What is going on with Ethereum?

One year after its historic transition to a proof-of-stake-based consensus model. How is the mechanism holding up?

Ether (ETH) is ceding ground to the market leader Bitcoin (BTC), with investors seeking refuge in the more widely held digital asset as the recent cryptocurrency price drop deepens. The second-largest digital currency by market value has fallen about 18% since June, while Bitcoin has retreated by roughly half during the same period.

The decline in Ether has contributed to reducing the digital currency's share in the total cryptocurrency market capitalization of $1 trillion from 18.4% at the beginning of the year to the current 17.8%. Meanwhile, Bitcoin's dominance has increased from 40% to 50.3%.

Once the most promising crypto network, which had magical years for its investors in 2017, 2020, and 2021, Ethereum is now going through rough times. A recent JPMorgan report has pointed out an increase in centralization within the Ethereum network following the Merge update and Shanghai merger earlier this year. The report, released on Friday, also noted a decrease in staking returns, dropping from 7.3% before the Shanghai upgrade to around 5.5%.

One year after its historic transition to a proof-of-stake-based consensus model, Ethereum has seen a huge reduction in energy usage and a marked improvement in network access; however, several technical obstacles still lie ahead in the future of the network.

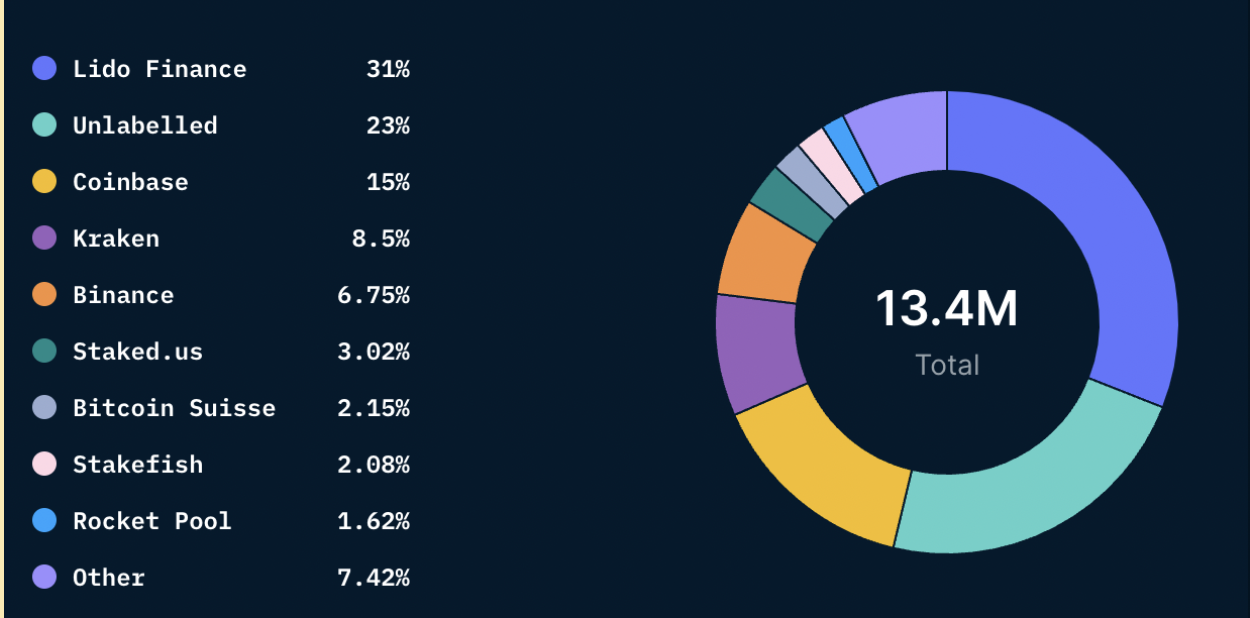

The report identified five major players - Lido, Coinbase, Figment, Binance, and Kraken - as having control over more than half of Ethereum's staking. Of these, Lido's influence is particularly noteworthy, as it oversees nearly one-third of the total staked Ether. This amplifies the issue of centralization in the Ethereum network, which poses a risk due to the concentration of liquidity providers and node operators.

Centralization by any entity or protocol introduces vulnerabilities to Ethereum, as a concentrated group of liquidity providers or node operators might serve as a potential weak link or be susceptible to attacks. They could even collaborate to establish an oligopoly that prioritizes their interests over the broader community's interests. When a crypto project becomes centralized, it concentrates governance, authority, and rewards in the hands of a few.

The most worrying issue with centralization is the creation of a single point of failure. In the case of Ethereum it means that if one of the central entities like Lido, Coinbase, or Binance experiences any technical issues such as security breaches, technical problems, or even government intervention, the entire network could become vulnerable.

Another well-known problem of centralized systems is the concentration of power and wealth in the hands of a few. When a small group controls the project's direction, this can result in a significant disparity in reward distribution. This situation undermines the ethos of financial inclusivity and empowerment that many cryptocurrencies aim for. In the case of the Ethereum network, more than half of its staking is in the hands of 4 big financial institutions.

