The FIT21 bill aims to establish a regulatory framework for digital assets as a consumer protection measure. It also seeks to prevent regulators like the SEC and the Commodity Futures Trading Commission (CFTC) from persecuting cryptocurrency entrepreneurs due to unclear rules.

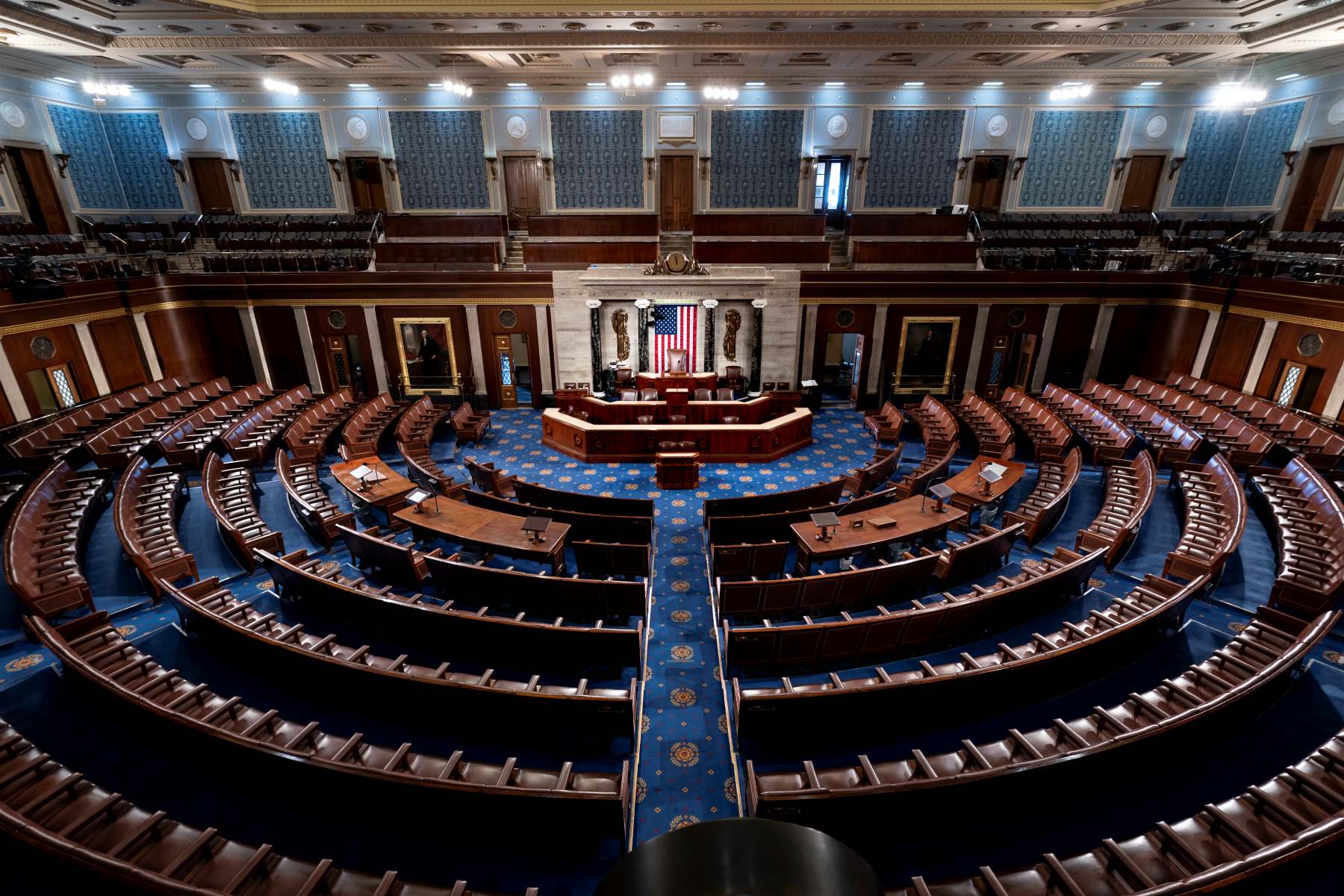

The FIT21 bill, formally known as the Financial Innovation and Technology for the 21st Century Act, was recently approved by the U.S. House of Representatives on the 22nd of this month. It still needs Senate approval to take effect. This first-moment approval may be considered a significant milestone in the market as it is the only crypto regulation project developed with the support of both Republicans and Democrats. This is predominantly positive from the industry’s perspective, which has been waiting for legislation to clarify the digital asset's situation.

