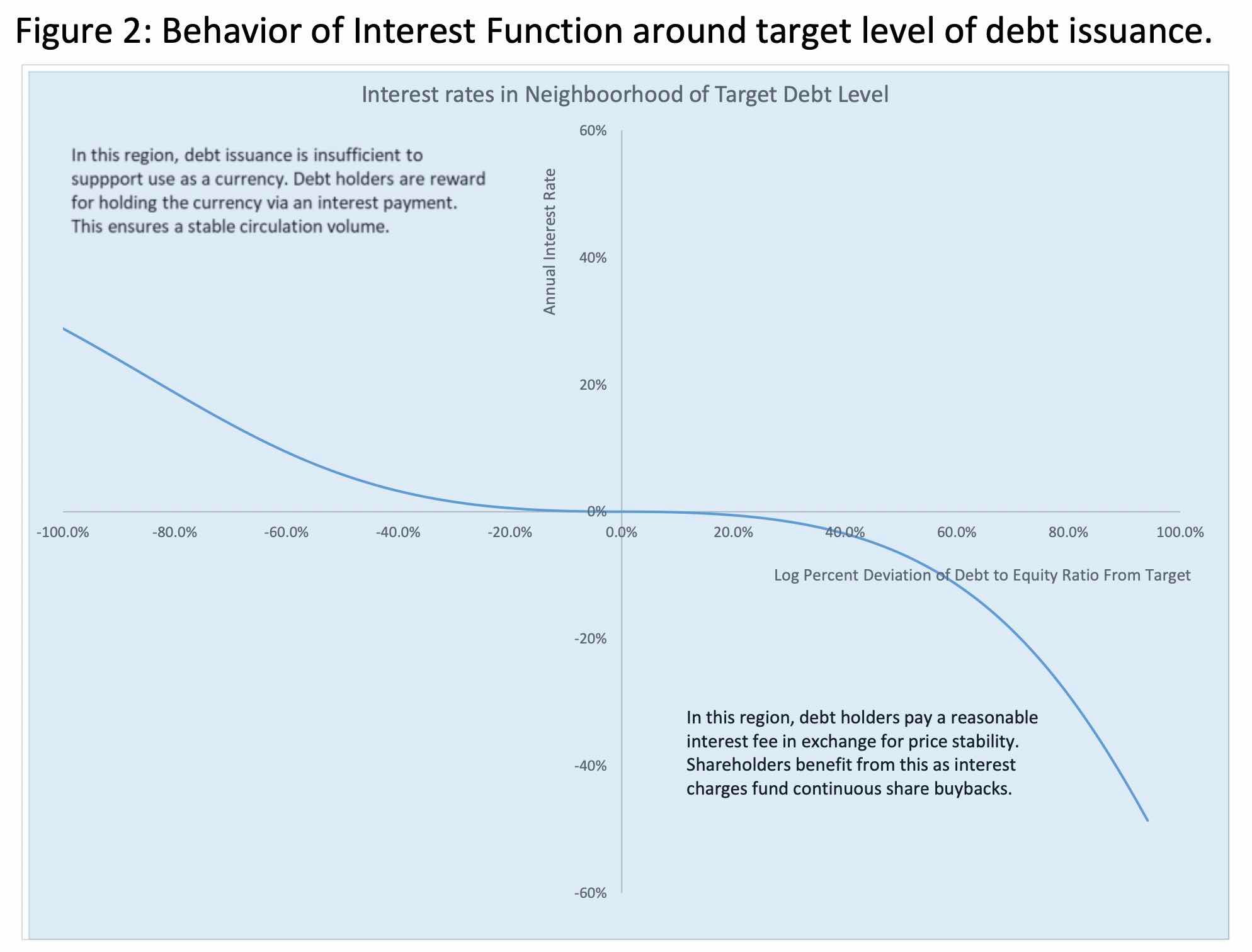

A closer look at behavior of the function near the target range is shown in Figure 2.

Negligible interest is charged as long as debt levels remain close to the target.

If user demand for SBC is extremely sensitive to interest rates, then the actual

Interest rates charged would also remain near 0 in practice. I expect that users will be willing to hold SBC despite a modest expected txn fee. This fee is the basis for charging interest on SBC holdings.

In this case, interest charges generate a small income stream for shareholders.

Income generated in this way is distributed through continuous repurchasing of shares. This process is implicit in the protocol.