Beyond gaining the majority of the wealth, those companies also control the decision-making. The will of those companies might not be responsive to the diverse needs and ideas of the community, being an obstacle to innovation inside the project.

Delegated Proof-of-Stake

After analyzing the current situation of the Ethereum Network we can perceive that it is having some problems with its Delegated Proof-of-Stake(DPoS) consensus model. DPoS evolved from PoS and allows users of the network to vote in delegates who then validate blocks. In a Delegated Proof of Stake (DPoS) system, network users have the option to collectively contribute their tokens to a staking pool and cast their votes for a specific delegate of their choice. Staking in DPoS doesn't require users to transfer their tokens to a specific wallet. Instead, they can utilize a staking mechanism or service provider to facilitate this process.

Delegated PoS can be seen as centralizing from a few angles Firstly, the entities responsible for staking other users' coins often lack a personal financial stake in the game. Essentially, they have the authority to make decisions while utilizing other people's assets and can be seen as rent-seeking for profits without the same level of risk or commitment.

Additionally, as previously mentioned, the fact that these entities are identifiable and known opens the door to potential coercion or conflicts of interest. This situation raises concerns about their ability to act against the best interests of the coin holders who have entrusted them with their stakes.

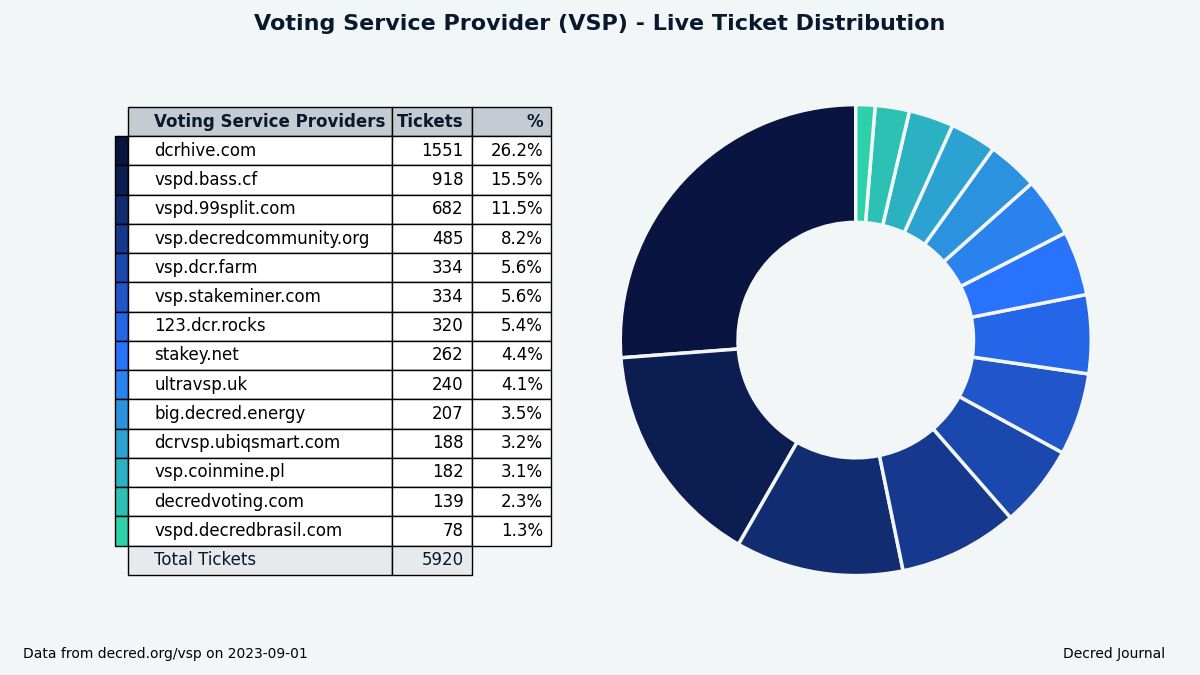

In contrasts

Decred excels in addressing the centralization aspect as a hybrid PoS/PoW project. Even if you opt for a voting service provider (VSP), it's essential to understand that this provider never gains ownership of your coins or the authority to vote on your behalf. Instead, the VSP functions as a communication intermediary, demonstrating that your coins are actively being staked. Once your coins have cast their votes, the association with the VSP is promptly terminated. It's only reinstated when the coin holder decides to stake their coins again. This unique approach safeguards user control and ensures that ownership and decision-making authority always remain firmly in the hands of the coin holder.

Moving Foward

The Ethereum network has gone through a lot of changes since its last updates. According to data from the Cambridge Center for Alternative Finance, the network has seen its energy consumption drop by more than 99.9% from the roughly 21 terawatt-hours of electricity it used when it was under proof-of-work consensus. But now new issues are becoming more clear, like the centralization of the network.

Do you think Ethereum is making the right moves? Or it will be just a matter of time before centralization ruins the project? Leave a comment with your opinion!

Comments ()