"FIT 21 alleviates this concern by leveraging the existing capabilities at the Securities Exchange Commission and the Commodity Futures Trading Commission... I’m proud to say that this bill is the product of countless bipartisan discussions between Members of the House Financial Services and Ag Committees. "

- Congressman French Hill, Chairman of the Subcommittee on Digital Assets, Financial Technology and Inclusion.

The FIT21 bill aims to establish a regulatory framework for digital assets as a consumer protection measure. It also seeks to prevent regulators like the SEC and the Commodity Futures Trading Commission (CFTC) from persecuting cryptocurrency entrepreneurs due to unclear rules.

Some innovations presented by the bill will introduce a "decentralization test" to determine whether a cryptocurrency is considered a security or a commodity. The SEC will regulate digital asset securities, while the CFTC will regulate commodities.

What could these potential changes mean for the crypto market? Will they increase investor confidence and security? Or will they centralize more of the crypto market into the hands of centralized finance, potentially favoring big firms? These are some of the questions that we will explore in this article.

Understanding the FIT21 bill

The Act includes detailed provisions for defining digital assets, registration requirements, operational standards, consumer protection measures, and ongoing studies and rulemaking mandates to adapt to the evolving digital asset landscape. Let's go through some of its essential points.

Definitions: FIT21 establishes definitions for some key terms of the market

A) Digital Asset: Considered a fungible digital representation of value. It can be transferred between individuals without an intermediary. Those are recorded on a blockchain.

Exclusions: Traditional securities like notes, stocks, treasury stocks, bonds, etc. Contracts of sale of commodities for future delivery or options on such contracts. Security futures products, swaps, specific commodities options, and leverage transactions

B) Digital Commodity

A digital commodity, according to the bill, refers to a unit of a digital asset that i) Is held by a person other than the digital asset issuer, a related person, or an affiliated person; ii)The blockchain system to which the digital asset relates is a functional and certified decentralized system; iii) It was issued through an end-user distribution or acquired through a transaction executed on a digital commodity exchange.

A digital commodity refers to any unit of a digital asset held by a person other than the issuer, related person, or affiliated person under conditions where the blockchain system is operational and validated as decentralized.

Exclusion: The term "digital commodity" does not include permitted payment stablecoins.

C) Blockchain

For the bill, blockchain is a type of technology characterized by:

Public Ledger: Data shared across a network creating a public ledger of verified transactions or information among network participants. Cryptographic Links: Data is encrypted to ensure the integrity of the ledger. Distributed Updates: The ledger is distributed among network participants, who update it automatically simultaneously. Public Source Code: The source code for the blockchain must be publicly available.

D) Digital Security

A digital asset is considered a security if it is part of an investment contract or associated with a functional but not decentralized blockchain.

Securities are subject to SEC regulations if they meet criteria such as: Lack of decentralization, meaning a single entity has significant control. It is being marketed as an investment. Involvement in transactions that are considered securities offerings. Exceptions: Certain digital assets can be exempt from being classified as securities if they limit annual sales, restrict non-accredited investor access, and meet specific disclosure and compliance requirements.

The decentralization test

The FIT21 introduces a decentralization test to figure out if a digital asset (like a crypto), should be treated as a security or as a commodity. The test measures the control a single group has over the digital asset and the blockchain system it operates on.

Digital commodities are regulated by the Commodity Futures Trading Commission (CFTC) and are typically decentralized, with no single entity controlling the network. FIT21 suggests trading them on exchanges like traditional commodities (gold, oil) with regulations in place to ensure fair trading practices.