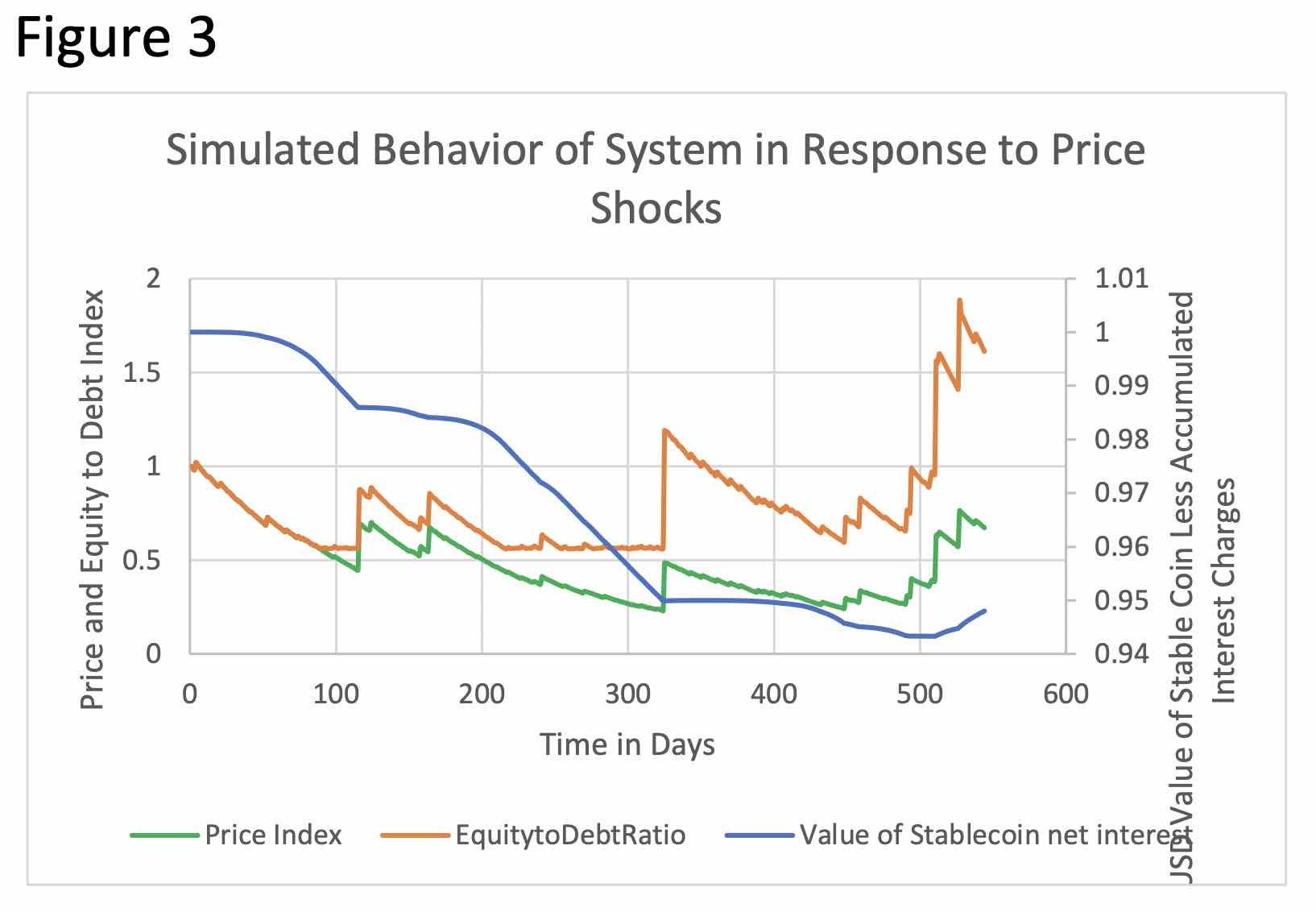

In Figure 3, I simulate behavior of the system using this interest function.

To perform the simulation, I set the initial price to 1 and draw a series of log normal random price shocks. I make an assumption that users respond to excessive interest charges by reducing SBC holdings. Specifically, if the system charges interest fees in exceeding 10% per annum, then demand for SBC holders decreases by 1% per day as users remove funds from the system. If the system pays out interest fees exceeding 10% per annum, then demand for SBC holders increases by 1% per day as users add funds to the system.

In Figure 3, the blue line shows the value of 1 SBC held for a period of 550 days. Throughout this period, the SBC remains pegged to $1.

However, the user accumulates interest charges for as long as he holds the SBC and these are charged as a txn fee. Accordingly after 550 days, the SBC

has accumulated about $0.05 in interest charges and has about $0.95

of transmittable value remaining.

Interest rates depend on price movements of the share currency.

Here, the price falls from a high of $1 on day 0 to a low of $0.25 on day 300.

On a day to day basis, movements in the equity to debt ratio mirror

changes in equity prices, so that leverage increases. Over the medium-term, however, users respond to interest charges by selling off SBC, so that the equity to debt ratio trends towards the target at all times.

IV. Review of How System Accomplishes Stablecoin Objectives + some extra details.

- Convertibility

Units of cryptocurrency sent to the protocol are converted into units of SBC at the exchange rate specified by the price feed. Likewise, units of SBC sent to the protocol are converted back into units of cryptocurrency. Conversion orders immediately stop the accumulation of any interest charges. However, to limit exploitation of errors in the price feed, the execution of conversion orders must be delayed for several hours after these txns first appear in the blockchain and must be based on the median of price reported during this interval. - Parity

Since the cryptocurrency and SBC are freely convertible, the USD price of the SBC token on external markets would remain fixed at 1 USD under all circumstances. If not, it would be possible to arbitrage price differences between SBC and USD on external markets. - Stability

The system remains stable provided that the ratio of value held in SBC debt to value held in cryptocurrency remains small [e.g. does not exceed a debt ceiling of say 20%]. To discourage excess debt issuance, the protocol imposes a negative interest rate on SBC holdings when the ratio of debt to equity in the system exceeds a targeted amount, say 5%. As the ratio of debt to equity grows beyond this point, this negative interest rate ‘increases’ exponentially. Effectively, debt accumulated in excess of the ceiling is instantly repudiated through interest charges, so that it is not possible for debt to grow to levels in excess of the system’s capacity. - Decentralization

The system is administered by the protocol itself and does not require human input aside from the price feed supplied by PoS miners. Accordingly, if the PoS mining process is decentralized, then the SBC protocol is decentralized as well. - Transparency

The system is administered by the protocol itself. Absent any bugs in implementation, this ensures transparency in daily operations. Human input is necessary to define the initial interest rate schedule and the delay between the finalization and execution of conversion orders. Changes to these parameters should occur through a multi-step PoS-based governance process. Market participants should always be allowed sufficient time to execute conversions before proposed changes are implemented.

Comments ()