Digital securities are regulated by the Securities and Exchange Commission (SEC). They are often associated with investment opportunities where investors expect profits from the efforts of a central entity, similar to stocks. Digital securities issuers must register with the SEC, providing detailed disclosures about risks and financial conditions.

Here’s a breakdown of the network factors analyzed by the decentralization test

- Control and Power

No single Controller: To be considered decentralized, no person or group should be able to make significant changes to the blockchain or how it operates. This concept is mainly adopted by most of the blockchain projects. This also applies to code changes; these must be made to fix bugs, improve security, or other necessary maintenance that the majority of users agreed on.

- Ownership and Voting

No single person or group should own 20% or more of the digital assets available. This ensures that an asset is well distributed and not in the hands of a few individuals. The rule also applies to voting power; no individual should have the power to control 20% or more of the voting decisions on the blockchain operation/funding.

- marketing and Investment

The creators of the digital asses shouldn't advertise it as an investment opportunity in the last three months. Investors must not be promoted like a stock or any other investment.

- End User Distributions

The network's digital assets should have been distributed fairly and broadly in the past twelve months, especially as rewards for helping the blockchain. This means distribution to encourage participation in the network.

What would be Decred considered?

Due to its decentralized, public, and transparent blockchain, Decred would likely be classified as a commodity. Politeia's self-governance process, which is united with the project's new paradigm of work, in which users are rewarded for contributing to the network, aligns with the FIT21 characteristics of a commodity. As such, Decred would be regulated under the CFTC.

And why does this matter?

2023 was a year marked by the regulatory siege against crypto in the United States. The SEC initiated several legal actions against major industry players like Coinbase and Binance. The role of the SEC in regulation has stirred controversy, as the absence of clear rules often results in regulatory actions through enforcement.

Cryptos being treated as commodities can be a good thing since it provides more predictable regulatory oversight. The CFTC regulatory framework focuses on ensuring transparent trading practices without the strict compliance requirements of securities. The enhanced regulation trustworthiness can attract more investors, who won't be afraid of the SEC's coercive and arbitrary actions.

Who is supporting this bill?

A letter of support to the FIT 21 has been sent to the House of Representatives. In this letter, organizations encourage the regulation of Digital Assets. Asserting that FIT 21 has essential consumer protection risk-reducing initiatives and that it will update U.S. legislation on the topic:

"Currently, the U.S. lags behind other major jurisdictions in developing a regulatory framework for digital assets. Major economies like the European Union, United Kingdom, Singapore, Japan, South Korea, the UAE, Brazil, and Australia have made significant progress. Without Congressional action to pass effective rules, American innovators will continue to migrate offshore."

Here are some organizations/companies that signed the project:

Organizations:

- Crypto Council for Innovation

- Chamber of Progress Consumer Technology Association

- The Digital Chamber

- Proof of Stake Alliance

- Stand With Crypto

Companies and Ventures:

- Andreessen Horowitz

- Block Circle

- Coinbase Digital

- Currency Group

- Gemini

- Kraken

- Marathon

- Digital Holdings

- OpenSea

- Paxos

- Stellar Development Foundation

Do they represent the whole crypto market?

Those organizations and companies are indeed crucial to the crypto industry. They are responsible for influencing a large number of investors and moving millions in crypto every day. Even with this big slice of the industry, they are primarily exchanges and ventures, also considered intermediaries.

Of course, the market wouldn't be so big without these organizations; a lot of the merit for reaching regular investors can be given to these initiatives. But in the end, the crypto projects are the ones for creating value and products worth using. The FIT 21 regulation can be good in many security aspects, but the opinions of developers and crypto projects should also be listened to. The safety regulations for investing in crypto shouldn't be formulated only by those trading large quantities but also by the people building them, creating innovation with their work; it would be interesting to see members from important crypto communities signing collective letters with their takes on the FIT 21 bill.

In the end, crypto projects will be bigger than exchanges or ventures. They are incentivizing self-custodial use of crypto and privacy enhancements, developing technologies that try to overcome the traditional financial system. Do you agree with cryptos being classified as commodities? Will this open more space for innovation and investment safety? Leave a comment below!

Comments ()